With the recent announcements of the Singapore Savings Bond (SSB) coming up in Sept, which is just 2 months away, there's a lot more thinking on my part regarding how best to utilise this new instrument to preserve and grow our wealth.

The advantages of this savings bond is widely reported in the newspaper. It's that you can cash in and liquidate the bond any time without price risk. For bonds, there is a maturity date and if you hold the bonds till maturity date, there is a guarantee on the capital invested. The price in between the purchase date (if you buy on par) and the maturity date can fluctuate widely, and possibly go down because of the near certainty of a interest rate increase in the short term, but you can sleep well on it. Because if you hold the bonds till maturity, you'll get back the par value of the bond. However, if you cash in early before the maturity date of the bond, you stand to lose (or gain) depending on the price that the bond is trading at that point in time. Well, the SSB don't have this advantage at all.

The other advantage is that the interest rate will pro-rate according to how long you hold. If you hold it for 1 yr, the interest rate of the investment sum will approach the 1 yr bond interest rate. If you hold it for 10 yrs, then you will get the interest rate equal to that of a 10 yr bond interest. Add to the fact that you don't have price risk when you cash out early, this serves as a quick and dirty way to hold your excess cash.

The last good thing about this is that it's guaranteed by the Singapore government. Ultimately, a bond is an IOU from the debtor to the lender, where the lender lends a sum of money to the debtor, with the debtor promising to pay the sum borrowed plus another interest to compensate the lender for lending. Hence, a bond is as guaranteed as the solvency of the debtor. If the debtor crash and burn, so too will your piece of IOU. In this case, the debtor for the SSB is the Singapore government. As good as gold, as they say.

Do bear in mind that you need about 1 month's time to liquidate the bonds. So, it's probably not good to leave ALL your extra cash inside. What happens if you have an emergency where you need a sum of money NOW? Got to think about that.

So how am I going to utilise this new instrument?

1. I'll first put in about 3-6 months worth of emergency cash in it as a first tranche. Since I'm paying my mortgage using cash, and I'm filling up my CPF with cash as an emergency hoard for paying my mortgage, and the CPF pays higher rates than the SSB, I'll likely put in an amount equivalent to 3 to 6 months of expenses WITHOUT including mortgage. I'll rather put my mortgage money in the CPF, thank you very much. Some people are funny, they are actually asking whether they can buy using CPF...

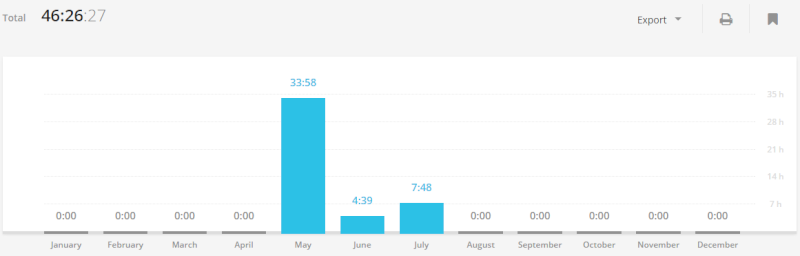

2. Next will be my war chest. Currently they are sitting in my POEMS money market fund, getting about 0.5% pa. If I put it in SSB for 1 yr, I'll get around 0.9% pa. For 2 yrs, it'll be about 1.2% pa and so on until 10 yrs, which is about 2.4% pa (and expected to rise too). Maybe I'll put in 2/3 of war chest inside here and will keep the rest as cash. The exact proportion I haven't worked it out yet..we'll see how it goes.

I'll put in my 3-6 months emergency cash in first, get to know how the system works, and see how to do it regarding my war chest. I'll be a great additional weapon to use, but I still wish we have more retail bonds lol

The advantages of this savings bond is widely reported in the newspaper. It's that you can cash in and liquidate the bond any time without price risk. For bonds, there is a maturity date and if you hold the bonds till maturity date, there is a guarantee on the capital invested. The price in between the purchase date (if you buy on par) and the maturity date can fluctuate widely, and possibly go down because of the near certainty of a interest rate increase in the short term, but you can sleep well on it. Because if you hold the bonds till maturity, you'll get back the par value of the bond. However, if you cash in early before the maturity date of the bond, you stand to lose (or gain) depending on the price that the bond is trading at that point in time. Well, the SSB don't have this advantage at all.

The other advantage is that the interest rate will pro-rate according to how long you hold. If you hold it for 1 yr, the interest rate of the investment sum will approach the 1 yr bond interest rate. If you hold it for 10 yrs, then you will get the interest rate equal to that of a 10 yr bond interest. Add to the fact that you don't have price risk when you cash out early, this serves as a quick and dirty way to hold your excess cash.

The last good thing about this is that it's guaranteed by the Singapore government. Ultimately, a bond is an IOU from the debtor to the lender, where the lender lends a sum of money to the debtor, with the debtor promising to pay the sum borrowed plus another interest to compensate the lender for lending. Hence, a bond is as guaranteed as the solvency of the debtor. If the debtor crash and burn, so too will your piece of IOU. In this case, the debtor for the SSB is the Singapore government. As good as gold, as they say.

Do bear in mind that you need about 1 month's time to liquidate the bonds. So, it's probably not good to leave ALL your extra cash inside. What happens if you have an emergency where you need a sum of money NOW? Got to think about that.

So how am I going to utilise this new instrument?

1. I'll first put in about 3-6 months worth of emergency cash in it as a first tranche. Since I'm paying my mortgage using cash, and I'm filling up my CPF with cash as an emergency hoard for paying my mortgage, and the CPF pays higher rates than the SSB, I'll likely put in an amount equivalent to 3 to 6 months of expenses WITHOUT including mortgage. I'll rather put my mortgage money in the CPF, thank you very much. Some people are funny, they are actually asking whether they can buy using CPF...

2. Next will be my war chest. Currently they are sitting in my POEMS money market fund, getting about 0.5% pa. If I put it in SSB for 1 yr, I'll get around 0.9% pa. For 2 yrs, it'll be about 1.2% pa and so on until 10 yrs, which is about 2.4% pa (and expected to rise too). Maybe I'll put in 2/3 of war chest inside here and will keep the rest as cash. The exact proportion I haven't worked it out yet..we'll see how it goes.

I'll put in my 3-6 months emergency cash in first, get to know how the system works, and see how to do it regarding my war chest. I'll be a great additional weapon to use, but I still wish we have more retail bonds lol