This is the second part of the Frasers Centrepoint Limited 3.65% pa bond. The first part is

here. I managed to get a copy of the prospectus and read it. Hence, for ease of reading, I summarised the main points of the bonds again here, with some additional information:

-------------------------------------------------------------

Duration: 7 years until 22nd May 2022.

Option for early redemption: Earliest date for optional redemption is 22nd May 2019 and on each interest payment date thereafter

Interest payment dates: 22nd May and 22nd November. First payment on 22nd Nov 2015.

Coupon yield: 3.65% pa

Open for subscription: 13th May 2015, 9 am

Closing: 20th May 2015, 12 noon

Minimum amt for retail: $2000, with integral multiples of $1000 thereafter

Retail (public tranche): $150 million

Institutional tranche: $50 million (

closed!)

--------------------------------------------------------------

I decided to do a FAQ of questions that I had gathered from interacting with others on facebook and the comments from my previous post. The information is laid bare here. It's up to you to decide if this is a good deal or not and I won't answer questions regarding whether it's suitable for you.

1. Can we use CPF to apply?

No

2. Can we use funds from Supplementary retirement scheme (SRS) to buy?

There are two stages in this. Firstly, there is an initial offer of the bonds, which is what they are doing now. Consider this the same as the IPO of stocks. After this initial offer, the bonds will be listed on SGX, where you get to buy at whatever market price the bond is offered.

You cannot use SRS funds to buy this bond at the initial offer stage. However, you can use funds from SRS to purchase the bonds from the market after it is listed on SGX.

3. How long do you have to hold it?

7 years, if you want 0% chance of losing your initial capital. There is a

slight complication in the redemption date, so please read point number 4 below. You can sell it anytime like stocks on SGX since the bond will be listed there, and you’ll be subjected to the market price of the bonds then. Hence, you might suffer a loss if you sell below $1 or book a profit if you sell above $1. Brokerage fees and comms apply too.

4. Can the issuer redeem the bonds earlier than the maturity period of 7 years?

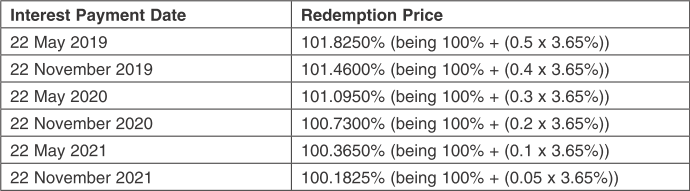

Yes. In the prospectus, page 47, it is stated that the issuer can choose to redeem back the entire tranche but not in part, of the bonds starting from 22nd May 2019 (inclusive), on 22nd May and 22nd Nov each year. They will have to give 1 month to 2 months of notice to the holders if they choose to do so. Furthermore, should the issuer choose to redeem early, they will not redeem back at par value of $1.

The table, also taken from page 47 of the prospectus, state the redemption price of the bond in % of the par value of the bond at different possible redemption date starting from 22nd May 2019.

For example, if they choose to redeem on 22nd May 2020, which is earlier by 2 yrs from the maturity period of 7 years, they will have to redeem back the bond at 101.0950% of the par value of $1, which is $1.01095.

5. When are the interest payment dates?

The bonds pay out interest twice a year, on 22nd May and 22nd Nov each year, from 22nd Nov 2015 (first payment) to 22nd May 2022 (last interest payment). 22nd May 2022 is also the maturity date of the bond

6. What’s the par value?

The par value of this bond is $1. When it’s listed, it will come in board lots of 1000 ‘shares’. Par value is what the price of the bond is when it is first issued out, and also the price that the issuer will redeem back from you, regardless of market price, at the end of 7 yrs on 22nd May 2022. There is a

slight complication, so please read point number 4.

7. What are the returns like?

If you bought the bond at par value of $1, and hold it for 7 yrs, you will be guaranteed your capital. On top of that, you will have interest paid to you at 3.65% per year, paid out twice a year.

If you bought the bond on the secondary market after it had been listed, the returns will then depend on the market price of the bond. If you buy it above par of $1, you will be guaranteed a loss upon maturity of the bond, because the issuer will redeem back the bond at $1, regardless of how much you bought it. On the other hand, if you buy it below the par value of $1, you will be guaranteed a profit at the maturity of the bond. 3.65% pa yield is only for a par value of $1, so if you buy above or below par, the yield will decrease or increase proportionally. For bonds, it’s better to calculate the yield to maturity if you buy it at any market price other than the par value, and at any other times other than the initial offer of the bond.

8. How does the bond work? Can you explain how the process is like for us to be paid?

If you’ve experience in buying shares, this analogy should clarify your fears. If a company wants to be listed on SGX, they will do an IPO for investors to get in. So investors will buy at the IPO price through ATM or internet banking. If it is oversubscribed, the issuer will do balloting, so you might not get everything that you bid for. They will have an allotment table to tell you how many lots of this IPO you get based on how much you want to subscribe.

After this IPO is over, the company becomes listed on SGX and you can buy/sell it, subject to market price. The shares certificates are kept in the CDP account, which can be linked to your bank account. If the company gives dividends, they will check if your name is under the registrar by checking up the CDP account. If it is, then you’ll be entitled to the dividends. Once the dividend is paid, it’ll be transferred to your bank account tied to your CDP account.

If you sell the shares, the share certificates will be transferred electronically to the buyer after a few days. The money you get from selling it will be transferred to your bank account tied to your CDP account again.

That’s for shares.

For bonds, they will also do an IPO. The ‘IPO’ price of the bond is called the par value. Investors participate in the bond IPO by going to ATM or internet banking to subscribe for it. Again, if the bonds are oversubscribed, the issuer will do balloting so you might not get all that you subscribed for. The allotment will be based on a table just like the IPO of shares. I will highly suggest applying odd and not even number of lots if you want more.

After the IPO of the bonds is over, the bond will get listed on SGX and you can buy/sell subject to market price. The bonds are in board lots of 1000 ‘shares’, so the minimum you need to buy is $1000 (exclude brokerage and comms). The bond certificate is also placed in your CDP account and when interest is paid (twice yearly), they will check if your name is under the registrar by checking your CDP account. If you have the bond certificate in your CDP account, the ‘dividends’ of the bond will be paid to the bank account tied to your CDP account.

Should the issuer redeem back the bonds, the money that you get is again transferred to the bank account tied to your CDP account.

9. Is it really guaranteed?

The guarantee of a bond is only as sure as the solvency of the underlying issuer. You will have to do your own judgement whether Fraser Centrepoint Limited will still be around in 7 years. If you think they have problems surviving till 2022, then it's better not to buy the bond.

Update: I did a post on the returns that you can if they choose to redeem it early on the 4th year. I'm just expanding a little more detail regarding the possibility of early redemption.

Please read it here.