I wrote about my offensive and defensive strategies two years ago here, but never really got a chance to review it to see if it's still relevant. Let's do it now.

In that post, I talked about the dilemma of using cash to shave off interest at 2.6% by doing a partial capital repayment, or using it to invest in the market by getting a return of more than 2.6%. It's not an easy solution and I opted to do both to avoid the two extreme end game scenario of being asset rich but cash poor OR paying excessive interest for my housing loan and being in debt for a good 30 yrs. So, I came up with 3 plans:

1. HDB capital repayment plan

This is to top up 12k every year, shared between me and my wife, so that my 30 yrs loan will be shortened by about half. So far, I've been consistently topping up 12k towards the end of every year towards the completion of goal. From last calculation, I would have finished the loan in another 12 years. I talked to my wife about the interesting scenario where my son will be stressing over his PSLE while we will be celebrating and popping champagne for a completed milestone of finishing our HDB loans, LOL! Finishing our home loan will be one of the greatest accomplishment and I look forward to giving HDB my last check to wrap up the whole affair.

2. Build up of capital for 1k/mth dividend plan

This plan is to build up a base of 240k capital, and when invested at >5% pa, will generate 1k/month. In that post, the expected duration is about 2-3 yrs and I think I'm still on track towards that goal. Next year will be the 3rd year and I don't see why I can't fulfill this project on time. Well, at least for the capital build up phase. I intend to slowly deploy even if I have the capital, so there's no rush to get the 1k/month. Realistically, I can channel $20-40k per year to this project, depending on how much I can save, and that depends on how much income I can earn, which is a variable. Every year, my income will drop drastically as the graduating students leave so I will have to work hard to push it up to last year's income as fast as possible in order to save more. I was initially worried about my income for 2017, but I felt a lot more secured when currently I have about 75% of my income confirmed for 2017. I should be able to start 2017 running. This 1k/month dividend income will come in at a very good time as I will have to reduce my work load to prepare for more family time. It couldn't have come at a better time, so I'm glad I started this way ahead.

3. Emergency fund of funds

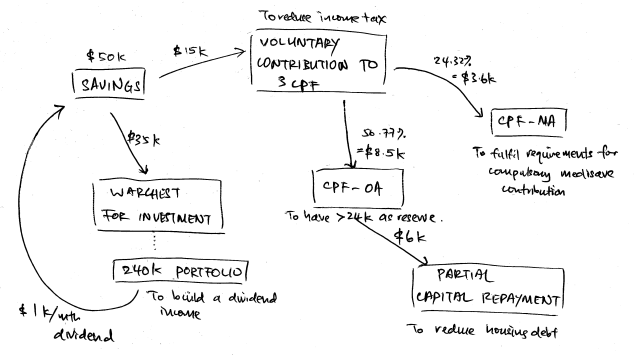

This project is to do voluntary contribution to my 3 cpf accounts in order to build up a full year of mortgage payment, to the tune of 24k. I did a tweak for this project. Instead of topping up 6 to 12k as mentioned in the article, I will top up 10 to 15k as voluntary contribution annually. Firstly, this will reduce the amount of tax I have to pay. Secondly, 56.77% of the contribution amount will be channeled to my OA, so that will be about 5 to 8k every year. I will then do a partial capital repayment of 6k using CPF (instead of cash).

So, the workflow goes like this:

Doing this achieves 5 things in one shot:

1) Reducing personal income taxes because voluntary contribution (VC) will have tax reliefs

2) Topping up MA to pay up for compulsory medisave contribution, as part of the VC (24.33%) will be channeled to MA, so there will be less cash outlay to top up just for the compulsory MA portion

3) Topping up OA to build an emergency fund of funds to have 1 yr of mortgage as reserve, so I know I can last 1 year without income and the mortgage for the house can still be paid for

4) Partial capital repayment to reduce housing debts so that the housing debt will be reduced and it helps to save on the interest for the remaining loan amount

5) More cash available since (1) to (4) comes from the same tranche of money by doing VC, so this enables my investment porfolio to build up faster. Ideally, I should have more money outside CPF than inside, to hedge against the policy risk and constraints of using CPF solely as a retirement tool.

It took me some years to realise this workflow and I should have done it much sooner, but that's the point of this post. If there's some self employed out there who is in a similar situation, you can short cut a few years of trial and error modify/adapt the workflow to suit your circumstances.

To be frank, having a child is not part of the plan when I wrote the post back in 2014. I think it'll be interesting to see how these goals will change when I review it a few years later after having a kid running around the house. I would expect more modifications to come for sure.

Trying to Make Sense of DBS’s 18% Return on Equity

19 hours ago

16 comments :

Hi LP,

VC to all 3 CPF accounts will not entitle you to tax relief. Retirement Sum Top-up Scheme (Means putting in monies into CPF SA ONLY) will entitle you to tax relief.

Hi betta man,

Disagree. This is not the first time you said it, and I'll still say the same reply. It does give tax relief and I had been getting it for years. Perhaps I'm a self employed but I confirmed that there is tax relief.

Hi LP,

Awesome and very clear goals there, looks like you are on the right track, just need to fine-tune it a bit to cater for the little one :-)

Cheers!

Hi LP,

I guess you know better then as I have been an employee all my life so far.

Hi Richard,

Haha, thanks for your kind words :) I have no prior experience in budgeting for a family, so I suspect will have to experiment a bit. But I don't think will make a lot of difference in expenses. I guess it boils down to expectation.

Hi betta man,

Haha, then you also understand the CPF system better than me! But from experience, as a self employed, there will really be tax reliefs for VC to 3 accts and I've done it for a few years. What's the difference between self employed scheme and employee? I guess it's for those interested to find out. There's a lot of info for employees on how to hack the system to get into semi retirement or FF faster, but not a lot for self employed. Hence, the post.

Hi LP,

Interesting , I like the chart on how the money flows and clear direction on how to achieve the target !! :-)

Gambateh!! Cheers 👍👍👍

Hi STE,

Thanks! Once the plans for the castle in the air is conceptualized, it's now time to wake up and start building the foundations :)

From my experience

Try to TOP up your Medisave, and get yourself a good insurance plan to cover the medicine fee.

Medical fee really sucking blood in sg.

Hi yeh,

Yup, part of the voluntary contribution amt will be channelled to MA, and I also top up to specifically the MA too. I think partly cos you're not a Singaporean, so you don't have a lot of subsidies and that's why you have to pay a lot more is it? My heart goes out to you :(

Hope you recover well!

Yes. But good that my Husband company cover spouse hospital bill.

Per admission can claim up to 25k. This really help us a lot and worry less.

Thanks for your concern.

Stay in C class can also cost a big bomb for the pocket.

Hi yeh,

Ah, I see..that's good, I guess every little thing helps to cover the cost, at least partially. Don't wrry about the cost then, take care of health first. Can always earn back later.

just thinking..why use OA to do capital repayment when the loan is 2.5%? OA earns 4%?

Hi babbler,

The idea is to reduce loans AND prepare a portfolio for dividend income AT THE SAME TIME. I don't want to do one at the exclusion of the other. Interest loan is fixed and guaranteed but investment returns are not. It's good, at least for me, to do both together.

Hi LP,

I agree it is better to have money in CPF OA rather than wipe off to service mortgage.

I myself never wipe out OA and have it raised every year. On top of that, I also previously use OA to buy some funds. In case of emergency, may need to liquidate those funds to have even more money in OA to pay off mortgage.

Hi Rolf,

Thanks for your comments, though I disagree respectfully :) Let me try to explain why.

Perhaps my circumstances is different, because I'm a self employed and I pay my monthly mortgage through cash and have very little cpf in the first place beyond what I voluntarily contributed (VC). So every month I have this cash outlay for the housing. I want to reduce the loan duration of my housing loan, so to do that without using CPF OA to do partial capital repayment, I'll have to use extra cash. Cash that could otherwise have been used to grow my retirement portfolio. I don't want more cash outlay.

The best solution for me is to do a VC (and get tax rebates) and also use some to pay off the loan. I'm still growing my CPF through my VC, I'm still growing my investment portfolio outside of CPF, I'm still getting tax rebates and it is good for me. I've built up close to 1 yr's worth of mortgage inside my OA already, and I'm comfortable with that.

Post a Comment