Look at this company's ROE below:

FY 2011 -- ROE 72.6%

FY 2012 -- ROE 47.7%

FY 2013 -- ROE 33.7%

FY 2014 -- ROE 25.6%

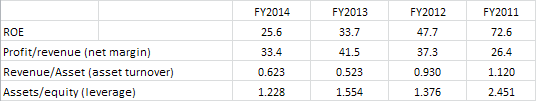

The ROE (return over equities) keeps falling from the 70+% range towards the current 25% range, but it's still pretty high. Would you say something is wrong? If so, what went wrong? It's important at this stage to break up the ROE into parts. It's called Dupont analysis, where ROE is split up into three components, net margin, asset turnover and leverage. If you multiply all the three components together, you'll get ROE, as shown below:

Here we can see that the net margin is very very good. Considering that the company IPO in FY2013 (hence anything before is suspect to me), I'll just concentrate on the 2013 and 2014 era. Net profit of 30+% is incredibly high. Take note that the leverage is also dropping from year to year at the same time. This means that the ROE is sustained by the higher asset turnover and also lower leverage. So what if the ROE dropped? It's still okay!

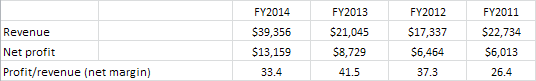

ROE is net profits over equity, so let's check the net profits over the years.

Revenue is rising, and net profit is rising also, but not as fast, which means that the cost of producing the profit also increases. But cost increasing is not such a bad thing. In their case, it's because there's a bigger cost attributed to project and production cost. They set up the cost first and ask for progressive payments, somewhat like construction industry. If there's zero cost, I'm going to have to start worrying for their revenues the next financial year!

It's like free cash flow. If it's reducing, it's not the end of the world. You have to dig out to find what's happening? If the free cash flow reduces because they are investing in stuff that will improve their revenue next year, it's a good thing isn't it? If the free cash flow is stable over the years, it just means that they are sort of in an equilibrium stage. The middle age to golden age of a company, where things are stable, not breaking into new industry or into new markets.

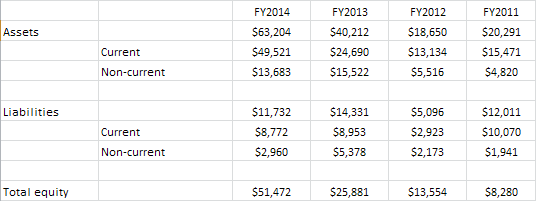

But ROE is part net profit and part equities. Let's see their equities.

You notice that there's a huge rise in the equities in FY2014. How come? The assets increased a lot while the liabilities is reduced too. The equity doubled from FY2013 to FY2014. If the net profits remained the same during the same period, the ROE would have been halved! Since it didn't drop by 50% (from 33.7% to 25.6% in FY2014), the net profit must have risen proportionally higher.

Let's see its NAV (cents).

FY 2011 -- 3.31 cts

FY 2012 -- 5.42 cts

FY 2013 -- 10.35 cts

FY 2014 -- 20.59 cts

Since the equity keeps increasing, of course the NAV also increases. Since the increment is the same as the rise in equity, the no of shares outstanding is not diluted too much. Indeed a check shows that it's the same since IPO (but it's only been a year since IPO, no big deal).

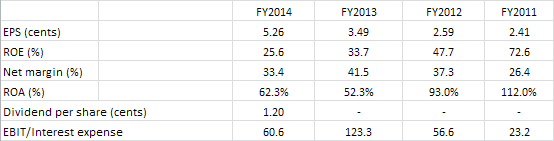

Here's the summary:

At last close, the PER is 5.3, P/B is 1.36 and yield of 4.3%.

Last year, it IPO at PER of 8.8, P/B of 3.0.

I want the readers to focus on the numbers alone without prejudice, hence I blacked out the name of the company below. If you highlight it, you'll see the company, haha! Also do take note that this set of financial results is not the latest. I just want to see the full year results to analyse the ROE - it's never my intention to recommend companies to buy.

The company name is: Starburst

Saturday, December 19, 2015

Subscribe to:

Post Comments

(

Atom

)

4 comments :

the roa so high! how come no competition?

Hi Kyith,

Indeed very high. When I computed it, I have to double check to see if I did it wrongly - it's crazy. Maybe they are in a specialised field where technicals and local know-how matters. I suspect their top guys are helmed by pple who are ex-regulars. I've been to one of their shooting range before and it's crazily high tech. There's day and night simulation lightings and you can finish the entire shoot in half a day, under air conditioned environment. Thoroughly impressed!

Interesting article about the Australian electronic chain Dick Smith.

https://foragerfunds.com/bristlemouth/dick-smith-is-the-greatest-private-equity-heist-of-all-time/

sshhh... I show you something more fun.

https://www.facebook.com/ken.chee/posts/10153431843968722

https://sg.finance.yahoo.com/q?s=8IH.AX

https://www.fool.com.au/2015/04/27/could-8i-holdings-ltd-shares-be-worth-9-cents/

Post a Comment