Today is the last day of 2017. Like previous years, I will grow reflective and think what I've done in the past year. I usually begin by asking questions to myself (and everyone) whether the year 2017 is a good year or not, and how anyone would grade this year out of 10. This year, I imagine having a conversation with myself, sort of an interview between me and myself.

Interviewer: I

Myself: M

I: I'd like to ask you this question. How would you grade this year 2017 out of a scale of 10? Can you share how and why you grade yourself this score?

M: This year is a fantastic 10 out of 10 for me. My usual categories are Finance, Mind, Body and Spirit.

Financially I did better than expected. I didn't do as much work because I had a child earlier this year, so I had to forgo some work scheduling so that I can be more present for my kid. But the lack of income is made up by other sources of income, so I ended up the year with nearly 70k of savings, when I only expected 30 to 40k. I was pleasantly surprised by that. I also managed to accumulate 240k, which means I can activate my plan to invest it at 5% pa to get a dividend income of $1k per month.

On the Mind part, I only managed to read 11 books instead of the usual 52 books a year. This is because the time I usually spent reading is now spent watching Netflix instead because I have only so much energy to spare throughout the day. I expect myself to start reading when things are more stabilised, but it doesn't seem like anytime soon. I did however read a few great books and I still take with me the lessons right now.

On the Body part, this is a total flop. No exercises, no more strict diet, no more pullups and pushups. No excuses for me.

On the Spirit side, I stopped meditating, but even after more than a year of stopping, I still think I got the positive effects of practising both mindfulness and meditating. There's nothing new on this front for me in 2017, just more of the usual stuff.

I: Hmm, from what you've described, it seems that 2017 is not such a good year isn't it? Why did you say it's 10 out of 10? Are you delusional?

M: Haha! Perhaps I am delusional. But there are people scoring 100% on every front yet they are also unhappy, so how do you make sense of it all? I think happiness is not just tied to these categories. More importantly, happiness is a state of mind, and this year 2017 is a joyous year for me. The birth of my son overshadows all the little things I had not achieved. My son is healthy and well, my mum who is recovering from cancer is also doing very very well and I am generally healthy. There's a lot of bad things that might had happened, but it didn't, so I am thankful and grateful for it. I make it a point to make every year a better year than the year before, and so far it had been true.

I: Alright, I see. So where do you see yourself at the end of 2018?

M: My big plan had been established a few years ago and I'm still following it. More of the usual, like saving 50k (or more) per year, and reading more often instead of watching Netflix. I don't think I still have the energy to exercise, but we'll see what we can do on that front. I want 2018 to be better than 2017 too.

I: What are your major challenges that you've encountered in 2017 this year?

M: It's getting used to a new regime and schedule after taking on a new identity - that of a involved father. I've seen a lot of tuition kids who fathers are absent and I am not going to let that happen to me, hence the conscious decision to be present to my kid. This means that there's a lot of personal time and work time that is sacrificed. I take it gladly.

The other thing is how not to not just survive but also to thrive in my caretaking of my son. I don't want to just feed and change the diapers, but also to build a relationship and really want to spend time with my son. I'm still learning to do well, but there's still room for improvement. At least he called me papa before anyone else and I'm secretly happy and glad that I must have done the right thing.

I: You said that this year you read less than your usual 52 books a year. How do you feel about that?

M: I think after a few months into the year 2017, I already had an inkling that I am not going to hit that figure, so I took it in my stride. I started taking down notes instead of just reading, so instead of going for breadth, I went for depth. I am practically studying the things I was reading this year, so it is very refreshing for me. I took a long break from reading and I felt better of it. I had been reading intensely ever since I started that habit in 2007, so a break after 10 yrs seem appropriate. It's a liberating feeling to be honest. I always felt that I had to continue reading and reading, because I had a target to meet. That was like being disciplined and goal oriented. I'm still learning to take things easy.

I: How do you feel about being a father?

M: That is one of the best thing that happened to me. I didn't know I am capable of giving love to another person, not even to my wife. I didn't know that I can be melted just by a flash of a smile and with tiny fingers wrapped around mine. I thought I won't be able to handle taking care of babies too. But I believe I handled it pretty well. I think my relationship with my wife also improved tremendously. We always think to ourselves, whether it'll be better being younger parents. But I think the answer is no. We're more ready now than before, and if we have our child before we're ready, we will be much more anxious and subjected to peer pressure. This is the best time for us.

I: Alright, we know you're a good father, but besides the baby, what's the scariest thing you've done in 2017?

M: It must have been the public speaking gig I had at DBS NAV. I had to prepare some presentation slides on powerpoint, and the last time I did that was back in my university days when I had to present to a panel of lecturers who are grading my thesis. It had been decades since I last did any sort of such speaking. That was some scary shit, but I think I managed to pull it off. It's definitely the scariest and the most stressful thing that happened to me in 2017. Even way above seeing my wife giving birth naturally to my son, for sure. I'm not the one in pain and I'm not scared of blood lol

I: Last question for you. If there's one thing in 2017 that you would like to repeat in 2018, what would that be?

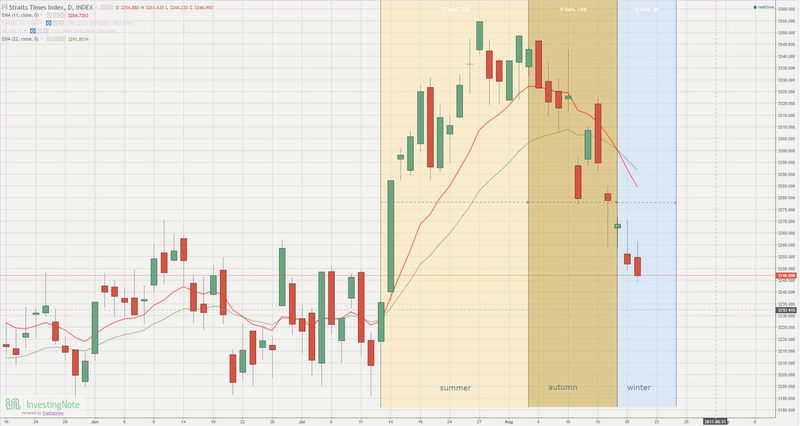

M: I'm quite torn by this question. There's the bullishness of the stock market that propelled by networth quite a bit. Do I want to repeat that? I think not. It might feel good, but I'm about 45%+ in cash, and I would like to have some chance to utilise that at some good point in 2018, haha! I think I'll go for great health for everyone that I love. I want that to repeat again in 2018 and I will be so thankful and blessed by it.

Interviewer: I

Myself: M

I: I'd like to ask you this question. How would you grade this year 2017 out of a scale of 10? Can you share how and why you grade yourself this score?

M: This year is a fantastic 10 out of 10 for me. My usual categories are Finance, Mind, Body and Spirit.

Financially I did better than expected. I didn't do as much work because I had a child earlier this year, so I had to forgo some work scheduling so that I can be more present for my kid. But the lack of income is made up by other sources of income, so I ended up the year with nearly 70k of savings, when I only expected 30 to 40k. I was pleasantly surprised by that. I also managed to accumulate 240k, which means I can activate my plan to invest it at 5% pa to get a dividend income of $1k per month.

On the Mind part, I only managed to read 11 books instead of the usual 52 books a year. This is because the time I usually spent reading is now spent watching Netflix instead because I have only so much energy to spare throughout the day. I expect myself to start reading when things are more stabilised, but it doesn't seem like anytime soon. I did however read a few great books and I still take with me the lessons right now.

On the Body part, this is a total flop. No exercises, no more strict diet, no more pullups and pushups. No excuses for me.

On the Spirit side, I stopped meditating, but even after more than a year of stopping, I still think I got the positive effects of practising both mindfulness and meditating. There's nothing new on this front for me in 2017, just more of the usual stuff.

I: Hmm, from what you've described, it seems that 2017 is not such a good year isn't it? Why did you say it's 10 out of 10? Are you delusional?

M: Haha! Perhaps I am delusional. But there are people scoring 100% on every front yet they are also unhappy, so how do you make sense of it all? I think happiness is not just tied to these categories. More importantly, happiness is a state of mind, and this year 2017 is a joyous year for me. The birth of my son overshadows all the little things I had not achieved. My son is healthy and well, my mum who is recovering from cancer is also doing very very well and I am generally healthy. There's a lot of bad things that might had happened, but it didn't, so I am thankful and grateful for it. I make it a point to make every year a better year than the year before, and so far it had been true.

I: Alright, I see. So where do you see yourself at the end of 2018?

M: My big plan had been established a few years ago and I'm still following it. More of the usual, like saving 50k (or more) per year, and reading more often instead of watching Netflix. I don't think I still have the energy to exercise, but we'll see what we can do on that front. I want 2018 to be better than 2017 too.

I: What are your major challenges that you've encountered in 2017 this year?

M: It's getting used to a new regime and schedule after taking on a new identity - that of a involved father. I've seen a lot of tuition kids who fathers are absent and I am not going to let that happen to me, hence the conscious decision to be present to my kid. This means that there's a lot of personal time and work time that is sacrificed. I take it gladly.

The other thing is how not to not just survive but also to thrive in my caretaking of my son. I don't want to just feed and change the diapers, but also to build a relationship and really want to spend time with my son. I'm still learning to do well, but there's still room for improvement. At least he called me papa before anyone else and I'm secretly happy and glad that I must have done the right thing.

I: You said that this year you read less than your usual 52 books a year. How do you feel about that?

M: I think after a few months into the year 2017, I already had an inkling that I am not going to hit that figure, so I took it in my stride. I started taking down notes instead of just reading, so instead of going for breadth, I went for depth. I am practically studying the things I was reading this year, so it is very refreshing for me. I took a long break from reading and I felt better of it. I had been reading intensely ever since I started that habit in 2007, so a break after 10 yrs seem appropriate. It's a liberating feeling to be honest. I always felt that I had to continue reading and reading, because I had a target to meet. That was like being disciplined and goal oriented. I'm still learning to take things easy.

I: How do you feel about being a father?

M: That is one of the best thing that happened to me. I didn't know I am capable of giving love to another person, not even to my wife. I didn't know that I can be melted just by a flash of a smile and with tiny fingers wrapped around mine. I thought I won't be able to handle taking care of babies too. But I believe I handled it pretty well. I think my relationship with my wife also improved tremendously. We always think to ourselves, whether it'll be better being younger parents. But I think the answer is no. We're more ready now than before, and if we have our child before we're ready, we will be much more anxious and subjected to peer pressure. This is the best time for us.

I: Alright, we know you're a good father, but besides the baby, what's the scariest thing you've done in 2017?

M: It must have been the public speaking gig I had at DBS NAV. I had to prepare some presentation slides on powerpoint, and the last time I did that was back in my university days when I had to present to a panel of lecturers who are grading my thesis. It had been decades since I last did any sort of such speaking. That was some scary shit, but I think I managed to pull it off. It's definitely the scariest and the most stressful thing that happened to me in 2017. Even way above seeing my wife giving birth naturally to my son, for sure. I'm not the one in pain and I'm not scared of blood lol

I: Last question for you. If there's one thing in 2017 that you would like to repeat in 2018, what would that be?

M: I'm quite torn by this question. There's the bullishness of the stock market that propelled by networth quite a bit. Do I want to repeat that? I think not. It might feel good, but I'm about 45%+ in cash, and I would like to have some chance to utilise that at some good point in 2018, haha! I think I'll go for great health for everyone that I love. I want that to repeat again in 2018 and I will be so thankful and blessed by it.