Since dow closed negative 80 last fri and nikkei is on holiday, I bet that hsi will open negative. This is knee jerk reaction from dow selldown. SO, before market for hsi opened, I bought put warrants for hsi. True enough, hsi fell sharply. But you know what? DBS HUNG UP ON ME AGAIN!! This time it's so serious that I can't even log in for around 15 to 30 minutes!

Goodness...luckily my put warrant had low gearing, otherwise I would have been killed there and then. It went up to a high of 0.32 before hsi rises up. Sigh, otherwise would have made close to 900 in the morning. Too bad, shit happens.

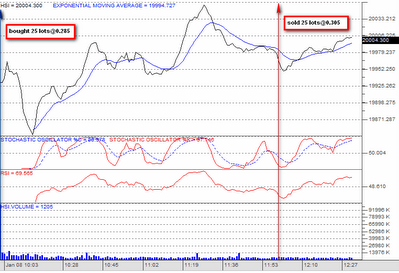

I placed several bids to sell off at 0.310, 0.305 and 0.300, before settling for 0.305 at 12 noon. The reasons for my selling can be seen from the chart:

1. Stochastic oscilator %K is finishing its minimum curve and is going to reverse. In my aggressive and risk taking mode, I'll wait a little more before I sell. However, the put warrant I've got don't react to minute changes in hsi, so I thought the rewards of waiting for another tick up is not worth the risk if it suddenly cheong upwards after %K reverses trend.

2. RSI also undergoing reversal, almost finishing the minimum curve

3. HSI price seems to have more downside, but I believe in charts more than the actual price, so there.

4. Quotes for selling is around 0.30/0.305, with the next bid up at 0.310. I tried one whole morning to sell at 0.310 but failed. I'm in a risk averse mode, so I thought I'll bid at the next bid at 0.305 and get out. Furthermore, if the website is down again, I'll be screwed big time. God knows what will happen in the afternoon.

So I sold off. The price never hit 0.305 again, so I'm glad I sold off at the high around that time. I'll decide whether to go in again in the afternoon. HSI is getting very unpredictable.

Yellow page cheong again, crazy stock. Is there really something going on? I hope longcheer will fall a bit today to hit the ema 20 days support line, so it can really cheong all the way up to cover the gap at 1.37. Will see how it goes later.

So far made $440 on warrants. Total returns at lunchtime: negative $190

0 comments :

Post a Comment