Croesus retail trust is doing a rights exercise. The mother shares just went XR last Fri and I thought I should highlight the important points to remind myself to take action. I always remember someone losing a huge amount on rights exercise in the past because of some misunderstanding. I hope this won't happen to any holders of Croesus.

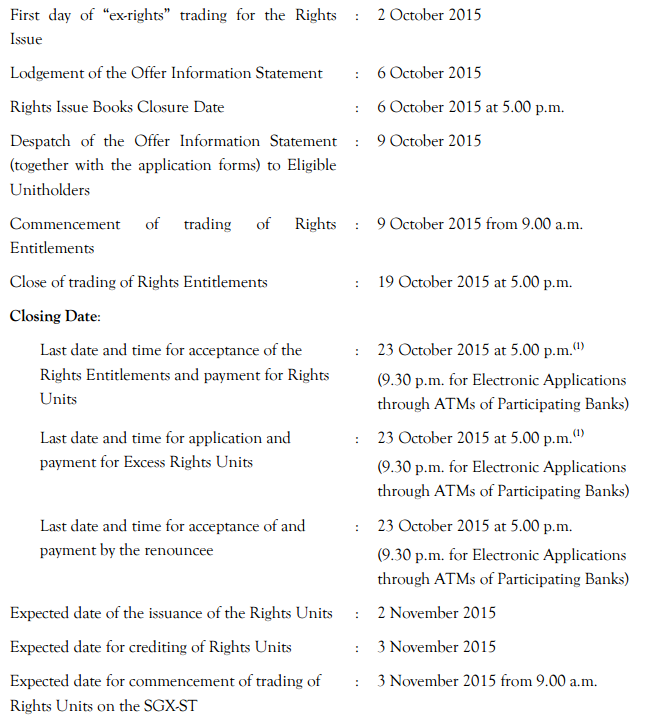

Here's the details from here:

The most important dates are the trading of rights entitlements, otherwise known as nil-paid rights, from the 9th Oct to the 19th Oct 2015. The second important date to take note is the closing date of the rights payment by ATM, which is on the 23rd Oct 930pm. Please do not forget to subscribe to your rights by paying for it, usually through the ATM, by 23rd 930pm. If not, all your rights will be rendered worthless!

For those who are new to rights, here's the main flow of events.

1. The company issuing the rights, called the mother share, will announce the rights issue. They will go cum rights (CR). If you buy the mother shares while you still see the CR status, you'll be entitled to participate in the rights exercise. After ex-rights (XR), you can't participate in the rights on any mother shares you bought from XR onwards. In other words, you're not entitled to any rights shares from this point onwards. The mother share, Croesus retail trust, went XR last Fri. So, if you only buy it today, you won't be participating in the rights.

2. After XR, in about a week or so, you'll receive a thick set of documents in your mail called the Offer Information Statement (OIS). In it, you'll get a set of documents detailing why they are doing the rights, the timeline (as shown above) and the way to go about subscribing for the rights. It's very detailed, so for first timer you should read all of it to get a gist of what to do. They even give different scenarios as an illustration, so really, go read it because it's very informative.

Inside the OIS, there is also a white form, I think it's simply called Form A or the ARE. In it, they will state the number of rights shares you are provisionally allocated based on the number of mother shares you have by XR date. Since this rights exercise is 22 rights for 100 shares @ 61 cts per rights shares, if you have 1000 mother shares by XR, you'll be provisionally allocated 220 rights shares. These 220 rights shares are known as nil-paid rights.

Why nil-paid? Because they have not been 'paid' up, or subscribed. You still need to pay 61 cts for each nil paid rights allocated to you. So, in our example above, since you have 220 nil paid rights, you'll need to eventually cough up $134.20 to subscribe for it. Thereafter, the nil paid rights gets transformed into normal shares. To differentiate this new addition of shares from the original mother shares, they call it the rights units. So after subscribing or paying up 61 cts for every right entitlements (or nil paid rights), they get transformed into normal shares (or rights units).

The last step on subscribing is important. Again, if you didn't subscribe and pay up, the nil paid rights provisionally allocated to you will be rendered worthless. And the last date to pay for it is on the 23rd Oct, 930pm, if you choose to pay through ATM.

3. How to subscribe and pay so that your nil-paid rights get converted to rights units? There are two ways - firstly it's through form A that is mailed to you together with the OIS. I blogged about this here.

The second and easier way is to apply through ATM. I always do it through ATM.

Just go to the ATM screen, click on other transactions, then look for something like “ESA – IPO applications”, then find the Croesus Retail trust. You’ll be guided to type in the amount of rights that you wish to accept out of the allocated (e.g you may be provisionally allocated 5000 rights but may want to accept only 2000), plus another separate screen where you’ll be guided to type how many excess rights you want to subscribe. Then you’ll come to a screen where they will tell you how much you have to pay. Make sure this screen you check carefully before pressing. I know for DBS you need to pay a service charge of $2.00, not so sure of other banks.

If you applied through ATM, then do not send any forms! It’s done – just wait for them to mail you how many excess rights you’ve successfully got and how much you applied for.

On 3rd Nov 2015, the rights units will start trading as normal original mother shares. There will be no distinction between these two and the rights exercise is deemed to have completed.

That's all, three basic steps. Okay, ready for complications? There are 2a, 2b 2c etc and 3a, 3b and 3c etc, which I'll give fuller details in future post for more advanced rights participants. I'll share some information regarding excess rights, how to make the best out of the rights exercise and also the part about trading of the nil paid rights in near future post.

Canada Hits Pause On Its Booming Population Growth

59 minutes ago

10 comments :

Thanks for the guidance.

Detailed and simple to understand.

Bookmarked for future reference.

:)

Hi Sir knight,

Most welcomed! Look forward to my post for more advanced players!

Thanks for your sharing, but I would like to know for the nil-paid right that I purchased from the market, do I still need to apply and convert it through ATM? Thank you

Hi anon,

Yup, still need to subscribe and pay 61 cts thru ATM, even if you had bought it during the nil paid rights trading period.

Hi, Good day, meanings that we bought the nil-paid right from the market today. I can apply and convert it thru ATM in the next day?

Hi,

Technically yes. But the trading period is not open yet, so u can't buy the nil paid rights yet. And once u paid for it thru atm, the stocks won't start trading till Nov. But basically what u said is right.

Thank you for your information :)

Hi, Good day, I'm intended to purchase rights from the market, but there are two counter no. which is BHRR and BHSR, I could not get further information about the difference of these two rights. So which is the correct one I should purchase?

Thank you

I'm not sure what you mean by BHRR and BHSR. The easiest way is to click on it and see the lot size. One of them is for 100 shares board lot and the other is 1 share.

Okay, I know what you mean already. BSHR is 1 share per lot. BHRR is the normal 100 shares per lot. To be sure, click on it and check that it's really 1 or 100.

Post a Comment