There's always a big hoo ha about CPF investors being unable to hit the 2.5% interest rate of ordinary account CPF. The statistics mentioned in this recent news is that over the last 10 years, more than 80% of those who invested their money in CPF would be better off leaving their money in the CPF OA. It's also stated that 45% of the investors made losses in the scheme.

I don't buy this. I dug further and saw this link for actual report of CPFIS-OA investors in the year ending 30th Sept 2015. For easier reference, I screenshot it below:

The first picture shows that really, for the year ending Sept 2015, 38% of CPFIS-OA investors lost money with returns of less than 0%. 46% of members earned a return of 0 to 2.5%, which means a total of 84% of investors might be better off not touching them and earning the 2.5% OA rate. And so it appears that the newspaper article is correct.

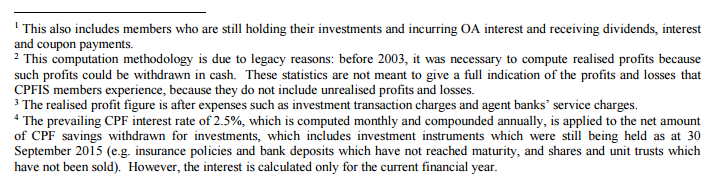

But let's look at the small footer, where all the important details are hidden

In pointer 2, it says that the data do not include unrealised profits and losses. This is not mentioned in the news article!

Imagine I have 3 positions:

1. Company A, bought 30 shares at $1, still holding on at $1.30

2. Company B, bought 40 shares at $1, but cut loss at $0.80

3. Company C, bought 30 shares at $1, sold at profit at $1.20

Out of the 3 positions, only 2 and 3 is realised and position 1 is still 'running'.

Total amount invested = 30*$1 + 40*$1 + 30*$1 = $100

Realized profit/loss = (40*-0.2 + 30*0.2) = -$2 (loss)

Realized profit/loss percentage = (-2)/100 x 100% = -2.0%

Oh no, so I'm one of the members with losses since my realized profits/loss invested is -2%

But if I'm counting my total profits/losses for that duration, I should include BOTH realized and unrealized profits marked to market, so

Total realized + unrealized profits = -2 + 30*0.3 = $7

Total realized/unrealized percentage = $7/100 x 100% = 7.0%

That's a far cry from my realized losses of 2%. Isn't it?

Thursday, September 15, 2016

Subscribe to:

Post Comments

(

Atom

)

17 comments :

LP,

Trust you to do your own verification!

That is why some of us have an edge over others ;)

Investing and trading is like the story of the 2 hunters and the bear.

We just have to out run the other guy...

LOL!

Hi LP,

If unrealized losses/profits are added, the result maybe worse no? Given that generally people will keep the weeds and pull out the flowers....

Nonetheless, I do agree that adding unrealized profits/losses will give a more holistic picture for an individual. But for a policymaker, this is not important cos ultimately, what they want to see is whether more or less "investors" make realized profits in excess of the CPF OA interest rate in a particular FY. This does not seem to be the case.

Hi SMOL,

Haha, I don't know where I got this insight from...either heard or read it before, so I went to dig out further :)

How about the transaction cost. I checked some brokers' CPFIS, the brokerage charges can be up to 1% if your investment amount per trade is not large enough, let say, only about S$1000 per trade.

Hi BeeT,

If you've already concluded, then no amount of data will persuade you haha :) I keep my mind open to the possibility that average investor could win/lose compared to 2.5% cpf oa rates.

However, I disagree that only realized profits are important. If you ask me, I think putting cpf money is also an unrealized position. Until you finally get your hands on the money you dutifully put in for bulk of your working years, I'll say it's not realized yet haha! So we're really comparing apples to oranges here.

Hi DUFY,

There's transaction cost and I think you're right, it should be more than usual. And there's also custodian charges too and a host of other rules (e.g. no buying/sell on the same day). I think it's to discourage pple from having a short term mentality. But hey, the authorities are also having a short term mentality in that they are counting realized profits/losses. What happened to long term investing and holding for long? lol

KNLBCCB this Lam Pa every day talk cock. Go work la.

Hi anonymous,

Care to put a name so that I can address you properly?

Haha, glad you liked it enough to make a comment! Thanks!

Hi,

Actually there wasn't a need to look at the footnote. The title already said it all, "THE REALISED PROFITS/LOSSES HELD UNDER CPFIS-OA....."

Honestly speaking, is the methodology of using realised profits/losses to gauge the effectiveness of the scheme a widely accepted one as compared to considering to one which includes the unrealised profits/losses? I suspect it is because it's much more difficult to gather the data of the investments and then mark it to market.

Also even if we include the unrealised profits/losses, it can make the stats better or worse.

I personally find that looking at it from just realised profits/losses will be better for the policymakers to make decisions. Furthermore let's not forget that the data spanned 2 decades.

Regards,

FFE

Hi FFE,

I suspect so too, as in it's more difficult to get the unrealized positions of all the members. As mentioned earlier, I'm just against the wrong use of stats. Since there's no data to say investors are better or worse off than 2.5% pa, we can't conclude. That's all.

Nobody I know uses the realized profits/loss to see if they are good investors. It's just not the right tool, I believe.

Interesting findings.

But also, to put it another way. Say this report has been running for many years and the composition of the realised profit/loss doesn't change much (doesn't look like it changes much YoY) - this may inevitably take into account the past unrealised profit/loss when investors subsequently sell off the position (to realise it, and hence being captured by the Govt data).

Do you get what I mean? The rolling effect may have already indirectly reflected the unrealised profit/loss.

Hi LPP,

I think I understand why you are getting certain responses.

The issue lies with the title of your blogpost.

"CPFIS-OA investors shouldn't invest? Really?"

It straight away create an impression that you are challenging this notion and advocating that people should use their CPFIS-OA to invest.

So I guess if DPM Tharman shows a different set of stats that present majority of CPFIS-OA investors beating the CPF rates, you will most probably write a post "CPFIS-OA investors should invest? Really?"

Regards,

FFE

Hi LGRT,

Yes, I thought of that too. If they show a report of all the realized gains/losses aggregated over say 20 years, that would have been a better gauge of investment prowess. But it's really hard to do that. CPF amt changes year on year, with cash going in and out and with investments returns plus dividends, it's going to be hard to track for just one individual, don't even talk about the whole population.

Actually this also raises some points about how the realized profits are calculated. It's definitely more complex than my examples shown in the blog. For one, I don't know what's the base line of the %. Starting amt at the beginning of the year? It's very complex.

Perhaps it's due to this that the authorities uses the simple realised profits/losses, sort of like a quick and dirty method of getting approximate conclusions. Like how pple just use P/E to get a quick and dirty valuation of a company.

Hi FFE,

Haha, what do you mean by certain response?

You're perceptive, and yes, I would have put up a title like what you've suggested. The point for my article is to challenge their wrong use of stats, not to advice or advocate any use of cpf for investments.

Personally I'm not a big stake holder for cpf. My job don't have cpf contributions, except for voluntary and the mandatory contributions. But if I have a huge amt of my networth tied in CPF, I will hesitate to invest in them. That will be my last warchest after all my available cash warchest is used up. And I will only do that in the darkest of times. The cost of this cpf warchest is pretty high considering we're getting min 2.5% pa guaranteed and compounded monthly. The use of this money will have to be safer than safe.

Dear Mr Butterfly

CPF interest is computed monthly,

but compounded annually (ie credited annually)

Cheers

Chew the Grok

Hi Chew the grok,

Oopsie, must have heard the wrong things. You're right, it's compounded annually not monthly. Thanks eagle eyes!

hi Mr Butterfly

No problem. Thank you for sharing so much good stuff.

Pull-up (over-arm grip, as opposed to chin-up) is the king of upper-body exercises, very functional. Ask the guardsmen with their FBO hehe.

I hope to read soon an update on your meditation experience.

Cheers

Chew the Grok

Post a Comment