Regarding rights issue, I've a fair bit of experience dealing with this, hence I would like to share some of my findings regarding the rights exercise. A rights exercise has got 2 components to it:

a. Firstly, the amount of rights entitled to you and the price of the rights shares.

This is basically the terms of the rights exercise. If a rights exercise is 2 for 10 @ 20 cts each, it means that for every 10 shares that you have, you're entitled to 2 rights shares at 0.20 per share. For example, the very recently completed first reit rights exericse, it's a 5 for 4 rights issues @ 50 cts. This means that for every 4 shares that you owned, you'll be entitled to 5 rights shares @ 0.50 per share.

b. Secondly, the excess rights allocation

Besides applying for your entitled rights based on the amount owned before XR, you can also apply for excess rights. These are shares that you apply over and above the ones that you are entitled to. The good thing about the excess rights is that you can get it cheaper than the price of the shares after XR and without paying any brokerage charges. The bad thing is that if you apply 50 lots of excess rights, you might not get any at all.

In this blog post, I'm going to share how to make the most out of a rights exercise. I'll explain in terms of the very recently completed first reit rights exercise, since their numbers are still fresh on my mind.

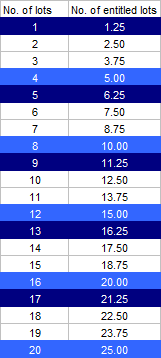

As mentioned, first reit rights is a 5 for 4 rights exercise, with each right shares priced at 50 cts. The price just before XR is around 0.95 to 0.97 thereabouts. After it goes XR, the price of the mother share will drop to reflect the dilution because of the greater number of shares. Since I do not own any first reit until it announced its intention to have a rights issue, I wanted to own a certain number of lots before XR so that I can maximise the amount of odd shares rounding when they start balloting for excess rights. The whole system works like this - preference for the allocation of the excess rights would be firstly for those odd lots holder. For example, if I own 10 lots of first reit rights, I'll be entitled to 12.5 lots of rights (10/4 x 5 = 12.5), so I'll end up with odd lots. If I apply for 1 lot of excess rights, the chances of me getting 0.5 lots to round up my odd lots is significantly higher than other people who do not have odd lots rounding. In fact, for all of my rights exercise I've been through, there never is a time where my odd lots are not rounded up. I'll say it's a pretty safe bet.

This works because straight away, you'll be entitled to 0.5 lots @ 50 cts each. It contributes more if you're a holder of lesser lots and it's not so significant if you have a lot of holdings to begin with.

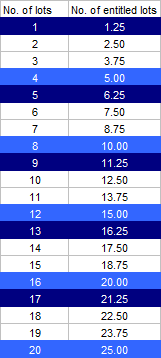

To maximise my lots, I worked out the maths empirically on a spreadsheet because it's easier to observe the relationship. Again, the

rights exercise for first reit is 5 for 4.

|

| First reit rights exercise: Optimum lots to get maximum excess rights for odd lots rounding |

The lighter blue rows are the round lots. If you do not want to end up with odd lots at all, you should buy in 4, 8, 12, 16, 20 lots etc, i.e. in multiples of 4. Doing so, you'll always end up with round lots. The darker blue rows are the optimum amount of lots to buy in so that you'll end up with the maximum amount of excess rights due to odd lots rounding. The lots are 1, 5, 9, 13, 17 etc, i.e. one more than the multiples of 4.

You can work out the formula for subsequent members of this series - it's 4n+1, where n is the any integer starting from 0.

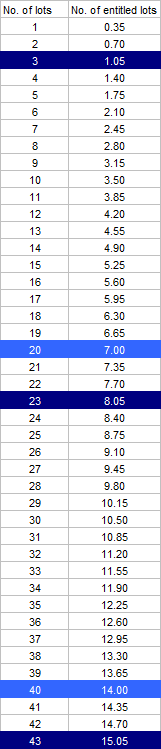

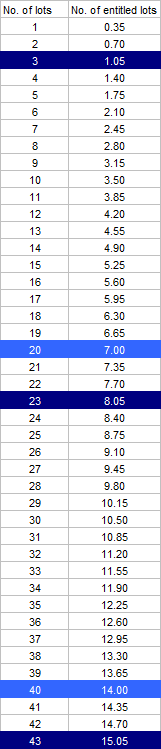

I'll give another example for the sake of illustration. Let's use the not too recent AIMSAMPIReit rights exerise.

This one is 7 for 20 rights exercise at 0.155 per rights share. Let's take a look at the allocation:

|

| Aims rights: Optimum lots to get to maximise the excess rights from odd lots rounding |

To optimise the amount of lots to hold in order to get the maximum excess rights from odd lots rounding, we have to buy 3, 23, 43 lots, i.e. 3 lots more than the multiples of 20. These are shown by the darker blue rows, as opposed to the light blue rows which are the number of lots for those who do not want any odd lots at all.

The formula to optimise this is: 20n+3, where n is an integer starting from 0.

People are afraid of getting odd lots and I do not know why. If you have POEMS or other brokerage accounts that allows you to trade odd lots on the open market, then there's really no problem with getting odd lots. I've traded odd lots on the unit share market on POEMS and they charge a lower minimum commission than ordinary lots, though the spread might be larger because of it's not liquid enough. Still, with the two examples shown above, you should be able to work out the formula yourself if you wish to capitalise on your chances of getting excess rights from the preference given to odd lots holders after the rights exercise.

The second thing to do to make the most out of rights exercise is to capitalise on the factors that affect the allocation. Let's list out all of them:

1. The amount of lots owned before XR

2. The amount of excess rights applied

As mentioned, preference would first and foremost be given to holders of odd lots after XR. Any others would be subjected to balloting or the rules set by them.

AK had done a very good post on the possible theory on how first reits distributes its excess rights. It'll make perfect sense to allocate based on the entitled rights (which in turn is based on the amount of lots owned before XR). It would seem that it had nothing to do with the excess rights applied, unless of course the excess rights applied is lesser than the allotment based on AK's theory. An interesting observation is that the excess rights allocated would NEVER exceed the amount of lots owned.

I did put the data collected after the rights exercise of aims together to do some number crunching. Unlike AK, I tried to put it to some model to see if it fits. Upon seeing his post, I think that it's more likely that the companies would stratified their excess rights allocation according to different strata rather than a function like mine. Anyway, here's what I found out:

You'll find that the amount of excess rights allocated (after accounting for odd lots) has nothing much to do with the amount of excess rights applied at all. I'm not looking for some formula that can be applied to all other rights issue (I doubt there is such a thing) but there seems to be no visual correlation between the two.

Looking at the lower graph, there appears to be some positive correlation between the amount of excess rights allocated (after accounting for odd lots) and the amount of holdings owned before XR. I understand that the entire relation is determined by the far flung end point on the right, so let's just ignore it for now. The best I can say is that generally, the higher the amount of holdings that you have, the more excess rights would be allocated to you. Again, the amount of excess rights allocated to you NEVER exceeded the amount of holdings that you have.

With my findings on Aims and that of AK, we can safely conclude the following:

a. Excess rights allocation is based on the amount of holdings that you have. The more holdings you own before XR, the more excess rights would be allocated to you.

b. Excess rights allocation does not seem to have anything to do with the amount of excess rights that you applied. In addition, the total excess rights allocated to you will not exceed the amount of holdings that you have before XR. So, save yourself the trouble. If you have 5 lots before XR, don't apply for 20 lots of excess rights - 5 lots of excess rights would be more than sufficient.

To conclude this very long post, there are 2 main ways to get the most out of a rights exercise. The first is to make sure you get the maximum number of excess rights for odd lots rounding since preference is given to those first. The second is simply to own more shares before XR. This would boost the chances of you getting more excess rights. If you do these two tricks, you'll end up with more bang for the same buck.