Having read Kyith's post here and 15hww's post here about financial security, I thought I should try it out for myself and see the necessary figures needed to reach financial independence. It's not so much as a fixed set of goal to reach by certain age, but more like a milestone or achievement kind of thing. It's like you play games and when you collect 999 of each items, or you pass through each stages of the games without losing any health, you get an achievement medal. Gamify the journey, if you will.

So the first thing is to get the past data of expenses tracked to see what are the ones needed for survival. I listed out them below, not in any order of importance, but left out tax. Not because it's not important but it's sensitive. The expenses here are solely my own, not my household. If it's a household item, then it's my share of it. Some items that I paid in full but it's meant for the household, I'll use an asterisk (*) to mark it.

Average monthly expenses in 2015

------------------------------------------

Hawker/food court - $340.14

Restaurants - $193.20

Utilities (nett of subsidies and rebates) - $51.85

Parents (excluding bonus and ang bao)- $336.67

Mobile phone - $37.36

* Internet - $45.58

Mortgage (including all fees) - $1036.69

Insurance (1 whole life, 1 limited whole, 1 term, 1 disability income and 1 decreasing term) - $500.85

Here are some comments regarding the above items:

1. Hawker/food court - Usually this involves tze char shared with my wife, with one drink shared. We seldom cook, so groceries expenses are not significant. We usually order 2 dishes - one meat and one vegetables. If she's not around with me, I usually order economic rice. It's 1 meat and 1 veg again, with no drinks. It works out to be about $11.33 a day, or about $5 per meal.

2. Restaurants - Always with wife. I don't eat restaurants alone as my primary aim is just to feed, not to dine. We always go restaurants (mid-tier ones) every weekend, occasionally there'll be trips during weekday to take advantage of the lunch discounts. On average, it's $48.30 per week, or about $24 per weekday. That's about right for the restaurants that we visit. Very infrequently, due to some celebration we'll go for higher tier restaurants that costs about $50 per head and above. Rare though.

3. Utilities - I was quite surprised by that amount. It must be the subsidies/rebates that the govt gives to each household that reduces that amount. On average, I would say our household bills is about $110 to $140, and that range will cover almost 95% of all bills. Since I worked mainly at home, and I switched on the aircon in my work room almost 8 to 10 hours a day, I will say it's cheap, haha!

4. Parents - Usually I give a monthly, then during special occasion (like CNY or birthdays) I'll give them an angbao. I've a brother to share the load too. Their mortgage is already paid for long long time ago, so this is more for food expenses. They almost always eat at home, and even if they are out, the expenses are paid by us. I think this amount is just about right, and I don't think I'm going to change it anytime soon.

5. Mobile phone - This is set to be reduced in the near future once my contract ends. Mine is with starhub 4G-300Mb, which I hardly use. My fibre plan with M1 gives me a free 1Gb data sim that I'm using in my dual sim phone. My future plan will reduce this cost to about $15 or so per month. I've not exceeded my data plan at all, but I think that's normal since I'm mostly on my home wifi most of the time.

6. Internet - Fibre from m1. I think I can optimise this further by consolidating my mobile phone plan with my fibre plan. My wife's bills is still paid by her parents (lucky!) so it's never in the picture. I depend more on a good and stable internet connection for work, so I rather be stingy on my mobile data plan and make sure I have a good connection at home. I'm footing the whole bill of the internet, so my household internet cost is NOT 2 times of the figure stated above.

7. Mortgage - The big bugbear. This is theoretically higher than it should be, since my plan is to make partial capital repayment to reduce the absolute amount per month. So far, I'm just choosing the option that allows me to keep the same mortgage payment per month but reduce the duration of the loan. Once I reduced that amount further, I will switch to keep the duration constant but reducing the monthly payout. Hopefully it'll drop down to $500 per month, making it much much more manageable in terms of risk of loss of employment.

8. Insurance - that's for 1 whole life, 1 limited whole, 1 group term, 1 disability income and 1 reducing term for property mortgage. Will be intending to increase the term part when I have a kid, but till then, things are likely to remain like this.

Okay, so having listed out the items, I have to arrange them in order of importance, with the 1st being the most important and so on. The order is based on what is most urgent and most important first. What can I not pay but would drastically change? What can I not pay but wouldn't result in any drastic changes? It's subjective of course.

In order of importance, with 1 being most important:

---------------------------------------------------------------

1. Hawker/food court

2. Utilities

3. Mobile phone

4. Insurance

5. Internet

6. Restaurants

7. Parents

8. Mortgage

The first 3 choices are immediate problems. Without it, I can't function and I can't work. Number 4 is important in the med to long term. If there's any problem, I want my immediate family to be able to survive and perhaps thrive. 5 and 6 is more entertainment, but without them it's going to affect how long I can work. 7 is the second least important because they have buffer and will still do well without my contribution. 8 is least important because I have a buffer in my CPF-OA account that can last for a year or so without active work. That gives me some buffer already. Besides, if push comes to shove, I borrowed from HDB so hopefully they are not as heartless as banks are, reportedly.

To gamify this, there are stretch goals to be met if 1 to 8 are all fulfilled. Naturally, all these stretch goals are good to have, but not really necessary. Wants, rather than needs. Here's some of them:

1. Hawker/food court

2. Utitlities

3. Mobile phone

...

...

8. Mortgage

----stretch goals-------

9. Travel/vacation

10. Play fund

11. Car expenses

Financial security milestone

---------------------------------

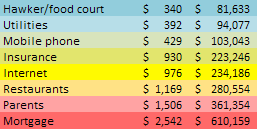

After listing the items in order of importance, it's easy now to see what are the incremental expenses needed to be covered by income, preferably passive. That's for the second column for the table below. The 3rd and right most column is the amount of capital needed to reach that level of expenses per month. It's based on 5% returns pa, meaning that if I need to get $100 per month, I need $24,000 in capital.

I'm currently at the mobile phone to insurance level. It's a huge jump! This means that my passive income stream can cover my expenses for food per month, my share of the utilities bill plus my phone bill. It's not much, but at least I know where I stand now.

Currently, I'm more interested on the 3rd column on the right, because that represents the amount of savings I need to accumulate in order to cover the expense on the left. If things don't change (but they do all the time, don't they?), I'll take about 9 to 10 yrs to reach the last level. Okay, maybe 12 years to be trotting along at a real comfortable pace. I know I'll reach there, it's just a matter of time.

Maybe when I'm nearer the end boss "MORTGAGE", I'll talk more about the stretch goals, haha!

Monday, June 13, 2016

Subscribe to:

Post Comments

(

Atom

)

2 comments :

Good site.

It's a great blog about finance thanks for sharing the blog to know more about finance..

Open Bank Account Online

Post a Comment