What a wonderful day for worldwide market!

They totally ignored the pitiful pleas of Dow's -90 close last night and rallied strongly. Most went from very negative to positive, so that's the kind of bullish undertone we're talking about there.

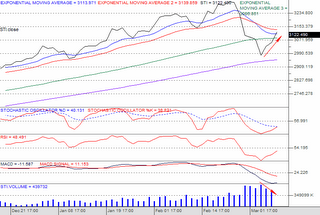

Nikkei went from -200 something to +9, HSI went from -60 to +270, while STI went from -50 (i think) to +27. Amazing recovery by STI with not too bad vol too. Most stocks are down in the morning, but by afternoon not a lot of stocks are red.

Again, I'm just amazed by the strength and resilient of blue chips. Yes, it's damn expensive to own 1 share but look at one fine example, CDL. Whacked down hard to 14.1 today, but bounced right back to close even higher than yesterdays at 14.8. Capitaland reached 52-weeks high of 0.800 too, simple great! I won't buy so much of penny shares now, trust me, if it takes me 1 yr of losses to find out, I'll do it again.

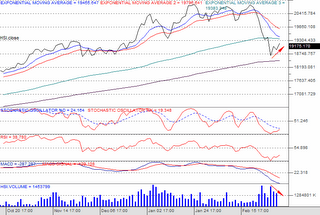

As I predicted, my take for HSI is that it'll drop to 19500 support and hold, thereupon it'll rally up. It did exactly, to close 300 points up. A pity I didn't buy calls as I swore off warrants, but seriously this boosted my confidence in my chart reading.

Swiber rallied up 0.060 to close at 1.30, with intraday high of 1.34. I bought more swiber at 1.31 to bring up average buy price to 1.275, 10 lots. The charts formed today is very good, MACD going to cross over red line and with a bullish engulfing (very big white candle) candlestick. Tmr chances are very high that it'll break today's intraday high of 1.34. I again bought 2 bids above support level of 1.30 (so it's quite safe) since it broken free of resistance at 1.28. Next resistance to test is 1.34, thereafter is 1.28 then the all time high of 1.42.

Pac andes climb 0.060 today. That's the 5th consecutive days of climb, bring it up from 0.865 to 1.12, a whooping 30% increase within 5 days. I supposed shortist are targeting this stock already. I dare them. Still more upside to come, pending on macro issues. Stocks are like that, if they break all time high, chances are they will keep on climbing. Same thing if it breaks support, it'll keep on going down until it finds another support. Intraday high reached 1.15 even..I think this will continue to move up more.

Good news for US side. Their gdp figures estimate have been raised from 2.2 to 2.5, expected better performance. That ought to make people feel more at ease. Europe all gree, dow is now at +50. Look forward to a good closing tmr, at least the funds manager will make it look good for account closure for the quarter.

We'll see sti's true colours next week.

They totally ignored the pitiful pleas of Dow's -90 close last night and rallied strongly. Most went from very negative to positive, so that's the kind of bullish undertone we're talking about there.

Nikkei went from -200 something to +9, HSI went from -60 to +270, while STI went from -50 (i think) to +27. Amazing recovery by STI with not too bad vol too. Most stocks are down in the morning, but by afternoon not a lot of stocks are red.

Again, I'm just amazed by the strength and resilient of blue chips. Yes, it's damn expensive to own 1 share but look at one fine example, CDL. Whacked down hard to 14.1 today, but bounced right back to close even higher than yesterdays at 14.8. Capitaland reached 52-weeks high of 0.800 too, simple great! I won't buy so much of penny shares now, trust me, if it takes me 1 yr of losses to find out, I'll do it again.

As I predicted, my take for HSI is that it'll drop to 19500 support and hold, thereupon it'll rally up. It did exactly, to close 300 points up. A pity I didn't buy calls as I swore off warrants, but seriously this boosted my confidence in my chart reading.

Swiber rallied up 0.060 to close at 1.30, with intraday high of 1.34. I bought more swiber at 1.31 to bring up average buy price to 1.275, 10 lots. The charts formed today is very good, MACD going to cross over red line and with a bullish engulfing (very big white candle) candlestick. Tmr chances are very high that it'll break today's intraday high of 1.34. I again bought 2 bids above support level of 1.30 (so it's quite safe) since it broken free of resistance at 1.28. Next resistance to test is 1.34, thereafter is 1.28 then the all time high of 1.42.

Pac andes climb 0.060 today. That's the 5th consecutive days of climb, bring it up from 0.865 to 1.12, a whooping 30% increase within 5 days. I supposed shortist are targeting this stock already. I dare them. Still more upside to come, pending on macro issues. Stocks are like that, if they break all time high, chances are they will keep on climbing. Same thing if it breaks support, it'll keep on going down until it finds another support. Intraday high reached 1.15 even..I think this will continue to move up more.

Good news for US side. Their gdp figures estimate have been raised from 2.2 to 2.5, expected better performance. That ought to make people feel more at ease. Europe all gree, dow is now at +50. Look forward to a good closing tmr, at least the funds manager will make it look good for account closure for the quarter.

We'll see sti's true colours next week.