There's a post called early retirement grid with the following picture below

|

| Picture taken from fourpillarfreedom blog post here |

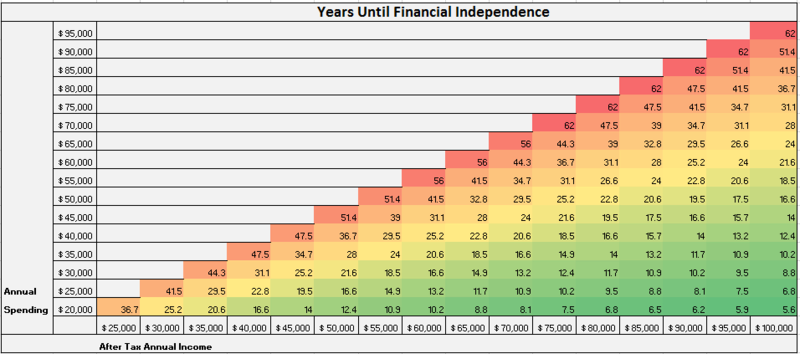

Basically it shows you how long you take to reach financial independence given your after tax annual income and annual spending. There's a few assumptions that comes with the table:

1) You're starting from nothing. It's good for those who had just been through the financial bombs of marriage and housing and renovation, because that's essentially what it is. After going through those 3 bombs, I have to start from scratch again and save up.

2) This is using a draw-down method of 4% of the portfolio annually. So you'll end up with almost nothing to pass on to the next generation.

3) It assumes you're investing the savings at 5% pa, and you no longer need to have any capital expenses in the near or distant future.

It might not be possible to hit all the assumptions. In fact, ignore that and let's see this philosophically. Firstly, you should be in the green zone. If you're in the red zone, that's quite dangerous because you're going to take a pretty long time of above 50 yrs to reach financial independence. Meaning you're going to work till you die. If you're in the yellow zone, you're too near the danger zone, and minimally you're going to need at least 25 yrs before reach your retirement. If you're in the green zone, you need less than about 14 yrs to reach your retirement.

Let's be truthful about this. It's good to have that option of being able to retire early upon reaching financial independence. You might not want it but it's still good to have that option. That's because when you're older, the choice might not be yours to take regarding your employment status. Someone will decide whether you can work for them, and when you still have bills to pay, that's going to be highly stressful. So, look up your annual after tax income and look up your annual spending and see what number you're at.

You probably know your after tax income, but you might not know your annual spending, especially if you've not been tracking diligently. It's alright, at least you know that now you have to have some semblance of tracking your spending. If you don't like to track every expenses down to the cents using some technology, that's fine. You can see how much you have from a dedicated spending account at the start of the month, and see how much there is at the end of it. It'll work fine. Either way, you need to know both your annual income and your annual spending.

From there, you know your FI number. The lower the number, the lesser the number of years that you still have to work, and the better it'll be. Did you notice that as you go down the column, your FI numbers drop too? Going to the right will also drop your FI number. Going down the column means you cut $5k off your annual spending, and going to the right means you increase your annual income by 5k. You'll notice for almost all the boxes, going down will decrease your FI number faster than going to the right. So do the easy thing first - cut down your expenses. Once you've cut down what you can, the only way to decrease your FI number is to raise your income level. I've talked about this at length in my blog posts here and here. That's why having a salary increment yet keeping your personal inflation checked in will be such a powerful force multiplier in your journey towards financial independence.

It makes you think twice about spending $5k on a Chanel bag right? That $5k you spent on the bag represents between 1 to 16 years of your life energy working before you can have early retirement! Think about it!

1 comments :

Thanks for featuring my early retirement grid, I appreciate it! I completely agree with pretty much everything you said in this post, especially pointing out that everyone should be striving to be in the green part of the grid. Excellent post :)

Post a Comment