The more important question is how to use market depth. I’m the first to confess that I’m not an expert, but I’ve read and researched enough to know a tiny bit about it, so I’ll share with readers here. I divide this into two sections, the first are the points to look out for when using market depth and the second is about the limitation of the information you get from it. It’s good to know both the usefulness and the limitations of it. By the way, I’m using poems, so it might differ a bit from yours if you’re using other brokerage platform, but it’s largely similar.

Section 1: Points to look out for

1. Is it a buyer or a seller’s market?

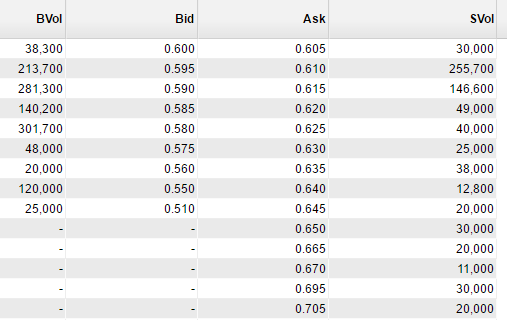

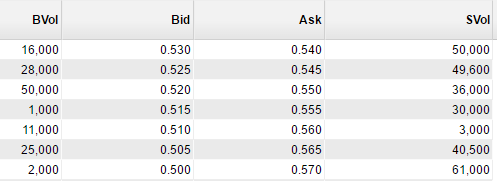

By comparing the total buying volume on the left side and the total selling volume on the right side, we can see if it's a buyer or a seller's market. Buyer's market means that the selling will be very well absorbed with very little price movement downwards, because there are a lot of buyers waiting in line to buy. Conversely, in a buyer's market, any buying up will be met with lesser resistance because there are not a lot of sellers waiting to sell at higher price than the current price. In other words, in a buyer's market, the ease of movement of price upwards is easier than the ease of movement of price downwards. In a seller's market, the reverse happens - the ease of movement of price downwards is easier than the ease of movement of price upwards.

|

| Buyer's market - note that there is so many pple waiting to buy on the Bvol side (left) |

|

| Seller's market - note that there are more pple waiting to sell on the SVol side (right) than the left |

2. Check immediate resistance and support level

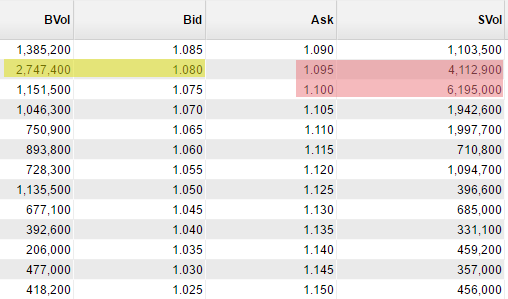

This is a TA concept. Resistance refers to a price where the price will likely hit a wall and move downwards. Support refers to a price where the price will likely hit a springboard and rebound upwards. Here, we are looking for big volume camping around a price range. If the normal queue is 1000, 800, 1500, and suddenly we see a 200,000 queue, then that is significant.

Looking at the above pic on the left side, we can see that there's a huge volume camping of about 2.7 million shares at 1.080. If the price is to go below 1.080, it will have to break that huge wall first. Hence, for the time being at least, it's going to be hard. On the right side, we can see an even bigger wall of about 10 million shares distributed over 1.095 to 1.100 range. It's going to take a while to break that wall and go to 1.105.

If you're buying, and you want to jump the long queue, you might as well queue at 1.085. If you're selling and you want to jump the queue, you might as well queue at 1.090. That's just one way to see it. You can also set a order to buy at 1.105 once the market price reaches 1.110, because it means the the stock broke out of the huge wall block and that's usually a good sign. Go back to TA to decide what to do with the information you get from the support and resistance levels.

3. Can the market absorb my buying and selling?

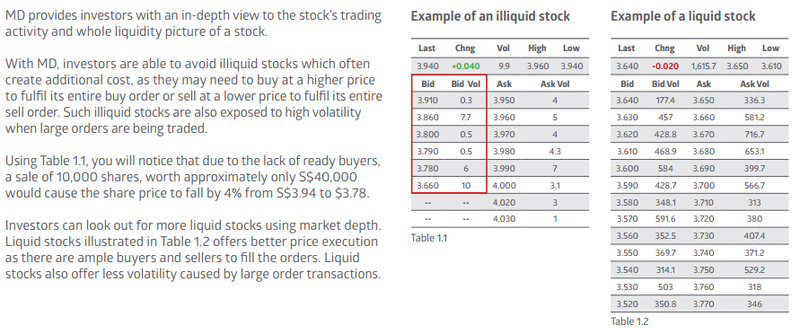

If you want to sell a huge volume, you want to ensure that the price remains as stable as possible. You don't want your huge order to bring down the price and end up having a lesser amount at the end of your selling. Likewise, if you are buying a huge volume, you don't want the price to be bidded up too huge so that at the end of the day, you'll end up paying more for your shares. All these requires the market to have enough 'depth' to absorb both your selling and your buying, without affecting the price too much.

A good analogy is that of a reservoir. If you scoop up a cup of water from it, the water level is not going to change much because it has a lot of 'depth'. Conversely, if you pour a cup of water into it, the water level is also not going to rise much (not even perceptible!). If you do the same experiment on a pail of water, you can see the water level rise and fall much more appreciably. This whole concept is market depth.

SGX guide here already have a great example, so I'm not going to reinvent the wheel. I reproduce it here for your reference.

Section 2: Limitations of market depth

1. Market depth is dynamic.

The information is probably only valid for a day. Maybe just for a few hours. We don't know. The volume reflects the live order keyed into the system, so it keeps changing. In a fast moving market, a static picture of the live market depth information probably should have an expiry date of only a few minutes.

2. Order volume might be hidden

I know institutional traders can have an option to disclose a certain percentage of their trades in the system only, called disclosed quantity buying/selling. Let's say that a big boy (BB) wants to sell 500k shares at a certain price, it can choose to disclose only 5k shares in the system, so only 5k is seen in the market depth, and not 500k. Is this available in Singapore, I'm not sure about that though as this is something I've read about in US markets. If it's available here, then whatever you see in the market depth is just what others want you to see.

3. Order volume might be fake

The orders placed might not be real. By fake, I mean that there is no real intention to buy or sell the entire order seen in the market depth. The volume in the market depth can be removed at any time. It could be used to test the market or to find out who the counterparty is. There are several reasons why they want to do this. One reason could be to prevent the price from going above a certain price. Whenever the volume gets depleted, more volume will be topped up to discourage buyers from bidding higher. This same trick can also be used to dispose of shares in a very orderly manner without people knowing it. Only people with too much time watching the 'tape' can see it. In structured warrants, you will see lots of such actions happening.

4. There are buyers or sellers who do not queue.

You’ll only see something in the market depth if people queue for it. There are companies where buyers or sellers do not queue at all. Immediate transaction will happen if you sell at bid and buy at ask, so in such cases, it won’t be so useful.

Conclusion:

Market depth is paid for under a subscription. I didn't use it in the past because I'm too cheapskate to have it. Is it useful? Yes it is, but it's not essential. Good to have but not that important in the longer run. Perhaps it'll be more useful for intra day traders, which I'm not.

8 comments :

Wah nice. Thanks for this post LP

Hi UN,

Most welcomed!

Shouldn't Buyers Market be a case when the supply (sellers) is greater than he demand (buyers) so that the buyers get a good price and vice versa for Sellers malrket.

Hi FFE,

I can understand where u are coming from. If buying vol > selling vol, you are saying that the supply (selling vol) are more than demand (buying vol), hence it should be called a buyer's market. I'm thinking more along this line, where the control of the market is determined solely by the buyer's action, hence it should be called buyer's market.

Ultimately it's just semantics, a rose by any other name should smell as sweet :) I'm not too concerned with names. But thanks for letting me see your views!

Hi temperament,

Haha, thanks for sharing your thoughts :)

I think if we don't want to lose money, it's inevitable that we will miss out one some opportunities to make money - that's just the nature of the game. If we don't want to miss out on any opportunities, it's also inevitable that we will lose money in some of the opportunities. So the question is whether we want to lose money by mistakes of omission or commission. I think most pple would choose the former. At least it's lost opportunities and not real monetary loss, haha

I also seldom buy/sell at current price. That is almost an exception to my style, so I plan to use it very infrequently. We do bottom fishing, at the level of depth that we want and wait for fishes to come :)

Here's the slides for market depth from SGX seminar: https://s3-ap-southeast-1.amazonaws.com/investingnote-production-webbucket/attachments/94d2059fc497a474bb24a215baeccf0fa2b65f2b.pdf?1492152484

Hi LP,

Thanks for this well-summarized post.

Since you have POEMS acct, do you use Phillip CFD? I am contemplating to open a CFD acct with them and not sure if it's worth a referral hassle.

Hi 22°C,

No, I don't have CFD account. Afraid can't help you with it :) If you want I can refer you to my broker. He's with me for the longest time (since 2006) and the fact that he's still around means he's not a fly by night kind of person. Let me know :)

Post a Comment