Just out of curiosity, I did a study on the ROE vs PB ratio for the different banks across the region. I fully understand that it's not a good apples to apples comparison because different banks have different regulations and capital requirements, and also different rules to recognise profits, bad debts and so on. But it's still good to see how the banks fare on these two metrics across the board.

All the figures are taken from the bestest platform to happen onto me this year: Investingnote. I don't just use them for the charts, but if you click on the tab 'Fundamentals', you can also get a quick and dirty ratios that are used commonly. They just don't have ROE, so I have to use a quicker and dirtier way to get my ROE by taking two ratios that they do have in the platform, namely Price to Book and Rolling PE. I just took the Rolling PE divided by the Price to book to get a rough ROE. For those companies that I can't find it from Investingnote, I used Yahoo finance to get the figures I want.

Don't trust me, I could have keyed in wrongly though.

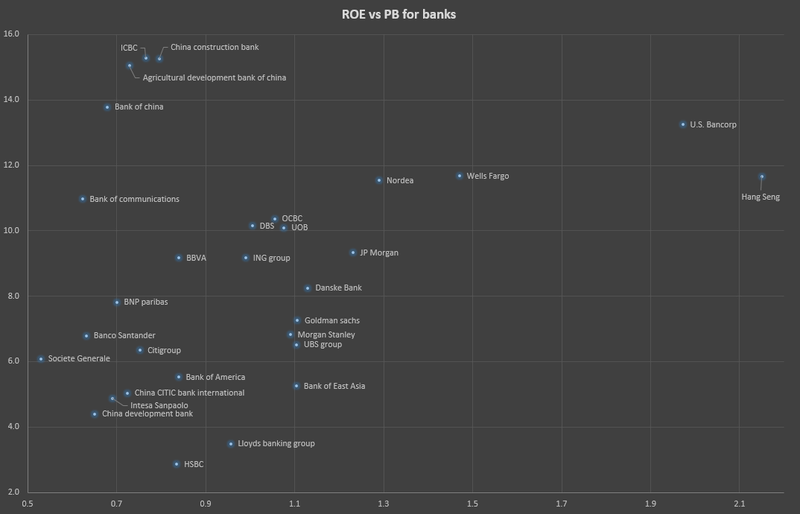

Anyway, here's the scatter plot:

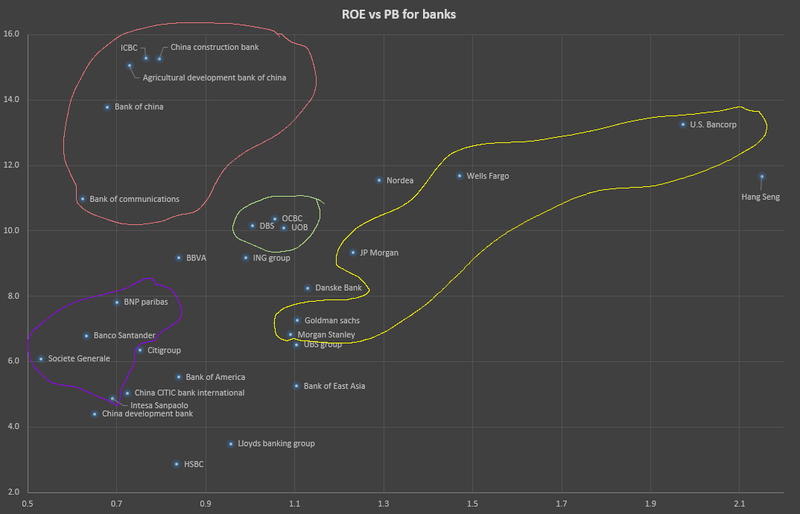

First look is that you can see a few clusters. Let me roughly group them for you:

The pink ones are the HK/China banks listed in HK. They are supposedly the best since they have the highest ROE with the lowest PB. But can their book value be trusted? We need to dig deeper into the figures. The best among them is ICBC and Agricultural development bank of China. ROE of 15+% with a PB of 0.7 to 0.8 is fantastic. Too good to be true? Again, I recommend readers to dig further and not to take these figures at face value.

The green cluster is our Singaporean local banks: OCBC, DBS and UOB. All of them have very similar ROE with OCBC taking the lead. DBS is the only one that is still priced below book (PB < 1) so technically they are still undervalued in terms of that.

The yellow cluster spread over a whole range of PB ratio, and these are the US financial firms. Of these, Wells Fargo and JP Morgan seems to be the best. US Bancorp seems too overvalued, even though they have the highest ROE.

The purple clusters are the banks from the EU side. Generally they are not doing too well, since they occupied the lower left corner of the scatter plot, characterised by low ROE and also low PB. It's interesting when there are investors who only look at PB ratio and determine that a low PB is always a good thing. Take a good look at the troubled banks. Almost all of them have low PB.

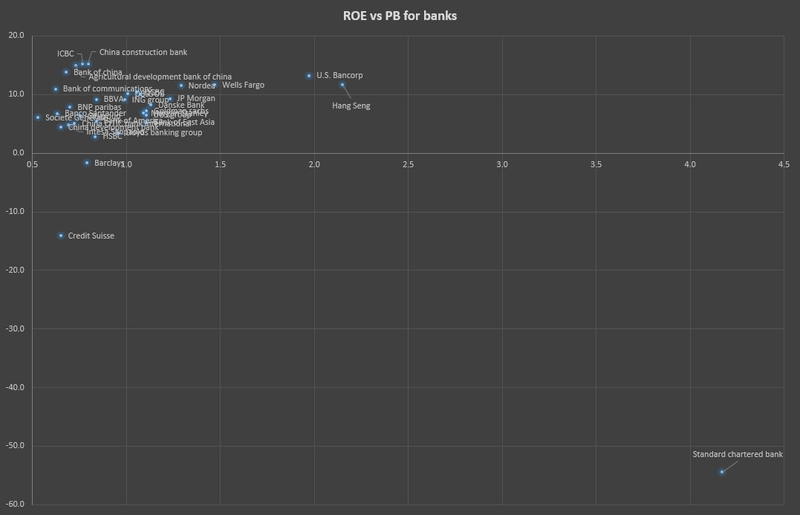

Why almost? You might also be wondering where is standard chartered bank? Here it is:

I excluded those banks with negative ROE (meaning they have negative earnings) so that we can see the scatter plot clearly. Barclays, Credit Suisse and Stanchart is right below the x-axis because they have negative earnings. The high PB ratio of Stanchart is strange. I didn't dig further but accepted the figures as it is. But those who are interested might want to do the dirty work of perusing their statements.

Seriously, I still think our local banks are worth buying, even after this recent run up. At the peak, they can reach a PB of 1.9 to 2.0. We're now around PB of 1.0 for the 3 local banks, so you can do your own calculations. Even at 1.5, there's still a lot of room.

STI 4000? Hahaha!

Trying to Make Sense of DBS’s 18% Return on Equity

19 hours ago

17 comments :

I have quite a bit of OCBC and DBS

They are for Long term.

Nice chart as comparison,,,at one glance! I'm still holding my OCBC and UOB ,,, but sold my DBS with big mistake after US presidential election. :-(

All past worries on exposure to O&G debts by big 3 banks disappears. :-)

Hi yeh,

Haha, how long term is that? There's always a time to sell, in my opinion. Otherwise you sit up and down a see saw, eventually go back to the ground level :)

Hi STE,

SAME! I had all three, but sold DBS after the election. Okay lah, we still have 2 more :)

Hi bro8888,

Haha, I heard it's just window dressing to close off the year with a bang :) The focus is now on higher interest rather than non performing loans lol

LP,

I have feeling if bank stocks go higher, your other 2 may disappear.

Banks are proxy to the economy ;)

Hi SMOL,

Wow, disappear in a good way (taken over) or in a bad way (close shop)? Haha

Long term investors becomes wrong term investor if it's the latter!

Opps!

Do excuse my poor England.

In disappear, I meant "disappear" from your portfolio as in you cash out.

Looking back, it seems early part of 2015 was the year to take some money off the table ;)

I sold one of my core holdings in Jan 2015 at $0.715 as I saw the fundamentals have changed only to see it go higher and higher all the way up to 0.739 :(

Was kicking myself for leaving too much money on the table then. The price yesterday was $0.40. I not kicking myself anymore ;)

There is a reason why Ministry of Manpower is getting stringent with businesses to report layoffs and retrenchments in a timely manner...

yes

now must learn to sell, see my ocbc and singtel.

sianz

buy but didn sell. only dividend. so now must learn to sell

Hi SMOL,

Haha, I get what you mean now :) Yup, I will sell it when the time is right..don't believe in holding long term when the economy and hence the stock market is cyclical, haha :)

Haha, maybe if you hold longer it'll become $4? :) I think we can't guilt trip ourselves on so many 'what ifs'. Can go nuts!

Hi yeh,

Well, might not be able to catch the top, so like what bro8888 mentioned so many times, slowly up and slowly sell! haha

Hi temperament,

Agree. If they are more like US banks, then I also will be scared! Those banks will go up and down with its own cycle, and I doubt you can really hold such companies for the long term since they also do their own trading. Need to watch it more carefully, compared to our 3 lao kok kok banks :)

thanks for your insightful article.

i happen to like standard chartered (singapore) esaver interest rates

standard chartered (UK) looks horrible from your plots so wondering if there is anything to worry about depositing with SCB singapore? thanks!

Hi simplefolk,

You really like scb? I dislike them to the point of transferring all my accounts, cutting all the credit cards issued by them, and moved my money elsewhere! In the past they are very innovative, but it seems now they just want to charge me money for every little thing.

Anyway, deposits with any banks in singapore is covered by insurance up to 50k. You can read more about it here: https://www.sdic.org.sg/di_overview.php. Pay special attention to this: https://www.sdic.org.sg/di_calc_of_comp.php

So go ahead and deposit away with scb :)

actually only like their short term interest rates :P

i have very simple banking needs, so innovative features usually not important :)

thanks for info on sdic insurance which unfortunately covers only up till 50k :(

Hi simplefolk,

haha, I see :) I guess if you don't want to have that kind of risk, you just have to spread 50k max per bank. No choice haha

Post a Comment