We often hear this nails-scratching-on-blackboard phrase "Buy low Sell high" until our eyes roll and our skin crawling with goosebumps. There's truth in it, except that like all aphorism, it's not as simple as it is. Let's deconstruct that phrase.

Buy low sell high consists of two parts. Firstly, you have to buy at a low and then you have to sell at a high. But unfortunately, the aphorism didn't really say what we're buying at a low. It's implicitly taken to mean buying at a low price and selling at a high price, but I think it's not right. Sometimes buying at $2 might not be better than buying at $2.50, especially when taking into account the risk of dropping even lower. It's better to bottom fish when the mud had settled and the waters become clearer; the chances of fishing a stone that breaks your line is lower. But clarity comes at a higher price, so if we have to follow another aphorism "Do not lose money", then it will make better sense to buy at a higher price rather than hope than the stock will make a V shape recovery by buying at a lower price.

The more correct 'thing' we're buying should be value. Hence it's more correct to say Buy High (in value) and Sell Low (in value), rather than the more risky proposition of Buy Low (in price) and Sell High (in price). Value means different thing to different people. If you're a trader observing a counter moving uptrend, buying at high value means the price touching the lower boundary of the envelope and then selling at the upper boundary of the envelope. If you're an investor, buying at a high value could mean buying when the price went below the intrinsic value of the company and selling when it's above. But do take note that regardless of what type of market participant you are, the price is never the thing we're focusing on. It's always about what the price means with reference to something else.

Since the aphorism consists of two parts, can we also reverse the order? Sell high (in price) and buy low (in price)? Effectively that's what shorting means. You sell off something and then buy back again at a lower price to make your profits. Again, this runs into trouble because basing your decision on price alone is hoping that the high price alone will catalyze the precipitous fall thereafter. No, it should be Sell Low (in value) and Buy High (in value).

By itself, this is quite an un-actionable advice. Without telling people how to determine value, it's impossible to follow this advice, hence it's not actionable. But to tell people how to determine the value, regardless of the 'value' in question here being a trading value or investing value, it will take more than 4 words. Maybe not even 4 books have the breadth and length to begin discussing it fully.

And that's the real reason why I love aphorism. If you know it, you'll appreciate the beauty and simplicity of all the mountains of knowledge condensed into a short sentence with a nice sound bite. If not, you'll understand it after you've made a mistake following it. Either way, you're going to take home something.

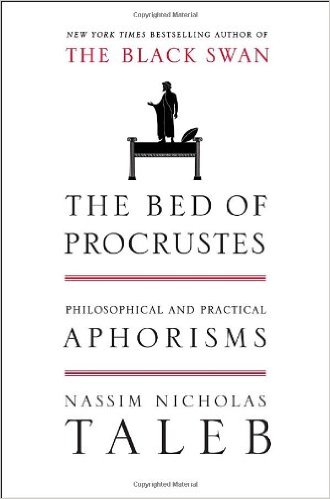

If you're interested in aphorisms, may I recommend a very good one by Nassim Nicholas Taleb titled "The Bed of Procrustes". It's a very easy read, but as with every such aphorism, you'll have tons of things to think about. I think of this book as an aperitif; something to whet your appetite with promises of more things to think about. Also works great if you're a blogger and need materials to write about HAHA

Trying to Make Sense of DBS’s 18% Return on Equity

19 hours ago

11 comments :

LP,

I see aphorisms as watered down versions of Zen koans.

Buy low; sell high.

Deceptively simple, but infuriating to execute. A quick glance at our portfolios we will know how we fare on this aspect...

A bit like Zen.

At first I thought I knew what "buy low and sell high" meant.

Then I discover I knew nothing.

Now with the passage of time and skin in the game - lots of scars, scabs and callous skin after - I now have a newer appreciation of what that phrase meant ;)

For me, the "how" part we have to discover it on our own.

When I first saw the header Buy High, Sell Low, not Buy Low, Sell High I thought there will be a twist.

Let me attempt to interpret it in another context.

Buy High, Sell Low means if you make a mistake and buy at a high price, you better make sure you cut loss early. How Low will depends on your cut loss strategy.

Ooo nice. I like that book too! :D

Hahaha!

Good point! Buy high (v) Sell low (v) ,,interesting. :)

Yah ,, I like the book ,,, another good one from him " Antifragile " ,,

Cheers !

Many times, I buy high and sell low because I relinguish the stock for something else better.

Hi SMOL,

Hmm, interesting....I never really thought of them as zen koans, but it could very well be! I agree very much on the how. You can hire a tutor or a mentor, but if what is taught and what is experienced doesn't quite gel, you won't 'get it' also haha

Do not mix up a mountain guide with a hiker. You can guide a hiker up the mountain but the hiker still have to move up himself!

HI Blursotong king,

Wah haha, I like that interpretation too :) But don't cut loss too many times lah, there's only so much blood in you to bleed!

Hi unintelligent nerd,

Haha, glad you like it :) He is one of my favourite author and modern day philosopher :)

Hi STE,

Yes, antifragile is a good philosophical book that I love to revisit once every now and then. The concept is very good. Learn to survive first (be robust), then learn to thrive when others are dying (antifragile). Excellent concept!

Hi anonymous,

Haha, I do these kind of capital recycling too, but I do that even when my cash position is high. I guess what I am doing is switching horses HAHA

Great post, thankyou

Post a Comment