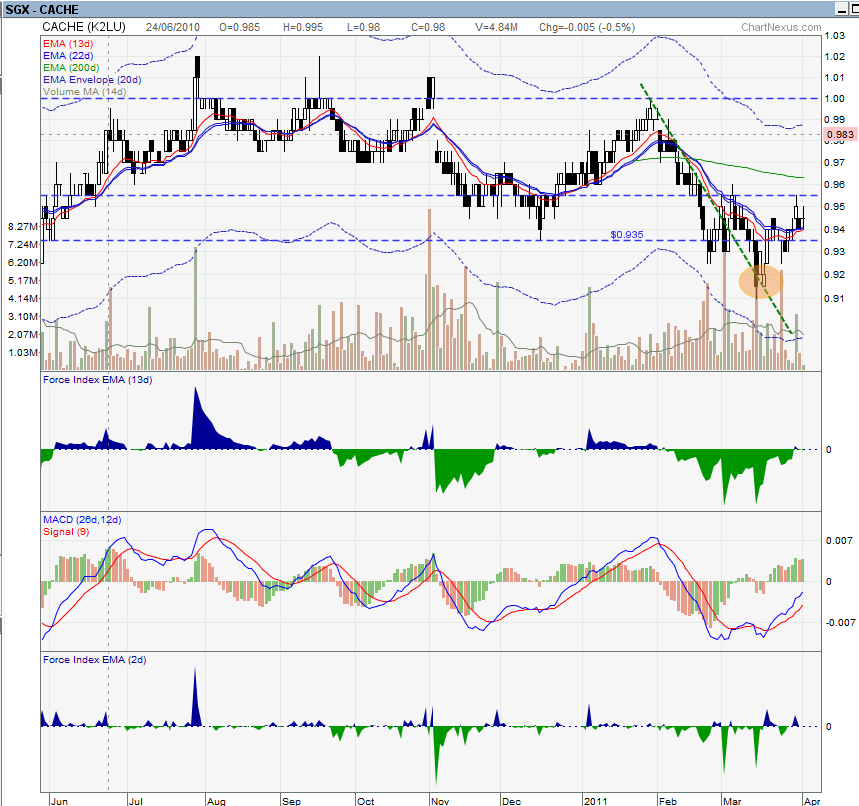

I've blogged about the charts on Cache a few weeks ago. Here's a mid action review.

Weekly

I bought it at 0.915 many weeks ago. Since then, the weekly bullish divergence has come to fruition. I'll be mapping out the exit strategy now. 0.955 - 0.960 is quite a resistance to clear. After that, 0.98 and eventually 1.00 is the level to go. Since it's a weekly divergence, maybe I'll wait till 0.98 and see how it proceeds. 0.955-0.60 gives me a ROC of 3% there abouts only...nothing fantastic but well, if there's money to be taken off the table before it slides out of my reach, I'll take it first.

Daily

The daily still looks pretty good. I love this kind of setup to enter any position. A clear cut bullish divergence on both weekly and daily, and the chart breaking the downtrend, retested downtrend line and bounce off. Now, after breaking downtrend, it might go trendless and trade sideways to consolidate first before moving up (or down), or it can move up from here. I don't know which, but it seems like the latter, judging from the series of higher highs and higher lows. Not sure if the 200ema will pose a resistance to the upward movement (there's not enough history to tell).

I guess from daily, the big fat resistance cloud is from 0.955 to 0.965. Clear that, we're off to 0.98 and eventually to the end Jan peak of 1.00. As a sidenote, there's a lot of reports on Cache, citing target price around the region of 1.30 if I remember correctly. So bullish? haha

Monday, April 04, 2011

Subscribe to:

Post Comments

(

Atom

)

2 comments :

Hi LP,

I just blogged about CLT too. Huat ah! :)

Hi AK,

Haha, I saw yours too :) Thanks for dropping by :)

Post a Comment