Another bond bites the dust.

Don't worry, this is not from the troubled oil and gas sector. It's the optional redemption of Capitamalls asia bonds, CapMallA3.8%b220112 announced from sgx here. I blogged about the bonds here and here.

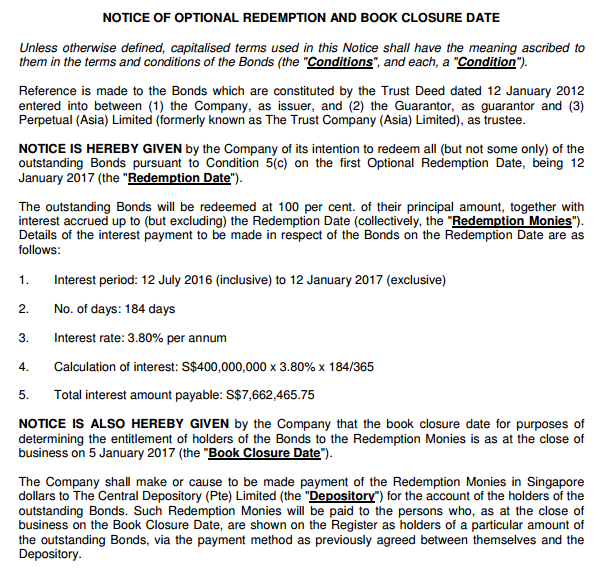

The full maturity of the bond is actually on 12-Jan-2022 but there is an option for early redemption on 12-Jan-2017 and every year thereafter. Since there is a step up option for the bond if it is not redeemed on 12-Jan-2017 to 4.5% instead of 3.8%, I guess there's every reason for them to redeem it back in full. The 3 months SIBOR now is 0.87%, about doubled since Jan 2015. I guess I was wrong to think they wouldn't redeem it. There's still another bond out there with 3.08% by Capital Mall Trust (not the same, but yeah) with no step up option and with maturity date in 2020.

How would this affect me?

It wouldn't affect my portfolio because I don't have any more of this bond. But it'll affect my parent's retirement portfolio, to the tune of $26k. Guess what, I'm going to take the redeemed amount and return it back to them. The last time OCBC pref shares redeemed back, I took the money and reinvested back into FCL bonds, but I'm not going to do so now. It would seem that in the very near future, it might be better to put the money in the safety and guarantee of a fixed deposit in the banks, rather than to take that extra bit of interest and risk the price volatility of the bond. Especially if I'm the one guaranteeing their capital.

Nope, going to return them the money. No more reinvestment of the money into bonds for them.

My November 2025 Personal Spending – $1,853

4 hours ago

6 comments :

how do you buy these types of bond? same as stocks traded on SGX?

Hi Bruce,

You can find it listed in sgx, just like normal stocks. I made a post on the retail bonds listed at sgx here, so you can take a look if you wish. Do take note that some of them is not longer listed, as it had been redeemed back. There are also newer listings not mentioned.

Hi,

Does this mean they will buy back all my holdings automatically? Or should i sell them on the market now?

Thanks for your advise!

Hi Dextor,

Oh, they will buy back automatically at par value. No need for you to do anything, and there's also no brokerage fees to be paid too. Just wait for them to return you the capital plus the last tranche of interest :)

Hi, I realised that the payment for the callable bonds was supposed to be 12 Jan 2017. My securities account shows a debit of the stock par value out of the account but I don't see it credited back into my savings account up to today. I linked to the trading account to my savings account.

Are they withholding the payment of the principle amount?

Anyone can advise please.

Hi Amelia,

This is so late already... You might want to call/email them and ask about it. Did you receive a letter saying that it had been redeemed? I did receive a few days after the full par value of the bonds that I had held had been refunded to my bank account on 12th Jan.

Post a Comment