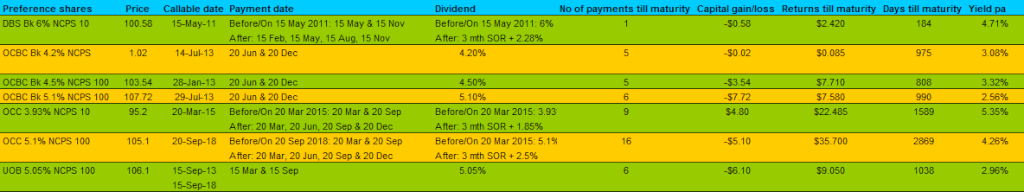

1. The preference shares is assumed to be called off at the first callable date at the par value. This means that with the exception of OCBC Bk 4.2% NCPS which has a par value of $1, the rest has a par value of $100. The respective banks that issued the preference shares will buy it back from the holder at the par value, regardless of whatever price that the preference shares is trading at.

2. I assumed that you had bought the shares last Friday on 12 Nov 2010. That is just an arbitrary date because I just took the last closing price. Based on that date, some of the preference shares still have some payment to be made this year, particularly those that had payment on 20 Dec. Depending on the callable date, there could be 1 installment of payment before it gets called off. I put down under the column "no. of payments till maturity".

3. Returns till maturity is the sum of the total number of payments made till the first callable date plus any capital gain (or loss) resulting from the difference in the price and the par value. So if a preference share is bought at 100.58 and the par value is 100, you will book in a capital loss of $0.58 per share. So the returns till maturity (in my definition) is the capital loss + whatever payments made from the time you bought to the first callable date.

4. Yield pa is the annualised yield calculated by the formula:

Yield pa = (returns till maturity)/(price of share) x 360/(days till maturity) x 100%

I think this is what they call the yield to call.

So here's the tabulated results shown below:

My thoughts:

1. Three factors affect the annualised yield till maturity - the callable date, the price that you bought in (above par or below par value) and the nominal yield. I think of all that factors, the price that you bought in is the most important. Why? Price that you bought controls the actual yield that you get from the preference shares, and can allow you to book a capital gain when it matures. That being said, OCBC 3.93% NCPS 10 is the only preference shares out of the 7 listed in SGX that is currently below par value. That boost the yield to 4.13% (3.93*100/95.2) instead of the nominal 3.93%. We haven't even talk about the potential capital gain should they choose to call it back.

2. All these looks very nice on paper. However, if the assumption that the preference shares are not called back, then things would not be so nice anymore. That is because 3 of the 7 preference shares have this dividend policy that if it is not called back, the dividend will be pegged to some percentage of 3 month SOR. Who knows what the 3 month SOR will be like when it is near the callable date? What I do know is that if the SOR is low, the banks shouldn't recall it back since they can get to use the debts at a cheaper cost. If the SOR is high, then the banks should want to recall it back and you don't get the upside from the new dividend policy. Tails they win, heads you lose.

3. To remove all the anxieties and messiness of the overall picture, it might be better to just concentrate on those preference shares without 'funny' dividend policy. You know exactly what the dividend you'll get before and after callable date. I think people who are into preference shares do not want to be troubled by such things. That's the whole point isn't it?

4. The best time to buy a preference shares is when they are below par. Like during the time when we're at the deepest of the financial crisis and all of these preference shares are at a discount to the par value (so are all the rest of the market).

18 comments :

When market is in crisis, look for potential multi-baggers blue chips where got time for NCPS. LOL

Well the banks are smart enough to make sure they have all to gain from issuing these NCPS.

If one willingly buys it with eyes open hoping to get a somewhat steady source of dividend then why not.

Hi bro8888,

I think so too. It depends on what you want I suppose. Some might just want the guarantee of a fixed dividend as a passive income. Might suit them very well.

Hi E,

I think so too. Preference shares is more alike to bonds than shares, and with the fixed payout, you don't really have to worry much about the price or the leverage or any of such things that plagued the reits.

For me, I wouldn't put much of my money into preference shares. I just don't have enough capital to generate a high enough dividend as passive income.

Multi-bagger blue chips with dividend yield more than 20% is also possible in the next deep crisis. Get your wallet ready for them.

Hi BULLy the BEAR,

I agreed completely with what CW8888 said.

And most important consideration, you most probably will get your NCPS dividend only if DBS Bank does well.

So might as well buy DBS Bank.

It gives better over all return.

Right?

And also what you mention, "Head DBS win and tail you lose.

You can never beat them.

Lawrence.

"Who knows what the 3 month SOR will be like when it is near the callable date? What I do know is that if the SOR is low, the banks shouldn't recall it back since they can get to use the debts at a cheaper cost. If the SOR is high, then the banks should want to recall it back and you don't get the upside from the new dividend policy. Tails they win, heads you lose."

When the interest rate is low, the price of the preference shares should be higher. You can sell the preference shares when that happen -y ou don't lose out at all.

I'm not very familiar with preference shares, but it seems like it works the same way as long term SGS or corporate bond. The only difference lies in that it's not mandatory for the preferences shares to be callable.

oh btw, i'm JWT. :D

And can i check with you on your calculation for returns till maturity? If I understand it correctly, your calculation is based on the following assumptions:

- It's called on the day of maturity

- Or the price remains the same as when you have purchased

- No commission

My calculation:

Taking DBS BK 6% as example which is bought on 12th Nov,

Returns till maturity = 0.06*100*(184/365) - 0.58 = 2.445

ROC = (2.445 / 100.58) * 100 = 2.43%

Yield p.a. = 2.43 * 365/184 = 4.82%

JWT

Hi lawrence,

I agree and disagree with bro8888. If you want a stable passive income with no regards to the capital part, it can't get more guaranteed than getting a pref shares. While dividend of counters might go up or down, pref shares dividend are fixed (unless you got into those that are pegged with 3 mth SOR).

If you buy blue chips when cheap, it beats pref shares of course. If you buy DBS bank now, I don't think your returns are good.

BTW, if dbs mother share gives ANY dividend, they must pay the preference share dividend. It doesn't matter how well DBS do, as long as DBS gives dividend to ordinary shares and they don't go belly up.

Personally I won't buy any of these pref shares now.

Hi JWT,

I'm not sure if the interest rate is high, will the pref shares go below par. I don't have the data to verify that. In theory, it should go down, but things don't really go according to theory. For example, if FED lowers rate, stock market will rise. But in practice, every time they lower rate, the market will crash lower.

I think you're right on that point on mandatory calling back of bonds once they reached maturity. It's perpetual for pref shares, but that's an option for them to call back.

Let's check on the calculation:

It's not right to put 0.06*100*184/365 because the counter do not pay dividend everyday, so it's not proportional to the number of days. They pay twice a year on 15 May and 15 Nov.

For 2010, it already went XD for the 15 Nov payment, so there's no more payment this year if you buy on 12th Nov. For 2011, there's still one more payment on 15 May 2011, so the total no. of payment till callable date (15th may 2011) is 1, which makes the returns:

0.03*100 - 0.58 = $2.42

ROC = 2.42/100.58*100 = 2.406%

Yield pa = 2.406 * 360/184 = 4.71%

Actually I also don't know why I used 360, haha :) Should be 365 days for the yield pa calculation.

Actually it doesn't matter if the price remains the same when you purchased it or now, because it will be called back at par value of 100 no matter what. So the price might drop to 90 or rise to 110, you still lose the capital of 100.58 (your purchase price) - 100 (par value) = 0.58.

Thanks for putting the effort to verify stuff with me :)

I have been holding DBS since 2003 and has been receiving consistent dividend yield every year even in the crisis years such as 2008/09.

Why? One reason, probably due to DBS maintaining its low dividend payout ratio and has more room to sustain its dividend payout.

Read more?

http://createwealth8888.blogspot.com/search/label/Education%20-%20Trading%20-%20Dividend%20Yield

You write so much on NCPS and that gives me the expression you are buying too. LOL

oops. impression

LP,

1. When interest rate goes down, the bond prices of say the 10-year Treasury bond goes up. This should applies to corporate bonds and preference shares too. We are not talking about interest rate vs. equities here.

2. The reason why i put "0.06*100*184/365" is b/cos I assume it works the same way as a corporate bond, and not a stock dividend. While bond coupon payments are given semi-annually or quarterly, if one were to cash out earlier, he is entitled to get the partial coupon depending on the period that he owns.

Taking SIA 2.1% bond as an instance, suppose the bond starts on 1st Jan 2010 and the coupon is given semi-annually in 31st May 2010

and 31st Dec 2010. Now, suppose I buy the bond on 1st Jan 2010 and sell it on 2nd Jan 2010, I believe I can get partial of the coupon payment. I'll omit the math here.

The confusing thing here lies in that compared to corporate bonds, it is not mandatory for the coy to give dividends for preference shares.

If what you say is right, wouldn't it be best that I buy the preference shares ONE DAY before it XD and sell ONE DAY after it XD?

3. "Actually it doesn't matter if the price remains the same when you purchased it or now" - I'm outlining the possible choices one has on the date of maturity. One of the choices is that if the Preference Shares is not called back on the date of maturity, one can still sell it. And that, the calculation made in my previous post is based on the assumption that the price does not change at all. Of course, this will not happen. What's expected to happen is that if a coy does not recall a preference shares, it's likely due to the fact that the global borrowing cost is still low, which in turn implies that bond price is high. One is highly LIKELY to gain a capital profit by selling the preference shares when it matures.

Hi la papillion,

I also agreed completely with your reply.

The only thing is I have not let you know that I try very hard to practise John Templeton's Quote: "Buy only when there is blood running in the street".

Another words Bull/Bear market cycle investing.

I understand CPF is not allowed to buy NCPS.

Can you share your opinion why not?

After all return of NCPS is > 2.5%.

Oh yes, if you have a "million" Dollars to spare, it seems very attractive to buy NCPS and just collect dividend perpetually, forget about investing, relax and enjoy life.

I admit sometimes, I dream about something like this. I do feel tired at times about investing.

But I know life is not so simple even if I have a "million" or two to spare.

I still have to try to do better then what NCPS can give rather then throw in the towel. If I throw in the towel, I most probably have lost my "marbles".

That's the irony of life.

Lawrence.

Hi JW,

Sorry for the late reply :)

1. Ya, I get what you mean regarding this. You're putting a 'should' because these things aren't confirmed right? I've not seen a situation where the interest rates are rising and the preference shares keep dropping before, so I'll keep my options open.

2. Wow, I didn't know bonds are paid on a pro rated basis. Now you're making me think if preference shares are pro rated too. Somehow, I don't think so.

If you buy 1 day before XD, get the dividend on XD and sell it, you won't make much. The price of the shares would drop by the amt of dividend given, at least on opening.

3. I get your point. I'm just assuming what I've stated in the post - that I'm going to hold it till maturity. Of course, you can sell it to lock in the capital gains should the price goes up so much instead of waiting for maturity :)

LP, thanks for your reply. I guess the best way would be to check with the issuer.

Thanks bro.

JWT

Post a Comment