Wow..just came back and saw a surprise.

Basically all the stocks froze just the way it was when I left home. I realised that sgx had a total system crash, all the online trades are off quotes so all online trading down. Best...never see this kind of things before in a world class financial hub before. Haha, must be too much volume for sgx to handle, total crash. Either everyone rushing to sell or everyone rushing for bargain hunts. I kind of think it's the latter.

Btw, system restored already, I received the news from dbs vickers clarity news, at 22:14, which is like 15 mins ago.

Overall, don't be panicky. In the morning, I saw almost all the stocks kena sell down, albeit at low volumes. But you know what, before lunch, sti was at -180, 15 mins after lunch, it rose up to -90 and eventually hover around -120 until system crashed around 4pm. Then everything froze. I think if system did not froze, we had a very high chance of recovering to -80. No cause for panic.

I woke up very early for this special day to buy puts. You know what? Nobody wants to sell. Even my sti put warrants that I thought cannot make it already, I still managed to turn over a -78% loss to a -22% loss. That's how bad it was, in the morning. Luckily I sold off, because afternoon rebound like crazy. I bought more CDL call warrant today. Thought it was a bargain again, haha. I did this to average down.

I keep my hands off hsi totally even though I'm very very tempted to buy call warrants. After a major selldown, a rebound is very likely. But I thought never mind lah, let it go. I'm holding too many risks as it is already.

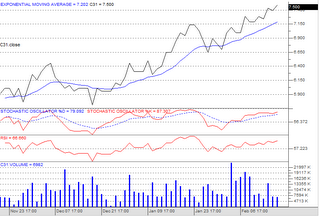

CityDevl had outstanding results, net profit jumps 75.5% thanks to bumper home sales in singapore and global hotels operations. CityDev earnings were also boosted by its 53-percent owned U.K. hotels subsidiary Millennium & Copthorne Hotels Plc which last week posted a 27.6 percent in annual underlying profit. All in all, excellent. All we need is for the macro issues to be settled and off CDL will go, in a blast.

Macro issues do seem to be settled. I posted earlier that China repudiated rumors that its going to impose tax on stock capital gains to curb investment, which is the reason behind shanghai harsh drop of 8%, which also caused dow to fall somewhat. Today shanghai rose nearly 4% offsetting the big drop. So that's really fine.

Something to worry is US GDP fell below expected. It posted 2.2 but was expected to be 2.4. OKAY, not such a big difference, so I think the reaction is not significant. Anyway, as of now, Dow is quite alright at -15. Anything less than 100 is no big deal.

I'm quite certain STI and hsi will rebound. And that might not be a good sign. As someone wise told me before: when it rebounds again, the real party begins. The next rebound is an excellent time to lighten your load. If not, might be too late already. I'll be looking for puts. I'm post here when I think it's time.

Wed, Feb 28, 2007 -- SPECIAL DAY

1. DOW crashed 410 down in one single session - worst since sept 11, 2001

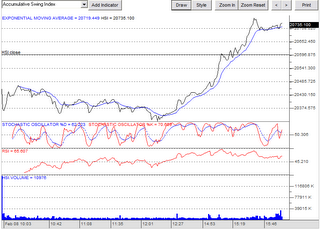

2. STI opened -180, closed -120 (the BIGGEST freakin drop I've ever SEEN, it's even worse than May 2006 correction)

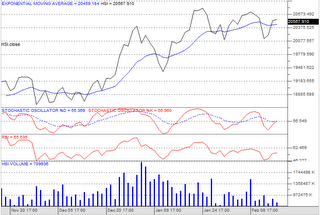

3. HSI opened -700 pts, closed -500. A freakin big 700 point drop..can you imagine, call warrants basically halved its value and puts doubled.

4. SGX crashed at 4pm, all online trades (not sure about broker trades) are off.

Basically all the stocks froze just the way it was when I left home. I realised that sgx had a total system crash, all the online trades are off quotes so all online trading down. Best...never see this kind of things before in a world class financial hub before. Haha, must be too much volume for sgx to handle, total crash. Either everyone rushing to sell or everyone rushing for bargain hunts. I kind of think it's the latter.

Btw, system restored already, I received the news from dbs vickers clarity news, at 22:14, which is like 15 mins ago.

Overall, don't be panicky. In the morning, I saw almost all the stocks kena sell down, albeit at low volumes. But you know what, before lunch, sti was at -180, 15 mins after lunch, it rose up to -90 and eventually hover around -120 until system crashed around 4pm. Then everything froze. I think if system did not froze, we had a very high chance of recovering to -80. No cause for panic.

I woke up very early for this special day to buy puts. You know what? Nobody wants to sell. Even my sti put warrants that I thought cannot make it already, I still managed to turn over a -78% loss to a -22% loss. That's how bad it was, in the morning. Luckily I sold off, because afternoon rebound like crazy. I bought more CDL call warrant today. Thought it was a bargain again, haha. I did this to average down.

I keep my hands off hsi totally even though I'm very very tempted to buy call warrants. After a major selldown, a rebound is very likely. But I thought never mind lah, let it go. I'm holding too many risks as it is already.

CityDevl had outstanding results, net profit jumps 75.5% thanks to bumper home sales in singapore and global hotels operations. CityDev earnings were also boosted by its 53-percent owned U.K. hotels subsidiary Millennium & Copthorne Hotels Plc which last week posted a 27.6 percent in annual underlying profit. All in all, excellent. All we need is for the macro issues to be settled and off CDL will go, in a blast.

Macro issues do seem to be settled. I posted earlier that China repudiated rumors that its going to impose tax on stock capital gains to curb investment, which is the reason behind shanghai harsh drop of 8%, which also caused dow to fall somewhat. Today shanghai rose nearly 4% offsetting the big drop. So that's really fine.

Something to worry is US GDP fell below expected. It posted 2.2 but was expected to be 2.4. OKAY, not such a big difference, so I think the reaction is not significant. Anyway, as of now, Dow is quite alright at -15. Anything less than 100 is no big deal.

I'm quite certain STI and hsi will rebound. And that might not be a good sign. As someone wise told me before: when it rebounds again, the real party begins. The next rebound is an excellent time to lighten your load. If not, might be too late already. I'll be looking for puts. I'm post here when I think it's time.

Wed, Feb 28, 2007 -- SPECIAL DAY

1. DOW crashed 410 down in one single session - worst since sept 11, 2001

2. STI opened -180, closed -120 (the BIGGEST freakin drop I've ever SEEN, it's even worse than May 2006 correction)

3. HSI opened -700 pts, closed -500. A freakin big 700 point drop..can you imagine, call warrants basically halved its value and puts doubled.

4. SGX crashed at 4pm, all online trades (not sure about broker trades) are off.