Hyflux recently announced plans to offer a 6% cumulative, non-convertible, non-voting, perpetual preference shares to raise funds. The purpose of this fund raising exercise is not known (or I've not read closely enough in the prospectus here). Regardless, let's see if this is worth looking into. First of all, let's take a look at the terms of the offer.

Preference shares is a type of hybrid between bond and equity (in fact, closer to bond than equity). The holder of this instrument will be entitled to dividend at 6% pa, payable semi-annually on 25th April and 25th October every year. Since this preference share is also perpetual, which means that unlike a bond, there is no maturity period for which the issuer will redeem back the bond. However, there is an option for the issuer to redeem back the preference shares on or after 25th April 2018. Take note that this is a right solely to be considered by Hyflux, not an obligation. If they chose not to redeem it back on or after 2018, then they will step up the dividend rate from 6% pa to 8% pa. If they chose to redeem it back, they will buy it back from you at par value. I will explain what's par value shortly.

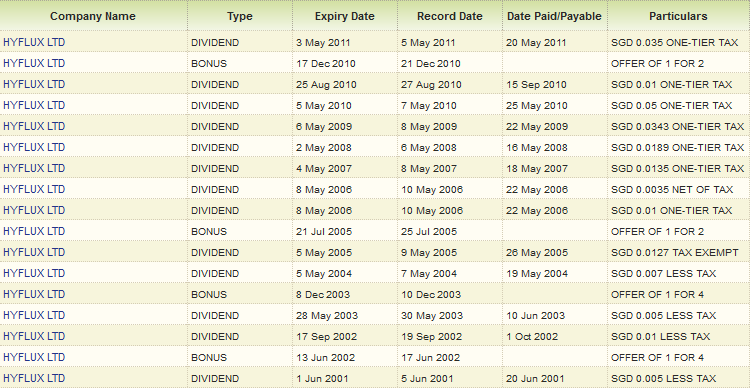

Interestingly, this is one of the few cumulative preference shares I've seen. The bulk of the ones I've seen are non-cumulative. Cumulative means that in the event that dividend is not given for 25th April and/or 25th October, the payments are accumulated and paid on the next payment date. In other words, the payment are cumulative. However, dividends are not guaranteed. From what I understand from preference shares of banks, if dividends are given to ordinary share holders, preference shares must also be given theirs. This makes it almost as good as guaranteeing the dividend if the track record of dividend given by the company is anything to go by.

What's par value? In this case, it is the issue price of the preference share at S$100 per share. This preference share will be listed and traded on the main board of SGX from 26th April 2011 onwards. Since you bought it at $100 per share and it is traded thereafter, the price of the share will go up and down according to factors like interest rates, macro-societal factors and just basically, market sentiments. This means that the price can go above $100 or below $100. But on 25th April 2018, should Hyflux choose to redeem back the preference share (again, it's a right, not an obligation to do so), they will buy it back from you at $100 per share, regardless of what the share price of the preference share is at that point in time.

Those who had bought the share at $100 and held it till Hyflux redeemed it back in 2018 will realise no capital gain at all, since it is redeemed back at par value (which is $100) too. However, they get to keep the 6% pa for the period they are holding the share till 2018. For those who bought at a price of more than $100 after listing, they will make a capital loss (hopefully the dividends collected will more than cover up that loss). Finally, those who had bought at a price below the par value of $100, they will make both a capital gain as well as all the dividend collected till redemption. Should Hyflux chose not to redeem back in 2018, they will step up the dividend rate to 8% pa, instead of the usual 6% pa. You can treat this as their 'punishment' for not buying back the shares from you.

The offer for the preference share is up to S$200 million in total value (i.e. 2 million shares are offered) to the public, with an option to upsize the offer to $400 million if there is unsatisfied demand under the reserve and/or placement offer. You can expect it to be quite illiquid and characterised by huge gaps between buy and sell bids after listing, judging from the daily quotes of preference shares offered by other companies. After listing, the shares are traded in board lots of 10 shares, so buying or selling 1 lot of preference shares will be around the range of $1000 in value. As a sidenote, there is no voting rights attached to the preference shares, so holders are not entitled to attend or vote at AGM.

If you choose to buy it,you have to act fast. The public offer will open at 9 am on 14th April 2011 and close at 12 noon on 20th April 2011. The process is through ATM like all other IPOs, so you will have to pay a small fee of a few dollars for the application. Other than that, there is no brokerage charge if you apply through ATM. For the balloting through ATM, you need to put in a minimum of 100 preference shares (i.e. S$10,000 in total at $100 per share) and subsequent integral multiples of 10. In other words, the minimum you can apply for is 100 shares, followed by 110 shares, 120 and so on. You cannot apply 101 shares or 102 shares.

For those who like a surer bet, you can try calling your DBS Vicks online broker (since the sole book runner is DBS) to ask for a placement, but will be subjected to brokerage charges at a percentage of the total value. The difference between balloting using ATM and placement through your broker is that in the former, you do not pay any brokerage fees and thus are not guaranteed to get the shares, while the latter you'll have to pay a fee and will be guaranteed an amount given to you by the broker.

I'll discuss about the ultimate question - whether it is a good buy or not - in the next post. This is getting very lengthy as it is now. In the meantime, you can read about other posts I've blogged in the past regarding preference shares:

Preference shares part 1

Preference shares part 2

Preference shares part 3

Preference shares part 4

*This article is contributed to IM$avvy financial portal, which is managed by Central Provident Fund Board and supported by MoneySense. This site has a noble aim of promoting financial literacy to the general population.

Thursday, April 14, 2011

Subscribe to:

Post Comments

(

Atom

)

2 comments :

found this explanation of preferential share easy to understand and it addresses the needed knowledge of simple or first timer investor like me.

Nice Article. Thank you for sharing the informative article with us.

This post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

kotak mahindra asset management

kpit technologies

Post a Comment