Today is the eve of the all important fed meeting outcome. If I'm not wrong, the results would be out tonight (or rather tmr morning) at 3 am like that.

Quite a couple of important things happened. First of all, china officials have said that the property market in china is reaching bubble proportion so is really going to tighten it. Shanghai bourse fell 5% today, dragging hsi down 350 points, totally wiping off yesterday's gain. Why the over-reaction? I thought last time it has already been known that officials are clamping down on property in china because it's too hot already? Perhaps this time, officials admitted that it's a bubble too, that's the difference.

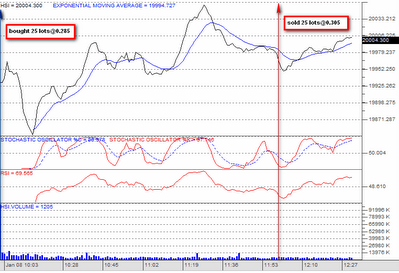

This news eradicated whatever i've said earlier about hsi. Daily charts on hsi is bearish engulfing, quite a powerful reversal trend to the downside. HSI broke ema14 days already, with stochastics and rsi showing downtrend. All in all, quite bearish. We have to look out for break in trendline support, projected at around 19,900. If it breaks, another horizontal support at around 19,300. I would term this as a correction first, unless trendline broke, then we'll see a prolonged downtrend for hsi.

Actually it's all in bernanke's mouth now. If he says something everyone likes, tmr sti and hsi cheong. If not...

Today's price action:

Pac andes

Yesterday: 0.98

Today: 0.935

Up 0.085, down 0.045 today, most likely due to profit taking.

Longcheer

Yesterday: 1.12

Today: 1.11

Still dropping..sigh...

Japanland:

Yesterday: 0.090

Today: 0.085

SeeHS:

Yesterday: 0.445

Today: 0.43

MAE enggr:

Yesterday: 0.235

Today: 0.23

Those holding shares dealing mainly in china properties do be careful. The cooling off measure taken by china to cool its property sector should not be taken too lightly. Those who hold singapore shares for short/medium term, should be looking at opportunities to sell. I can almost smell correction coming, can you? I bought my sti put warrants long time ago to hedge my positions (still in the red now).

Quite a couple of important things happened. First of all, china officials have said that the property market in china is reaching bubble proportion so is really going to tighten it. Shanghai bourse fell 5% today, dragging hsi down 350 points, totally wiping off yesterday's gain. Why the over-reaction? I thought last time it has already been known that officials are clamping down on property in china because it's too hot already? Perhaps this time, officials admitted that it's a bubble too, that's the difference.

This news eradicated whatever i've said earlier about hsi. Daily charts on hsi is bearish engulfing, quite a powerful reversal trend to the downside. HSI broke ema14 days already, with stochastics and rsi showing downtrend. All in all, quite bearish. We have to look out for break in trendline support, projected at around 19,900. If it breaks, another horizontal support at around 19,300. I would term this as a correction first, unless trendline broke, then we'll see a prolonged downtrend for hsi.

Actually it's all in bernanke's mouth now. If he says something everyone likes, tmr sti and hsi cheong. If not...

Today's price action:

Pac andes

Yesterday: 0.98

Today: 0.935

Up 0.085, down 0.045 today, most likely due to profit taking.

Longcheer

Yesterday: 1.12

Today: 1.11

Still dropping..sigh...

Japanland:

Yesterday: 0.090

Today: 0.085

SeeHS:

Yesterday: 0.445

Today: 0.43

MAE enggr:

Yesterday: 0.235

Today: 0.23

Those holding shares dealing mainly in china properties do be careful. The cooling off measure taken by china to cool its property sector should not be taken too lightly. Those who hold singapore shares for short/medium term, should be looking at opportunities to sell. I can almost smell correction coming, can you? I bought my sti put warrants long time ago to hedge my positions (still in the red now).