I started collecting information about the 7 preference shares that are already listed in SGX. Soon, there'll be one more addition to the family by DBS. I shall skip all the technical details about what actually is a preference share, since I've mentioned at length in other posts. For quick reference, here's the two posts I made on preference shares:

Preference shares part I

Preference shares part II

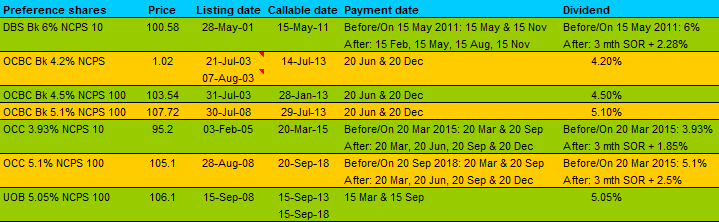

Here's a compiled list of all the 7 preference shares below. Please do pay attention to the remarks below the table, as they contained important information relating to the preference shares.

Remarks:

1. All the preference shares listed above have par value of $100, with the exception of OCBC Bk 4.2% NCPS which has a par value of $1.00.

2. For OCBC Bk 4.2% NCPS, there are two listing date. For the first tranche listed on 21-Jul-2003, it is issued at a price of $0.995. For the second tranche listed on 7-Aug-03, the issue price is $1.0027. All the other preference shares are issued at a price of $100.

3. I typed out information related to the DBS preference shares here, OCBC here and UOB here. Please double check the information yourself. It's late at night and I'm sleepy.

I think what's important here is to pay close attention to the callable date and the dividend payment policy. Especially the dividend policy. The callable date is important because it determines when the party might end. For example, DBS 6% NCPS 10, the callable date is on 15-May-2011. This means that on that date or thereafter on every dividend payment date, the bank might recall back the preference shares by paying the holder the par value of the preference shares, which is $100. If you bought it at $100.58 last Friday and they recall it on 15-May-2011, you get payment on 15 May 2011 only (too late for the 15 Nov 2010 payment because it had gone XD, thanks to WR for pointing out my mistake), hence you'll get less than the $6 per share. At the same time, you'll have to incur a capital loss because the bank will give you $100 for each share you bought. Since you bought it at $100.58, you'll stand to lose $0.58 per share

That's not all. After the callable date, if the bank did not recall the preference shares back, the dividend policy will also change. Instead of giving 6% pa on the par value (i.e.$100), they will give you 3 month Swap Offer Rate (SOR) + 2.28%. The 3 month SOR as of last Friday (12th Nov 2010) is 0.268%. The highest since 2008 is around 2% and the lowest, well, is right now.

Let's say I'm the bank. If by 15 May 2011, the 3 month SOR hovers around the same level, say 0.3%, then instead of giving each preference share owner 6% pa, I'll be giving them 2.58% pa (0.3 + 2.28 = 2.58). That is much lower than the 4.7% preference share that DBS is going to launch soon. Will I recall them back? Probably not, unless I need the money (I didn't bother to find out exactly how many 6% pref shares are issued, compared against the 4.7% one) because I can secure the debt (selling preference shares is sort of a debt) at a cheaper cost and use it to generate profits. Let's see how it turns out by May 2011.

Some of these had two callable dates, and I didn't list out those callable dates that had passed. I just want to say that the banks do not have to recall at the callable date. It's just a possibility to consider. I'll do some more analysis on each preference shares because I think it's quite interesting to see their total returns, assuming they will be recalled back at the earliest possible callable date.

9 comments :

Hey LP,

Thanks for this post. It removes a misconception I had about DBS NCPS 6% I bought almost 10 years ago. So, DBS might not be returning my capital next year. :(

Morn AK,

Ya, I think if the 3 mth SOR remains at this level till next year, they shouldn't want to cash in this opportunity to get a sum of money at such a low cost compared to the 4.7% one.

I also think that unless the 3 mth SOR reaches near 2.42% (4.7-2.28), they really have no reason to cash it out. But I'm just speculating here. I suppose if you're really really interested, you can see how much DBS have to pay by cashing out all the 6% preference shares at par value (I remember the figure, there's a total of 11,000,000 shares issued) and compare against how much DBS stands to gain by selling the 4.7% one. If the figures are about the same, perhaps they really meant to cash it and keep their tier 1 debt constant.

hi ak71, i recall you made a comment about tax refund or something from the DBS pref shares you are holding back in Part II of LP's post on pref shares?

I'm curious about this because as i'm a student, i do not pay any income tax. so should i be looking to get a tax refund or something too?

Dear LP,

Please be careful what you write. You wrote that if someone buys the DBS 6% last Friday, he will get payments for Nov 2010 and then two other payments, Feb and May 2011.

This is WRONG!

The ex-date for coupon payments for Nov this year is already gone. So if someone bought last Friday, he will get nothing for Nov payments. Also, DBS 6% has payment twice yearly, in May and Nov, until May 2011. Then they will pay 3 months SIBOR Plus 2.28% every three months. So if someone buys last Friday, he will ONLY get a 3% (since it is only 6 months) payment in May 2011. There is no payment in Feb 2011. After May 2011, he will get a prorated payments after every 3 months. Please do check your facts and understanding. If not you will cause people to misunderstand and be angry when they do not get the Nov 2010 and Feb 2011 payments.

Cheers,

WR

Hi LP,

Time will tell. Frankly, even if they pay me 2.5% per annum on the NCPS, I would just leave it be. It is like CPF OA. I don't have a lot in there anyway. I was a poor man 10 years ago. ;p

Thanks again! :)

Hi Anonymous (student),

Dividends used to be taxed at source. Then, IRAS would refund the amount taxed to us as they calculated our income taxes. We would be taxed according to our income tax bracket which, for me, was invariably much lower than the tax for dividends at source. So, I would end up paying very little income tax in absolute dollars usually.

It is no longer necessary as dividends are no longer taxed at source. As a student, you do not pay any taxes. So, no worries. :)

CPF OA 2.5% compounded interests so it is not the same leh.

Hi WR,

Thanks for alerting me on my mistakes. As you mentioned, there shouldn't be a payment on Feb - must have read wrongly on the table.

As for the 15 Nov payment, you're right again, it should have been XD already.

The facts and understanding is not wrong, it's just that I slipped up. Still, no excuses on my part. Thanks again for alerting me, I'll change the post accordingly.

Hi AK,

Ya, understand what you mean. If you only have less than 5 lots (50k capital), it's not going to make a lot of difference, esp when compared to your bigger holdings like saizen and aims :)

Hi LP,

DBS NCPS 6%, 1 lot only 10 shares. Each share $100. Cheap, cheap. ;)

Post a Comment