Out of curiosity, I wanted to find out more about Jumbo Group Limited IPO. This is the group that is famous for their Jumbo Seafood and their signature Jumbo chilli crab, black pepper crab, salted egg golden prawns and crispy baby squids. They have restaurants under the Jumbo seafood brand in Singapore and PRC too. Besides this, they also have JPOT, Ng Ah Sio Bak Kut Teh, Chui Huay Lim Teochew Cruisine, J cafe, Yoshimaru Ramen Bar, as well as Singapore Seafood republic. Singapore Seafood republic is found in Japan, specifically Tokyo and Osaka.

To be honest, I seldom visit any of their restaurant brand. Even the famous Jumbo seafood restaurant at east coast (I live in the east), I've been there only less than 5 times in my entire life. It's always a touristy kind of place, and I don't feel like spending a lot of money to eat okok food. But that's just me. Neither did I visit Jpot, or Jcafe or any of their outlets, sad to say, haha!

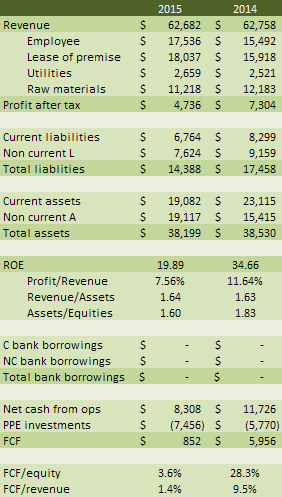

But what's impressive is their results. Since the finalised version of the prospectus is not up yet, I've to work on the preliminary one. Facts might change, but anyway, here's a summary of the key financials:

Here's a few key points:

1. Revenue had been rising, together with earnings after tax. This rise in earnings is not likely fueled by debts, as you can see from their Assets/Equities from 2012 to 2014. It seems to be driven by the greater profit margin of their business, which is always a good thing.

2. ROE at 23% to 26% is fantastic, especially so when they are not crazily leveraged. As a comparison, ROE of Oxley, the company that I recently covered while trying to decide whether their bond is a good buy or good bye here, shows an ROE of about 18% in 2015, but their assets/equities (a sort of financial leverage) is 6.81 times! Okay, granted, that's not fair since they are of different industries. Let's compare with other f&b establishments listed locally - Japan Food holdings and Soup restaurants.

Here's Japan Food holdings (figures in '000):

And here's Soup restaurant:

If we compare these 3 f&b places, we can see that the ROE of Jumbo is in a very good and envious situation. Jumbo's ROE is about 25% compared to Jap Food of about 20% and Soup restaurant of about 7%.

3. Great net profit margins. Their net profit margin varies from 8% to the more recent 12% in 2014. I think f&b business is kind of hard to have high profit margins, and Jumbo is doing a great job as a company (but ripping us off as consumers!). Their top 3 things in 2014 that reduces their net profit, besides tax, are raw materials and ingredients (43.3% of total cost), wages and salary (27.1%) and lease of premise (9%).

It's interesting when we compare with Jap Food holdings in 2015, because the top 3 cost are lease of premise (31,1% of total cost), wages and salary (28%) and raw materials (19.4%). So are Japanese food materials less expensive, seafood ingredient more expensive or somebody is serving us lousy ingredients? lol

Just for curiosity, the top 3 cost in 2014 for Soup restaurant are wages and salary (36.2% of total cost), raw materials and ingredients (23.9%) and lease (17.5%).

4. ROA or Revenue/Assets - this gives us how much profit they can generate from investing in their assets. It's not shown in the table, but Jumbo has consistent ROA throughout 2012 to 2014 ranging from 16% to 19.4% (in 2014). Very good, when compared with that of Jap Food, which is about 12 to 18% and Soup Restaurant of about 2 to 5%.

5. Jumbo do not have a lot of long term debts. Their total bank borrowings is about 4 to 7% of their total liabilities. One year of their net profit can cover their total bank borrowings 7 to 17 times over, so it's really not a concern. If you use their free cash flow (FCF), each year of operations can cover their total bank borrowings by 4 to 12 times. It's a very robust balance sheet that they have. Comparing with Jap Food holdings and soup restaurants, I'm quite surprised that F&B business do not have a lot of debts. Perhaps it's such a good cash business that they don't need debts to tide over their cash flow problems, if any.

6. Jumbo is generating free cash flow like crazy. I'm lazy, so I'm using FCF = Net operating cash flow - cash needed for PPE as a proxy. It's stable and consistent, can't ask for more.

It's hard to say if this is a good buy or good bye without knowing the ipo price. Since it's IPO - It's Probably Overpriced, but it'll be good to look at this again. What I like about Jumbo is that it's a cash business, not highly leveraged, great ROE, good net margins for a f&b business and best of all, fantastic free cash flow. What's not to like about it?

Perhaps the IPO price, lol

----------------------------------------

Latest update:

Many thanks to musicwhiz who told me that the IPO prospectus is now in Catalodge under SGX. Strange, I always thought that Opera is the place to find such prospectus. Anyway, with that finalised prospectus, things are a lot clearer.

They are listing it at an IPO price of $0.25

Here's some pro forma per share data:

NAV: $0.068

EPS: $0.027

PER: 9.3x

Dividend policy: No fixed policy. Intention to distribute not less than 30% of net profits in FY2016 and FY2017. 30% of EPS of 0.027 will be 0.81 cts, representing at least a 3% pa dividend if FY2015 earnings remain the same.

With an IPO price of 25cts, Jumbo is priced at 3.7 times of NAV. Let's compare the other two f&b enterprise listed here:

Jumbo NAV: 6.8 cts, IPO price: 25 cts (3.7x)

Japan Food holding: 2.5 to 2.8x NAV

Soup restaurant: 4.8x NAV

What about the PE ratio of Jumbo?

Jumbo EPS: 2.7 cts, IPO price: 25 cts (9.3x)

Japan Food holding: 15 to 22x

Soup restaurant: 4 to 6x

Looking at the ratios, the business of Jumbo seems more like Japan Food holdings than of Soup restaurant. If we go by that standard, then the PE ratio of Jumbo might ultimately trade around 15 to 22x, which means a price range of about 40.5 cts to 60 cts. I'm not looking at NAV because it's not really relevant in such a business.

They are putting out 2 million shares for public offer (for us) and 86.233 million shares for private placement. There's also 72.1 million shares (separate from private placement) taken by cornerstone investors (namely Orchid 1 Investments Pte Ltd by Heliconia capital management- 40 million shares, and Mr Ron Sim, CEO of Osim - 32.1 million shares). With only 2 million shares out for retail investors, this is going to be as hot and spicy as their signature chilly crab.

Verdict: Good buy, if you can get any. More likely you'll get insufficient number of shares to make it worth a stag after commission, haha!

Thursday, October 29, 2015

Subscribe to:

Post Comments

(

Atom

)

15 comments :

Nice analysis. Thanks! Makes one hungry reading it too haha.

Hi YP,

You should really look at the pictures in the prospectus LOL

Hi LP,

I have been there less than 5 times too, always due to relative celebration. I must say the food is quite good but the price is really scary, I will not go there on my own.

Cuihuilin is a teochew restaurant and is very popular too. But I find the food so-so for the price.

I hope they dun expand too fast and it remind me of how bad QC in both food and service cost Tung Lok and paradise rather dearly.

Read somewhere the price is 25 cents. From fool

3. How much is the company valued at?

Based to its issue price of S$0.25 per share and an expected share capital of 641.3 million shares (post-invitation), Jumbo Group is valued at S$160.3 million. That will value the company at a price to book value of 3.7 times its book value post-invitation and at 11.6 times its price to earnings ratio post-invitation.

Ya... Doesn't look cheap

Hi SI,

I just updated the article after reading new information - I just got my hands on the finalised prospectus. I think we shouldn't base this type of business on NAV. If we look at PE, it's just alright, not priced exceedingly high so there's still some meat for the IPO to run. IPO won't be cheap one lah, hahah!

Heard that there is a conditional dividend of $50M+ to be paid out 5 days after it is listed. Anyone can verify?

Hi Bennet,

Yup, it's on pg 49 (prospectus page) of the finalised prospectus. I quote:

"On 19 October 2015, our subsidiaries declared an aggregate of approximately S$51.7 million in conditional interim dividends, which shall be paid within five (5) business days of the date our Company is admitted to Catalist and trading in our Shares commence. Please refer to the section entitled “Restructuring Exercise” of this Offer Document and the “Independent Auditors’ Report and the Compilation of the Unaudited Pro Forma Combined Financial Information for the Financial Year Ended 30 September 2014 and the Six-Month Period Ended 31 March 2015” as set out in Annex C to this Offer Document for more details."

Do note this IPO is not for new owners, unless I read it wrongly. It's under past dividends, and it's already declared (19th Oct) before the IPO. It's just that it won't be distributed unless they are listed.

If you notice, the total sum raised in the IPO is 88,233,000 x $0.25 = $22 million only. And $51 million is declared...lol

I mean "do note this dividend (not IPO) is not for new owners.."

Hi LP

jumbo sounds good. Perhaps i shd get some, provided i can.

If they throw in some discounts for shareholders dining at their restaurants its is real bonus!

Hi Paul,

Haha, if they give discounts like soup restaurants, I'll be a great deal, I agree! Every now and then I'll receive flyers to eat there, but always with min spending haha

Hi SillyInvestor,

Don't know whether IPO PE is 9.3x (per LP's data) or 11.6x (per you).

But if it is 11.6x, could you please explain how it is derived? (as I don't understand within your context of post-IPO expected share capital of 641.3mil shares & mkt cap of $160.3mil).

Sorry for my query, but a newbie here ... Thanks very much.

Jumbo IPO seems reasonably priced IMO.

But theres another thing to consider - given that Jumbo is IPO-ing on sgx catalist, plus only 2M shares for retail, could there be liquidity issues?

Hi anon,

Pls leave a nickname next time? Easier to refer to you.

I think liquidity depends on how many shares you're getting in. If you're entering 200,000 shares, it'll might be a real problem. But if it's 2000 shares, it should be fine. Given enough fire power, there'll always be a liquidity issue. Then, it's a matter of execution rather, and working with the bid/sell queue rather than anything else.

Any decision to buy the stock should probably take into consideration the conditional dividend which I believe new investors will not be receiving and will basically erode the value of the stock.

After the $50M special dividends paid out to pre-IPO shareholders, the financial ratios of Jumbo will look very ugly!

Already, even at IPO, the assets to Total equity ratio is already >13 times (with total Equity at $5.798M and Total Liabilities at $69.178M).

So after $50M special dividends paid out, the company will have negative equity!

All financial ratios will turn uglier.

I'm not sure if the 50 mil dividends to be declared after listing is already included in. My accounting skills are not so good. If it's not inside, then we have to be careful. Anyway, will become clearer once they ipo haha

Post a Comment