There are two benefits that a father can claim, if you fulfill the following conditions:

1. Your child is a Singapore citizen

2. You are lawfully married to the child's mother

3. If you're self employed, you must have engaged in your business for at least 3 months before the child's birth

As a working father, I'm entitled to 3 types of benefits:

1) Government paid paternity leave (GPPL)

2) Government paid shared parental leave (SPL)

3) Government paid childcare leave (GPCL)

A lot of information can be found in the aggregate of links here. But trust me, it's actually quite confusing, especially when there are so many links point here and there. I digested as much of the information as I can, and as accurately as I could, and present it here:

Government paid paternity leave (GPPL)

I'm entitled to 2 weeks of GPPL. There are 2 ways to take the paternity leave. You can either :

a) take it in one continuous block within 16 weeks from the birth of the child. This means 14 calendar days, inclusive of weekends and public holidays taken consecutively from start to end. OR

b) take it by days, with a break in between leave dates, within 12 months from the birth of the child. This is will be based on the number of working days you have per week. If you work on a 5 day work week, your total entitlement will be 2 weeks x 5 workdays per week = 10 days

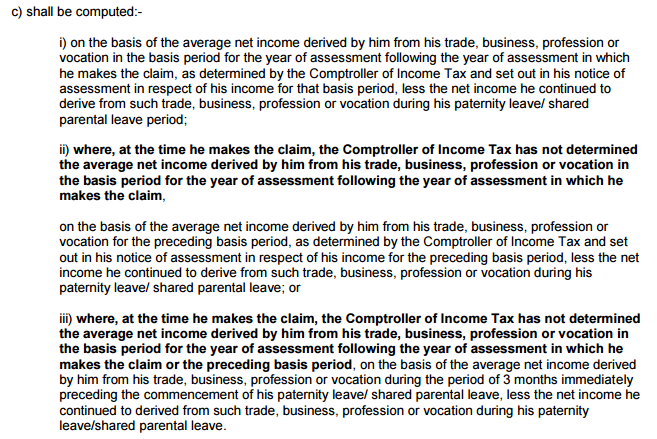

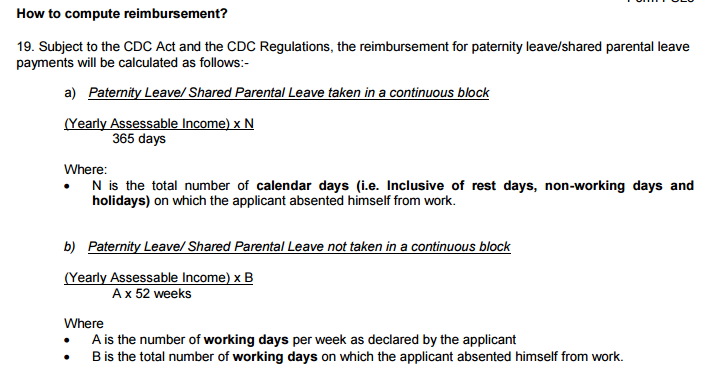

The leave is also subjected to a cap of $2,500 per week, so one cannot claim more than $5,000 from the GPPL for the 2 weeks. The exact payment is calculated based on our notice of assessment from the IRAS, specifically, the net trade income portion. Exactly which year of assessment of our tax will they use, they are unable to advise. I found this, read it, yet I ended up being as clueless as I started. So I emailed them.

They can only say that the latest net trade income details in their system at the point of submission will be used, and if there are any discrepancies, we can write back to them by providing the notice of assessment for their review.

I did find out how they compute the reimbursement and that depends on whether you take it in one continuous block or take it by days.

I took (a) as I think it's better for me. You might want to calculate both and see which works out better for your case.

Government paid shared parental leave (SPL)

Government paid shared parental leave is the sharing of 1 week out of the 16 weeks of the government paid maternity leave by the mother with the father. For the father to even qualify for the SPL, the wife must first be eligible for government paid maternity leave in the first place.

This SPL must be consumed within 12 months from the birth of the child, and any unconsumed SPL after 12 months will be forfeited. There is no minimum period that an applicant must have carried on his trade, business or profession in order to qualify for SPL, as long as there is allocation from his wife to him in his current employment.

I have no experience in this as I didn't apply for this. My wife has problem claiming maternity leave as it as, so no help from me in this segment. The explanatory notes for both GPPL and SPL is here.

Government paid childcare leave (GPCL)

This is for both parents each to take paid leave to take care of the child. It'll be eligible for both parents per year until the child reaches above 12 years of age. Those who are employees will get doubled of what I'm going to write next because I think half of the childcare leave is reimbursed to the company by the government. Again, I'm LPPL so I can only take the GPCL, which is half of what normal employees are entitled to. For a child below 7 years old, the GPCL is 3 days per year per parent. For a child between 7 to 12 years old, the GPCL is 1 day per year per parent.

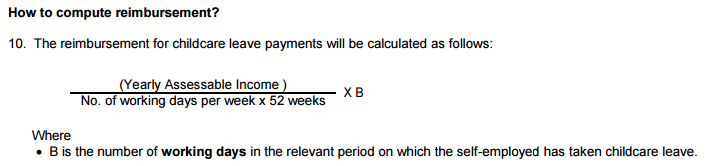

The calculation is based on the number of working days per week, and that you have to key in when you submit your claims. The formula is here:

Do take note that the childcare leave is subjected to a cap of $500 per day, so there'll be a cap of $1,500 per calendar year.

The full details for the GPCL is found here.

Application

Before you apply, you need to key in your banking details and update your particulars.

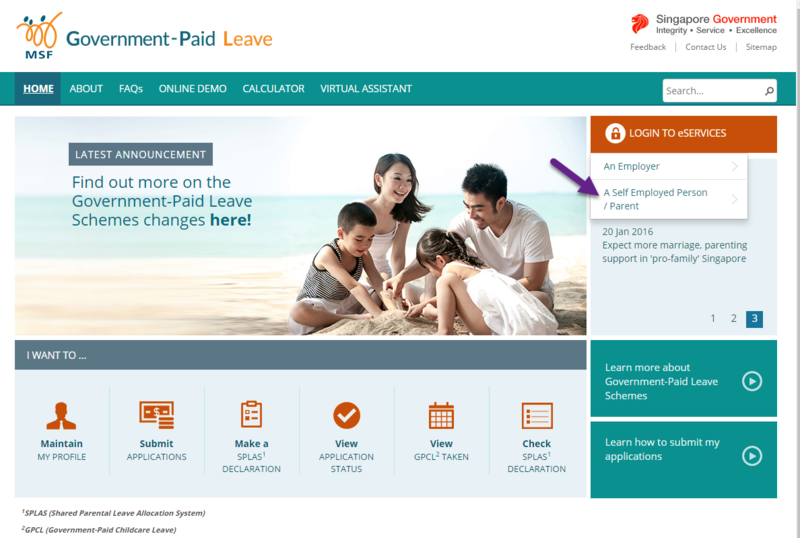

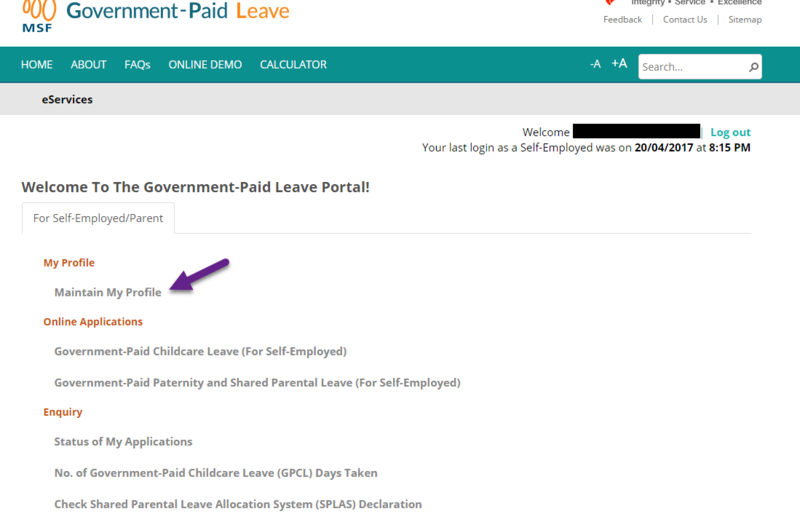

A) Go to the government paid leave website here and login to the e-services as a self employed person

B) Click on Maintain profile and update your details, including the all important banking details. This will be the bank account that the money will be transferred to, when it is submitted and approved.

C) Under Online application, there are two options: Government paid childcare leave and government paid paternity and shared parental leave. The instructions are clear cut and you just need to submit the information such as working days per week, birth cert number of your child and the child's birth date etc. The whole process takes less than 5 mins to submit.

I think for both my submission of GPPL and GPCL, only 3 to 4 working days transpired between the date of submission and the receipt of the reimbursed money from the government. I think they have a service standard of processing the entire thing by 10 working days. The whole process is very smooth and painless, once you sort out what you can claim and how much.

4 comments :

Wow, I didn't realise there was such a big difference between self-employed and employee when it comes to government paid child benefits. Totally forgot about the other half that is paid by the company then reimbursed by the government. Reckon we sometimes take it for granted!

Hi FS,

Come here make me feel cheated :( lol!

But hey, what's the benefits like for your company regarding such things? At least let me know what I'm missing out so that I can 'die' in peace lol

Hi LP,

My company has all the benefits you said, plus $1k for medical claims and $150 for the new baby gift. I could also work from home for my last pregnancy month. Well, it's good but I am still leaving, haha! Benefits and money are not better than the flexibility and free time for being a self employed!

Hi Jes,

Haha, I know what you mean, sometimes it's never about the money but the flexibility :) Happy you made a decision haha

Post a Comment