Just got news that Capitacom trust (CCT) is issuing rights to acquire Asia square towers 2. It's a 166 per 1000 shares @ $1.363, renounceable rights issue. This means that for every 1000 mother shares you hold before it goes ex-rights (XR), you are entitled to 166 shares of rights, which you then need to go to the ATM before a dateline is up to subscribe to it by paying $1.363 per right shares.

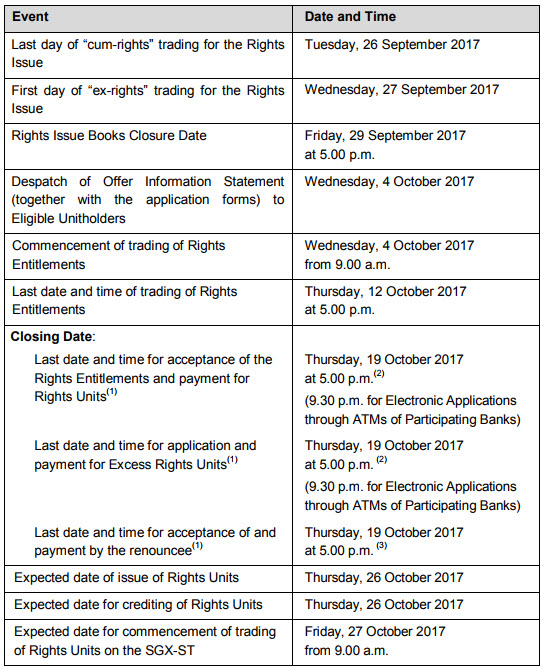

Here's the timeline for the major events of the rights issue:

I've been answering a lot of posts on rights recently, especially on Investingnote, so I thought I might want to consolidate all the stuff and recap all the posts I've made on the rights. I don't think I have updated my information on rights exercise in this blog ever since SGX implemented the 100 shares board lot instead of the 1000 shares. 100 shares makes it less complicated actually; less things to hack.

Basic rights information

Before going into the strategies part of rights exercise, let's have a breakdown of what to expect. The timeline for rights goes like this:

1. You get announcements of a rights exercise. Pay attention to the x per y shares @ z price. "z" is the subscription price for the rights exercise. For example, a 25 for 1000 shares @ $1.25 means that for every 1000 shares of the mother shares you hold before XR, you are entitled to a 25 rights that you need to subscribe at the atm for @$1.25 per rights price. Take note that upon subscription of the rights (by paying $1.25 per rights), you are converting the nil paid rights (so called because you haven't subscribed to it; you are just holding the rights to convert to ordinary shares) to ordinary shares.

nil paid rights => before you subscribed by going to atm for it

paid rights = ordinary shares => after you go to atm to pay for the subscription per rights shares

If you don't subscribe to the rights before a certain date, the rights will expire worthless.

2. There is "renounceable" and "non-renounceable" rights exericse. Sometimes non renounceable rights exercise is called a "preferential offering". Renounceable rights means that the rights can be sold off if you don't want to subscribe to it. This means that there will be a nil-paid rights trading period where you can sell off your nil paid rights. Note that if you don't want to subscribe to the rights by going to the atm, the rights will expire worthless. I can't stress that enough. If you don't want to subscribe, go and sell your nil paid rights during the nil paid rights trading period. For this CCT rights exercise, it's renounceable, so the nil paid rights trading period is from 4th Oct 2017 to 12th Oct 2017. During this period, you can sell off your nil paid rights or buy more if you want.

The mathematics of it all is described elegantly below:

Nil paid rights price + Subscription price = Price of mother shares after XR

The subscription price for this cct rights exercise is 1.363. Let's say upon XR, the price of cct mother share is at 1.450. The nil paid rights price should be trading at 0.087 (1.45 - 1.363). If the price of the nil paid rights is way below 0.087, then the logical question to ask if this: is the mother share overvalued or the nil paid rights undervalued? It presents an arbitrage opportunity here. But this is advanced technique to play with rights, and it's highly advisable for newbies not to do it unless you know what you're getting into. Don't want you to get into a quagmire of doom.

Link on difference between preferential offering and renounceable rights: here

3. Know how many entitled rights you have. You can calculate yourself by dividing your shareholdings by 1000, round down to the nearest integer and multiply that by 166. For example, you have 5500 mother shares before XR, so you'll be entitled to 5500/1000 = 5.5 = 5, then 5 x 166 = 830 rights shares entitled. ** If you don't want to calculate manually, or want to confirm, wait for the Offer information statement (OIS) to be sent to you. In it, there'll be a circular on the whys of the rights exercise, and the how to the different scenario where a shareholder can subscribe to the rights. Most important, there will be a form where they will tell you explicitly how much rights you are entitled to. You can either fill the form, send a cheque and post it to them for rights subscription, or just ignore the form and go to the atm to subscribe for the rights. In the above example, you are entitled to 830 rights @ 1.363 each, so you have to pay $1,131.29 to convert the nil paid rights to ordinary shares. And you have to do so by 19th Oct 2017, if not it'll expire worthless.

** update on 22nd Sept 2017: I asked my broker whether we will get fractional and proportional allotment of rights, meaning that if we have 900 shares, do we get (900/1000*166 = 149.4) 150, 149 or 0 shares? He said we will get 149 and not 0, because it is proportional, and 149 and not 150 because it is rounded down, not up. I learn new things everyday.

4. You can also subscribe to excess rights above and beyond your entitled rights. Using the above example, you have 5500 mother shares before XR, so you are entitled to 830 rights shares. Beyond that, you can apply for another 1000 excess rights. In total, you have to pay (1000+830)*1.363 = $2,494.29 for all the rights. You will definitely be able to get 830 new shares, because well, that's your entitlement. But for the excess rights, preference will be given to round off odd lots and the rest is luck. The issue here is, after the new board lots is changed from 1000 to 100 shares per board lot, it's unclear whether the rounding of odd lots is still based on 1000 shares or the newer 100 shares. If it's based on 1000 shares, it's likely you will get 1000 - 830 = 170 excess rights, minimally. If it's pegged to 100 shares per board lot, it's likely you will get 900 - 830 = 70 shares minimally. I am for the latter, not the former.

How much to subscribe excess? I think if you hold very little holdings before XR, you can potentially double your holdings by getting a lot more excess rights. Let's say you have only 1000 shares, you'll be entitled to 166 rights shares. Rounding to 200 shares will likely give you another 34 excess rights. But you might get another 500 shares of excess because you're lucky and you have small holdings. So in total, from 1000 shares before XR, you might get 1000 + 200 + 500 = 1700 shares, of which the extra 700 shares, 166 is your entitlement, 34 is for rounding off odd lots, and 500 is just that lady luck shines upon you. 700 shares @ $1.363 each will lower your average price way below the theoretical ex rights price (TERP).

If you have much more holdings, then don't think so much lah, just put 1.0 times the holdings before XR. It's unlikely you will get excess rights beyond the number of shares you hold originally. Let's say I have 5000 shares, I'll be entitled to 830 rights shares. I'll just apply 5000 - 830 = 4170 excess rights, so that in total, I'm applying for 5000 rights. Likely you won't get it all, but you'll hit some and the rest will be refunded back to your account.

Link to step by step guide on using ocbc atm to subscribe for rights: here

5. Check for the rights shares to come in. For this cct rights exercise, the expected date of commencement of trading for the rights shares is 27th Oct 2017, 9am. The expected date of crediting of rights units is on 26th Oct 2017. I'll check the CDP account around night time to ensure that the rights shares are credited into my account if you're using non-custodian brokerage. If that's slow, try checking the refund in the bank account where you applied for the rights. From the amount of money refunded to you, you can back calculate to see how much excess rights you got. The slowest confirmation is after a few days, you will get a snail mail of the rights shares you get through your physical mail box.

From fastest to slowest:

a. Check refund of funds in same bank acct linked to atm during subscription

b. Check CDP for stock holdings. Will need a pin number from them, so go apply beforehand

c. Check physical mail box for snail mail confirmation

Strategies for rights player

Now that the basic is covered, let's talk about strategies. There are strategies for existing shareholders who already holding shares before the rights exercise is announced, and there are also strategies for people who want to take advantage of the rights to get into the company at a favourable time. These are the wannabe shareholders. I must say rights issue favour the latter rather than the former. That's just the way it is.

I further define two types of player: the casual and the advanced one. Casual ones are usually newbies, but need not be, and quickly wants to get over the rights issue as soon as they can. Advanced players want to hack the rights and get a more favourable price, meaning getting their average price below the theoretical ex rights price (TERP).

w: no of mothers shares before XR

x: no of rights shares successfully subscribed

y: price of mother shares before XR

z: subscription price of rights shares

TERP = [(w*y)+(x*z)] / (w + x)

As you can see, to get a lower average price, you need to get much more excess rights beyond the rights ratio. If the rights ratio is 166 shares for every 1000 shares held before XR, to get a lower price than TERP, you need to get more rights shares than 166.

Link for casual rights player: here

Link for advanced rights player: here

For existing casual shareholders:

a. Just wait for offer information statement (OIS) to come in. It'll inform you of the number of entitled rights shares you have.

b. Go atm and subscribe to the entitled rights

c. At the same time, apply for the excess rights. There's also a $2 admin fee charged by every bank.

d. Wait to see how much excess rights you get

e. Update your spreadsheet/program on your holdings

For existing advanced shareholders:

1. Sell all your mother shares before XR, buy back after XR and after the price drops lower than TERP

2. Buy more mother shares before XR and take adv of the drop in price, be entitled to more rights, apply for excess

3. Buy nil paid rights during nil paid rights trading period, esp when there are opportunities for arbitrage, subscribe to entitled and also apply for excess

* 2 and 3 can be combined, but make sure you know what you're doing

For casual wannabe shareholders:

a. Buy the mother shares before XR

b. Wait for OIS to inform you how much entitled rights you have. If you bought too close but still before XR, the OIS might not reach you on time. So calculate manually.

c. Go atm and subscribe to the entitled rights

d. At the same time, apply for the excess rights

e. Wait to see how much excess rights you get

f. Update your spreadsheet/program on your holdings

For advanced wannabe shareholders:

1. Buy in after XR, at or below TERP, and skip all the rights exercise

2. Buy in before XR, get your entitled rights, apply for excess

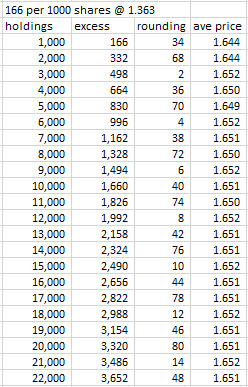

2a. To decide how many lots to get in, look at the table below:

Since preference is given for excess rights applicants to round off odd lots, and assuming that the rounding of odd lots is for 100 shares per board lot, it make sense to change the number of shares you want to buy before XR to maximise the odd lots rounding. For example, if you get 1000 shares before XR, you are entitled to get 166 excess. To round off to the next nearest round lots, you are almost guaranteed to get 34 excess rights (to round to 200 shares). Can we maximise that rounding so that you can get the best out of it?

I didn't show the whole table, but you need to get in 47,000 shares so that you can get 98 shares of rounding. But we haven't looked at the average price of all the shares, after including the rights exercise. No matter what price you got in (must be reasonable of course) for the mother shares before XR, the advantage of getting more 'guaranteed' excess rights for the purpose of rounding odd lots reach a diminishing returns after 5000 shares. For the above table, I use an entry price of 1.70 for the mother shares. You can see that there's a slight dip on the average price for 5000 shares.

But all these just to shave off less than 0.005 cts on your average price? That's why I don't do such hacks anymore. It's just not worth the time. In the past, where the board lot is 1000 shares, there's some savings to be had, but not anymore.

Just ignore this method safely, knowing that you are not going to hack a lot to get a lower average price using this method.

3. Buy nil paid rights during nil paid rights trading period, subscribe to entitled

* 2 and 3 can be combined, but make sure you know what you're doing

This should do it! The end-it-all guide to rights exercise for newbies and a good refresher for oldies!

My November 2025 Personal Spending – $1,853

7 hours ago

9 comments :

LP, catch no balls. But u blow my mind

Only catch the part "not for newbies"

Ok. I scram

Hi SI,

Haha, i'm sure you'll understand if you have to do many rights exercise too :) You don't invest in reits meh? I mean totally?

nice information...

Current XR price is $1.64. So, can I say that the price is effectively the same as before the announcement of the rights issue, assuming I purchase all the rights I am entitled.

To avoid odd lot, can we just apply 100 shares (if we have 1000 mother shares), instead of 166 shares?

On top of that, then we apply excess right (as many as we want and/ or can afford).

Hi anon,

Hmm, you can do that, but that's silly. It's like leaving money that's yours on the table. I wouldn't advise that.

Hi Bro

Just read your post about 10years back

Remember the Joseph Cycle?

Simon is dead in 2016.

His macro views if not deadly accurate on 2008, is also reminiscent today at 2015 bull. Any views?

Hi Ken,

Yeah, joseph cycle. Is he really dead, oh no...

I don't really hve a view though. I'm not a macro cyclical kind of person. I still do bottoms up TA, if there's such a term for it lol

Do you need Personal Finance?

Business Cash Finance?

Unsecured Finance

Fast and Simple Finance?

Quick Application Process?

Finance. Services Rendered include,

*Debt Consolidation Finance

*Business Finance Services

*Personal Finance services Help

Please write back if interested with our interest rate

Contact Us housingfinance22@gmail.com

Contact us on whatspp +447513195409

Post a Comment