Recently, I was given an opportunity by a reader to explain more about CAGR. It's not a brand of cigar. It's refers to compounded annual growth rate - a calculation to find out the compounded returns per year (note that this is different from simple interest rate). I actually wanted to share how silly this calculation is about but I had a feeling that I've written about it donkey years ago. After searching, I realised I did write an article about CAGR here, so I'll just highlight or perhaps add some points to it.

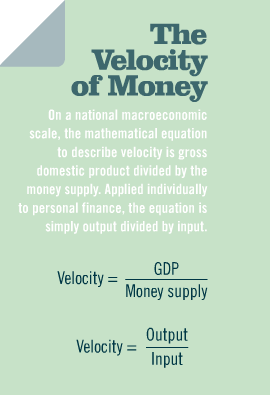

Frankly, I've not used CAGR for years because of I realised that with one calculation, the whole story can be quite distorted. Basically the calculation of CAGR depends on three variables - Future value, present value and time period. The most significant gripe I have about CAGR calculation is the fact that you can get hugely wide differences in value by just changing the variables. Essentially it boils down to a GIGO (garbage in garbage out) system where the output depends firmly on the input that you put it.

Take a look at this example. Let's say these are the figures for yearly profit from year 1 to year 4 respectively:

Present value: 10

Future value: 25

Time period: 3

CAGR: 35.7% per yr

Here's another example of yearly profit from year 1 to year 4 respectively:

For those who are synchronous with me in thought would have realised that the CAGR for the two examples are exactly the same. Why? The first example and second example looks very different but the three variables that affect CAGR calculation - namely present, future value and time period - are all the same.

1. Firstly, you must realise that the CAGR just draws a straight line between the start value (present value) and the end value (future value) and ignores all the ups and downs in between them. In a non-linear world, this assumption is just plain bullshit. I can make a good CAGR by carefully selecting my base year and my final year, so do be careful of it. Statistical calculation must be treated firstly as a blatant lie.

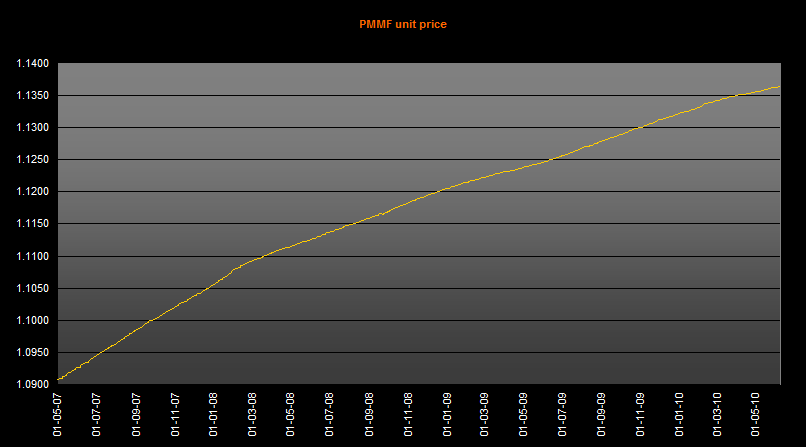

2. Secondly, it would be better to accompany CAGR calculation with the actual values of the data points in between the present and final values. To make it better, I would suggest a graph. It's like doing linear regression calculation in A'lvls - you must accompany each calculation with a scatter plot. This will give a bigger picture of the meaning of the CAGR value calculated.

3. Lastly, I simply do not use it anymore. From experience, projecting the past into the future is at best a guesstimate because the reality could be more optimistic but usually more pessimistic. Since it's a guesstimate, there's really no need to put a numerical figure to your guesstimate. I do not use it anymore because I fail to see the value of such calculations in fattening my wallet, though it might well do to fatten my ego.

Frankly, I've not used CAGR for years because of I realised that with one calculation, the whole story can be quite distorted. Basically the calculation of CAGR depends on three variables - Future value, present value and time period. The most significant gripe I have about CAGR calculation is the fact that you can get hugely wide differences in value by just changing the variables. Essentially it boils down to a GIGO (garbage in garbage out) system where the output depends firmly on the input that you put it.

|

Take a look at this example. Let's say these are the figures for yearly profit from year 1 to year 4 respectively:

10, 15, 20, 25

Present value: 10

Future value: 25

Time period: 3

CAGR: 35.7% per yr

Here's another example of yearly profit from year 1 to year 4 respectively:

10, -2, 45, 25

For those who are synchronous with me in thought would have realised that the CAGR for the two examples are exactly the same. Why? The first example and second example looks very different but the three variables that affect CAGR calculation - namely present, future value and time period - are all the same.

So, what does that leave us?

1. Firstly, you must realise that the CAGR just draws a straight line between the start value (present value) and the end value (future value) and ignores all the ups and downs in between them. In a non-linear world, this assumption is just plain bullshit. I can make a good CAGR by carefully selecting my base year and my final year, so do be careful of it. Statistical calculation must be treated firstly as a blatant lie.

2. Secondly, it would be better to accompany CAGR calculation with the actual values of the data points in between the present and final values. To make it better, I would suggest a graph. It's like doing linear regression calculation in A'lvls - you must accompany each calculation with a scatter plot. This will give a bigger picture of the meaning of the CAGR value calculated.

3. Lastly, I simply do not use it anymore. From experience, projecting the past into the future is at best a guesstimate because the reality could be more optimistic but usually more pessimistic. Since it's a guesstimate, there's really no need to put a numerical figure to your guesstimate. I do not use it anymore because I fail to see the value of such calculations in fattening my wallet, though it might well do to fatten my ego.