I seldom talk about CPF, because I'm a self employed. It's a little different for me. When I want to find out more about it, there's not a lot of information out there that curate and collate all the info that I want. Hence I put up this article about CPF especially for self employed. The details are still relevant, perhaps the figures need to be updated from time to time, but those are easy to find out once you know what you're looking out for.

Every year, I'm going to have to contribute to the mandatory medisave account . This is pegged to a percentage according to your income and also your age. There is not tax relief for this mandatory part. But if you contribute above and beyond this sum, then you will have tax relief, subjected to conditions and limits. I also do a voluntary contribution to my 3 accounts, and that is tax deductible, again given conditions and limits.

Here I want to explore the how part, not the why part. The why part had been covered in my earlier post. Every year I do this but every year I'll forget how to do it. Frankly it's quite frustrating to read again and again. Hence I'm going to do this post to remind myself how to do it (the execution part, not the why part). If other self employed people find it useful, that's a bonus.

How to pay for your mandatory medisave account:

1.The easiest way is to go to the CPF e-service to do it. The link is found here. They will ask you to log in using your Singpass also. You might want to first check out your medisave liabilities first to see how much you have to pay. If it's, say $1500, you need to pay off that amount because that is the mandatory amount that any self employed have to pay. Not an option, especially if you have renewal business license. Anything beyond $1500 will have tax reliefs, subjected to conditions and limits.

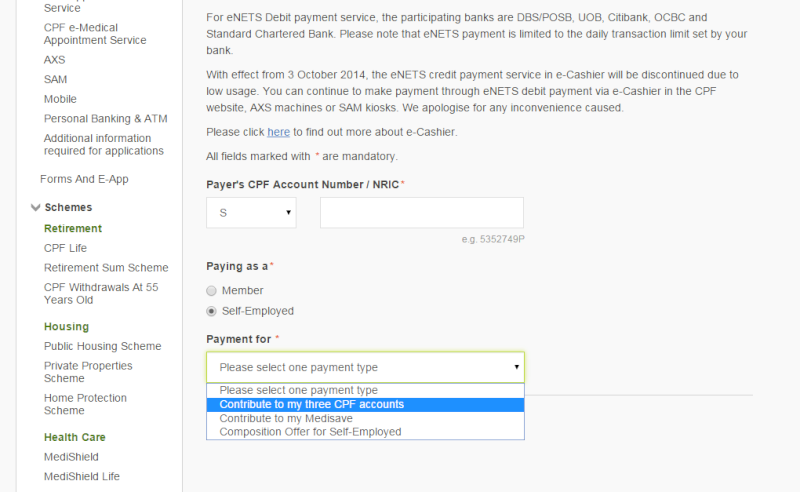

Once you've checked, you just click on the e-Cashier. You have to pay as a self employed, then contribute to my Medisave. The next screen will be to key in how much you want to put in. You can also check your allowable contribution, which is the limit you can contribute per year. That's all there is.

Oh, one last thing - you might be subjected to transaction limits by the banks. If so, then do in smaller amount and do it again the next day. It's convenient in that way.

2. You can also do it with SAM machine. The recent 2-3 weeks breakdown of all CPF services makes me resort to this. Try not to do it, because it's more inconvenient, and you can only pay using NETS, which is subjected to limits by banks per day. So you might even have to make a few trips just to do the same thing.

How to do voluntary contribution to 3 accounts:

1. Same thing, go to the same link as above, click on self employed by this time click on the "contribute to my three CPF accounts". You should be able to follow the instructions from there, which is largely the same as the above. For me, I've to do it in three tranches because of the limit imposed by the bank. You can change the limit lah, but it's kind of safer this way too. Anyway, just a few clicks away only.

2. Can this be done by SAM machine? I explored the whole options but it can't be done. Maybe I don't know how. But from what I see, voluntary contribution can be done using AXS machine. Must be machine and not the web version of it. I tried to do so but the whole CPF online system is down, so I can't test it out. Still, it's a good option to have in case the main CPF site goes down again.

Though the recent upgrade of the CPF system makes me so frustrated, the good thing is that the new upgrade is easier to navigate than the older one.

Wednesday, December 16, 2015

Subscribe to:

Post Comments

(

Atom

)

4 comments :

If I make voluntary contribution to all 3 accounts but MA has reached the medisave contribution ceiling, what will happen ?

Hi betta man,

I've no idea. The immediate guess is that they will channel more into the other 2 accounts. I've someone who wanted to max out the MS by voluntary contribution so that the salary will be channelled into the other 2 accounts instead of 3. I'm not sure if it's the same.

Hi,

You can specifically deposit money in MA. The other option is just deposit in CPF and CPF will automatically divide it out into the different accounts. If MA is maxed out, it will only be divided into the other accounts. However, for it to be tax-deductible, it will depend on your income.

Hi K,

Thanks for commenting on this and verifying my info.

Post a Comment