Rationale for putting cash into CPF

There's not a lot of write up for self employed people out there regarding CPF, so I might as well shed some light based on the findings I've done. So this is really tailored for self employed people who are not employed by any companies. The reasons why I want to contribute are:

1. Tax planning - if you know you'll have good earnings for the year, you'll want to plan your taxes ahead so that you don't have to pay unnecessarily

2. Build up a super emergency cash in the form of CPF, especially in the Ordinary Account, for the sole purpose of paying the mortgage when shit hits the fan. This is so super emergency that I planned never to use it at all unless absolutely necessary. The built in trouble and impossibility of taking out that emergency funds only adds serves to highlight the strict conditions in utilizing this fund. If shit really hits the fan, I'll have to go the nearest CPF building to sign some forms so that I can pay my mortgage loans from the OA account of my CPF instead of the usual cash payment for me.

Take this as the emergency of my emergency cash. Ideally, this should be about 20 to 24 months worth of housing mortgage so that I can tank for up to 2 yrs living at bare minimum with a roof above my head.

Getting your hands dirty on the bloody abbreviations

With this in mind, I started reading up on 3 things:

A. Self-employed Mandatory Contribution and Voluntary contribution to medisave account (VC-MA)

B. CPF Minimum Sum (MS) topping-up scheme

C. Voluntary contribution to CPF

A. Self employed Mandatory Medisave contribution (Mandatory Contribution)

For the self employed, it's voluntary to contribute to CPF. However, the medisave account needs to be topped up, and that's the only thing that is compulsory. As long as you're self employed and is a Singapore citizen or PR making a yearly net trade income of more than $6000, you'll have to contribute to medisave account.

| Table 1: Self employed compulsory medisave contribution rates in 2014 |

This contribution is subject to a cap based on different age groups. For example, if you're between 35 to 45 yrs old, you'll have to pay a max of $4800 that year, which corresponds to a monthly income of $5k. Even if your net trade income is more than $5k per month, $4.8k is the maximum amount that you have to contribute to your medisave account.

Okay lah, medisave is going to be useful in the future. Sooner or later, the amount will be used, so might as well put it in a good place earning high interest to pay for the future. Pay now and use later. For more information, you can read the link here.

Self employed Voluntary Medisave contribution (VC-MA)

This is different from the compulsory one, even though both are contributed to the medisave account.

1. You are a Singapore citizen or PR, AND

2. You have made a voluntary contribution to your medisave account in the previous year

The key word here is 'AND', not 'or'. A little planning is important, especially if you know that in the next 1-2 yrs, you're going to earn more money and you need that extra tax relief by doing voluntary contribution.

The tax relief is limited to the lower of:

1. Voluntary cash contribution directed specifically to Medisave account (VC-MA)

2. Annual CPF contribution limit ($30,600 in 2014, $31,450 in 2015) less Mandatory Contribution amount

3. Prevailing Medisave contribution ceiling table (MCC). It's $48,500 for 2014.

It sounds really complicated, but I assure you it's not. IRAS website illustrates with very clear examples of what happens when a self employed earning this amount, putting that amount in CPF voluntarily over and above his compulsory medisave contribution can get how much relief. You can find the link here.

B. CPF Minimum Sum (MS) topping-up scheme

This minimum sum topping up scheme is for you to top up your own or your loved ones' Special Account (SA) or Retirement Account (RA). Whether it's funded to SA or RA depends on the recipient's age. If the recipient (can be yourself) is below age 55, it'll go into the SA. If the recipient's age is 55 or more, it'll go to the RA account. CPF has a strict definition of loved ones. To them, 'loved ones' include only your parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings. No mistress, no friends, no co-habitants and no dependents.

The amount of tax reliefs is equal to the amount that you topped up, subject to a cap, of course. The maximum tax relief for contributing towards your own SA or RA is $7k per year. The maximum tax relief for contributing towards your 'loved ones' SA or RA is $7k per year also. Remember to read the definition of 'loved ones' above. The tax relief cap of $7k is applied separately, so you can theoretically get a max of $14k tax relief per year if you top up BOTH your own SA/RA and your 'loved ones' SA/RA.

Oh, by the way, it's called CPF Cash Top-Up Relief for a reason. To qualify, you should use cash and you can't transfer your own CPF account to others. Also, for spouse and siblings, they must not have an annual income exceeding $4k in the year of top-up. Otherwise, you won't get the tax relief. You can read more about it in detail in the link here.

C. Voluntary Contribution to CPF

This is different from Voluntary contribution to medisave account (VC-MA). This is where you inject money into all 3 accounts (OA, SA and MA) in your CPF, in a ratio that is dependent on your age.

| Table 2: CPF contribution / allocation rates for different age groups in 2014 for wages > $750. For wages <$750, click here to see the table. |

It's not really good to see that table, isn't it? The reason is that the amount of money that you voluntarily contributed to all 3 accounts in your CPF does not have an employer's portion. Let's say you're between 35-45 yrs old, your contribution rate should be 20% and 16% from employers, forming a total of 36%. But since you're contributing voluntarily, your entire sum will form the 36% normally contributed by both employer and employee, Of the 36 parts, 21 parts, 7 parts and 8 parts will be contributed to the OA, SA and MA respectively.

It's really easier to see the contribution amount in the form of a ratio below.

| Table 3: CPF allocation rates (ratio) in 2014 for different age groups |

Okay, this makes it much clearer. If you contribute $10k voluntarily to 3 accounts, you'll end up contributing $5,834 (10k x 0.5834) to your OA, $1,944 (10k x 0.1944) to your SA and $2,222 (10k x 0.2222) to your MA. But you can only contribute up to a cap. That cap is the Annual CPF contribution limit ($30,600 in 2014, $31,450 in 2015) less Mandatory Contribution amount. The Mandatory Contribution amount for a purely self-employed person not being any employee of any company is also the money that you have to contribute to your medisave account by law every year.

What about tax relief?

First, you must hit the conditions:

1. You are a self employed person and you've a positive net trade income in the yr of assessment and

2. You've contributed to your mandatory medisave contribution in the preceeding year and/or

3. You've made voluntary contributions to your medisave account (VC-MA) in the preceeding year

Basically if you haven't contributed any amount to your medisave account that is mandatory or voluntarily, you won't be entitled to the Voluntary CPF contribution tax relief. If you hit the conditions above, then your tax relief will be the amount contributed subject to a cap, which is the lower of:

1. 36% of your net trade income for 2014 (37% of net trade income for 2015)

2. Annual CPF contribution limit ($30,600 for 2014, $31,450 for 2015)

You can see this link here to read up some illustrations.

Above all these, there's this site that clarified a lot of queries for me. I don't even know how to do a voluntary contribution for CPF until I read the FAQ here. It's a very useful read for all self employed people.

Take away:

So, what's the right course of action? Firstly, I have to pay the compulsory medisave account. You can (1) pay it directly to your MA account, or (2) you can do a voluntary contribution to 3 cpf accounts so that a certain % will flow to your MA, but make sure your contribution to MA is equal or higher than the amount of medisave you are legally required to contribute yearly. If not, you still have to top up your MA to hit the legal requirement. That's not a choice.

After that, I'll have to weigh these 3 factors:

1. How much cash do I want to keep for my personal investment as a warchest

2, How fast I want to fill my fund of the mother of all emergencies, in the form of OA in my CPF

3. How much tax reliefs I can knock off my income to bring my assessed income to a lower tax level.

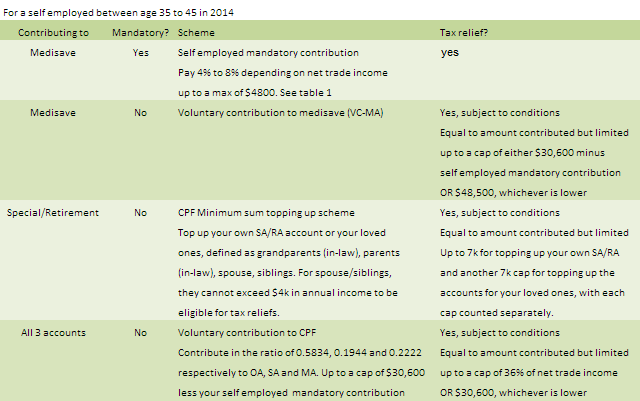

Here's a brief summary of all the schemes. That hardest part of this research is making heads and tails of all the available top ups with their abbreviations and jargons.

|

| Table 4: Summary of schemes available and tax reliefs |

My answer to the above 3 factors will allow me to decide how much money I can contribute and also into which account. I will be contributing to all 3 accounts (doing a Voluntary contribution to all 3 accounts), and not just contribute to my SA account (through CPF Minimum sum top up scheme). The main reason is that the tax relief for Voluntary contribution to CPF is higher than the CPF minimum top up scheme. The other reason that I need to build up my OA to pay for my housing. I can't pay for my housing using SA, even though the interest rate is higher. It just doesn't serve my purpose and address my concerns.

18 comments :

Hong Lim's Return Our CPF gang is going to hate you for doing this. LOL!

Hi bro8888,

They have their own agendas to do...and I've my own reasons for contributing :) Let them do what they want haha!

LP, always a planner for life :)

Haha bro, you are going to find out something really important on the difference between cpf monthly contribution and 1 shot contribution.

it is good that you start planning early before you really contribute. Or you will find your resources stretched when u take action.

by the way, you must have some decent income to be thinking this way. So kudos to you.

To be frank, only 1 year tanking fund is enough. (Stop playing so much games lol)

unless you take bank loan.

CPF oa is also really good for trading.

You take a look. Where got money market cash account at philips capital or else where give 3.5% p.a. to store your cash. When you are in between trades.

the problem is withdrawal. So if you designate it as emergency mortgage repayment and PARTIAL income replacement for retirement. It is fine really.

haven't met a wise self employed who hates cpf. Unless they don't earn enough or has bad money management. In which case, better for them to be kar kia and earn a salary. Their lives may be better in the long run.

LP : You did the right thing in contributing to your CPF (my personal view).

Keep going and keep growing...

Hi B,

Hehe, I'm self employed, so I need to think clearer and harder than others to reach the same point..no choice!

Hi SMK,

Haha, thanks for your affirmation!

Actually I mentioned 2 yrs of cash in OA for emergency cash for mortgage because I included my wife's portion. So, 2 yrs of my own portion of mortgage = 1 yr of total mortgage. Since it's either a pay all or nothing kind of situation, I better include the case when my wife cannot pay off too in a really shit-hits-the-fun situation. Worrying too much? haha

Unlikely I'll be using CPF OA for trading haha...It's not the right place for me to do that :) But hey, it's another war-chest if I want to lol!

Hi Richard,

Thanks!

Hi LP,

If I am self-employed and looking to minimize my tax. What is the best way and maximum CPF contribution I can make in a year?

Thanks,

K.

Hi K,

The max you can contribute is $30,600 for 2014 and $31,450 for 2015. This amt includes everything that you put into cpf, no matter which account. If you're self employed and employed also, your employer will also pay you cpf and this amt is inclusive in the 30,600/31,450. If you're purely self employed like me, then this amt also includes the compulsory medisave contribution we have to pay.

There are only 3 ways to put into cpf - either the SA/RA, MA and to all accounts. Which is the best way depends on your life stage and your financial situation. For me, I still need to pay mortgage, so I need to contribute to OA, since that's the acct that you can 'withdraw' to service the HDB loans. So my best way is to contribute to all 3 accts.

It might not be for your case.

Tax reliefs for SA/RA is also capped by a 7k limit.

Take the time and read the post. I've spend half a day reading the various sites to compile it into a post that you can read in 5 mins but maybe appreciate in 1 hr. You'll find your ans in there :)

Hi LP

Thank you very much for writing this post. I was googling for "shall I put money into CPF" and arrived here.

Previously an employee for 8 years, and now self employed for 4 years. I cry inside when I see my "not growing" CPF statements and very much miss having employer contribution.

I've always talked about making voluntary contributions to CPF exactly for reasons mentioned above, but get shot down by other self

Employed friends; "don't be silly, keep cash better, CPF cannot take out. "

And its for that reason I really want to contribute to CPF. Cash is so liquid. Money in the bank, no atm card also, still can easily take. So many bank branches around. So easy to spend, buy this and buy that. People ask to borrow money, sometimes hard to say no (ok that's just me, I know it's a problem).

But to borrow your points: savings for emergency funds to pay for mortgage and hard to or cannot take out. I like that. The other benefits would be a bonus - interest gains, tax relief etc etc.

Going to CPF website today to sign up contribution, start with small amount first. Baby steps.

Thank you again, and thank you to all those left comments. I've learnt a few things.

Ris

Hi Ris,

Haha, glad you found this useful :) I've been doing this for 2 years already, and will continue doing so unless the circumstances changed. The good thing about it is that it's voluntary, so at the end of the year after my review, I needed the liquidity to invest for example, I will contribute lesser or none. It gives me choice and I plan to exercise that choice wisely and responsibly.

Hi LP,

I wonder if after you've amassed 2 years' worth of monthly HDB loan deductions from your OA, would you consider every few years make a lump sum payment to lessen your loan amount and years, or is it better to just follow through with the number of years of loan and using that amount for investing?

Thank you.

KW

Hi WK,

I'm currently doing both - making lump sum payment every year plus doing voluntary contribution towards CPF. Lump sum payment to me is more important than voluntary contribution to CPF. There'll come a time when the amount of interest saved is negligble and most of the monthly mortgage is just principal (instead of interest). That might be a good time to stop making lump sum payment if you have better use of the money.

To answer your question, yes, i'll make lump sum payment. I'll also save aside money for investing. It's the % that I'll adjust.

not too bad article which passed on a tolerable information.awaiting for more updates along these lines.

Online Tax Services

Tax Professional

Online Tax Preparation

Income Tax Preparation

Nice to be visiting your blog again, it has been months for me. Well this article that i’ve been waited for so long. I need this article to complete my assignment in the college, and it has same topic with your article. Thanks, great share. inspiration

Post a Comment