Incredible, can you imagine how 'happy' I was, after not being able to log on since 840am till 4pm? Don't say that I didn't tried calling them at their useless customer service hotline. The line is really too hot, since last year, I can only recall being able to talk to a real person hiding behind the false front of automated voices, perhaps like 5 times?

Dbs vickers online website reached a new level of lowness! It really made me resolute to sign up with poems after CNY! I must make a deposit of 1000, returnable after 3 months, NOT PROBLEM! Hear that DBS?! If you don't want to earn my commission, I'll gladly pass it on to someone else!

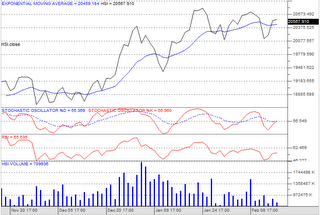

HSI behaved well today. It dropped quite a bit before returning with strength to close at +30 today. It totally changed my bearish view after today to slightly bullish. I just need another white candle to confirm the reversal in trend, with the stochastic lines cutting over each other. Macro-wise, a bit of uncertainty here and there. HK might not be doing too well after singapore lowered the corporate tax to 18% to compete against their 17.5%. The effects won't be so soon, but it'll trickle over time. Another thing to worry about is the rumor that is floating around...that china might raise the interest rates of borrowing after CNY. This might have a reactionary effect of lowering down HSI after CNY. Not to mention the record breaking high of dow for two consecutive sessions.

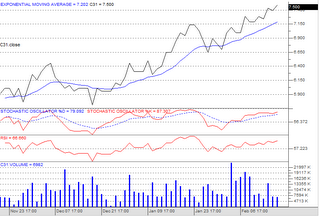

As of now (cos I can't do any trading today), I'm still holding onto my call warrants for hsi. Going to chao sng already, hold so long. But I really wish that HSI can be strong enough to recover from this week's down, otherwise my losses might get worse. I'm also holding onto capitaland warrants. This one already making 600 plus, but I think there's more upside for capitaland based on the charts. I'm just waiting for a bit more and I'll sell off to cash in. Next week, I'll watch out for my warrants. BTW, it's really profitable to short capitaland warrants intraday. It's perfectly safe because I'm already holding on to the warrants, fully paid for. During the day, I'll just sell at what I think it's the intraday high, then throughout the day, I'll look for opportunities to buy back at a lower price. Can make some money like that, very safe.

Longcheer sucky as usual, dropping and dropping to 0.75. I think selling should stop after CNY. Seriously, what did longcheer do to deserve this? It is still making profits, just below expectations. It is still consistently giving out dividends. It has good news coming out (from china's 3G announcement). Bad things could be that longcheer has warned of lowered next quarter earnings. The management very honest, already give people warning of things to come. Greed and fear rules the market I think.

Still holding..what to do?

Portfolio bleeding even worse now, all due to longcheer's continued fall. Now standing at a staggering losses of 22.5k. This amount even exceeded my all time high losses of 18k last year. Haha, I really outdone myself this year. Still, I'm happy with my trading, esp. my buy of capitaland warrants which is trying to recoup my losses. Every bit helps now, and this week I've earned 130 plus from shorting the market from the shares/warrants that I own.

The anticipated market correction should be coming? But maybe if everyone is thinking about it, it won't happen...at least not so soon. Overall, I think STI still quite bullish as trendline is not even broken.

I'm really having a red red Chinese new year. Hope your portfolio is better than mine!

-------------

I checked the charts for globalvoice..it's certainly raised a lot of eyebrows today with the rise to 0.160 intraday high. Based on daily charts, a correction is due. But weekly still got more steam to come. Tread carefully and remember that the market rule nowadays is to buy on rumors and sell on news. You might not want to wait till the results is out...remember clearly my longcheer experience. Won't want any of you to have the same experience as me.

Osim should have bottomed out already. I think it's the best time to buy now, if you want to average out or hold for long term. Should't see anymore downside for this one.

-------------------

0 comments :

Post a Comment