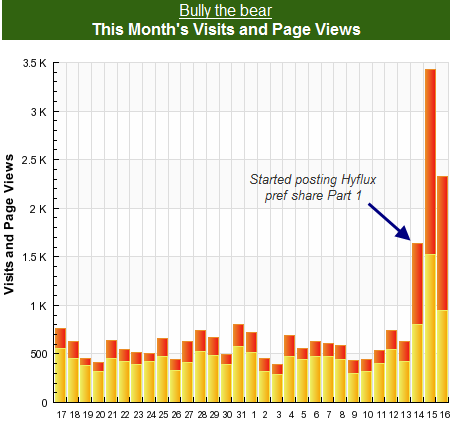

It seems like hyflux preference shares issue is getting a lot of attention lately. Besides splashing nearly a whole page on the local newspaper, it is also widely commented in internet forums and blogs. To see how immense the interest in the hyflux preference share is, one only have to look at the explosive increase in viewership after I've posted the two articles on my opinion regarding this fund raising exercise.

This is not the only indicator of the immense interest in the preference shares. Here's a few more:

1. The owner of finance.sg had his site banned by adsense (the appeal is still pending), likely because of the huge spike in traffic after AK and me posted our opinions on the preference shares.

2. The placement for the preference shares is so hot that the bookrunner, DBS, had received orders almost seven times the planned number of shares (i.e. S$200 million offer size). As a result, the offer is prematurely closed since the maximum number of allotment for placement cannot exceed $200 million.

3. Since the placement is oversubscribed by 7 times, the allotment for the placement is roughly 14% (1/7 = 14.28%). This is in line with what I've read in the forum for those who had been allocated their placement shares. It range from 10% to 15% roughly, based on a small sample of people who had mentioned their allotment percentages.

I was quite shocked by the strong demand for the preference shares, frankly. It goes to show that there are a lot of money floating around waiting to be deployed. Is that another indication that the bull run will carry on? But one thing for sure, the offer for the retail tranche of the preference shares would be pretty hot. Perhaps you can only get the minimum of 1 lot unless you really put in a lot of capital. Most likely it will be more oversubscribed than the placement shares, because those who did not get enough from the placement would likely try their luck in balloting for the retail tranche. Of course, you have to add in a huge number of those who would stag this preference share to get a quick buck.

If it's oversubscribed by 7 times, you probably need to put in 70k to get 10k (100 shares) of the preference shares. If it's oversubscribed by 10 times, you probably need 100k to get 10k worth of it. You can do the math yourself. But know that there is only 2 million shares to go around for everyone, so maybe some might not get any at all. Judging by the huge response of the placement, it seems like many would likely try their hands on the balloting to sell on the first day.

It'll definitely be interesting to see how the opening of the Hyflux preference shares be like on 26th April. Would hyflux bring big bucks for the holders? haha :)

Saturday, April 16, 2011

Subscribe to:

Post Comments

(

Atom

)

10 comments :

I am not buying Hyflux 6% CPS.

Thank you for supporting Hyflux fund raising if you are one of those subscribing for it.

Hi,

I think this is the first preference share that allows:

1) CPF money to buy. i may be wrong.

2) 6% cumulative if not paid for in the current year. What does it means? Does it means 12% the next year and so on? i think it is impossible. No?

3) if not recalled 6% will be increased to 8 % Another very impossible. No?

This 3 conditions are really "killers" for the public besides bank FD rates are peanuts.

I only like to quote the cantonese's saying,"Where in the world can you see bull frogs jumping all over the streets"?

Caveat Emptor o. k.

If I applied any, I am prepared to be a sucker. i mean i am prepared to lose the money.

i am quite puzzled why CPF money is allowed? On the other hand if CPF is allowed for some "S CHIPS" i think this counter is so much "better" than "S Chips". Ha! Ha!

Hi bro8888,

I'm not getting either :)

Hi temperament,

The dividends are not guaranteed. That means that if the ordinary shares are paid a dividend, then preference shares would also be entitled to dividends. If for some reasons, the pref shares are not given a dividend even though the ordinary has it, then this payment will be accumulated and paid in the next payment period.

However, if there is no dividend declared for the ordinary shares, then the pref shares need not be paid. Hence, the pref shares dividend are said to be cumulative but not guaranteed. At least that's what I understand.

Hi LP,

I think the fervour has died down somewhat going by my blog's readership numbers in the last two days. Of course, I do not have a part 2 or part 3 to my blog post on Hyflux's preference shares. So, your statistics could be a more accurate gauge of the strong interest that is out there. :)

I would feel very bad if my blog post on the matter contributed to Derek's 3 years relationship with Adsense coming to an end. :(

As an aside, good luck to all who are subscribing to the preference shares although I am not sure if good luck means getting the shares or not getting the shares. ;-p

Hi LP,

About the 6% dividend being cumulative but not guaranteed, hah! this is where the saying, "Where in the world can you see bull frogs jumping all over the streets"? But if it is guaranteed, i will be much more afraid not less. Then I think this is equivalent to an "S Chips" company belonging to the "twilight zones"

Because, 6% cumulative dividend is a practical joke for "April Fools"; because it it happens, then the company must be doing very badly one year and then doing super excellent the next year.

So do you think such a Company can survive & exist in this world?

Caveat emptor.

Hi LP,

Sharing my new blog post on the topic:

Hyflux director divested all his shares.

Alarm bells?

Read? Hyflux 6% Perference shares

Hi AK,

Haha, i saw your new post on it :) I think regarding Derek's adsense, it's just a matter of time before they start banning everyone!

Hi Temperament,

Really caveat emptor when we are buying/selling financial instrument. I guess there are pple who do not like it and who likes it, hence they will always be buy and sell queue, haha :)

Can someone help me with 2 qns pls?

1. What happened to DBS Bk 6% NCPS 10 after the callable date on 15May11? Can't find info on that. Is is delisted and called back at par value?

2. Comments on what will happen to Hyflux CPS on callable date? Hold on and hope for 8% or sell before price hits too low if bought at high?

Thank you very much.

Hi LP,

Assuming if Hyflux accumulates the pref dividend by not paying out any dividends to both pref shareholder and ordinary shareholders. And if Hyflux decides to redeem the Pref Shares, am I right to say that Hyflux MUST still pay all accumulated pref dividends upon the redemption? Thanks, J.S.

Post a Comment