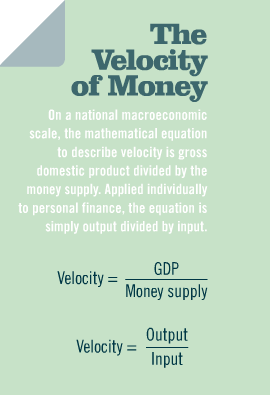

I remembered this particularly interesting concept, called the velocity of money. It is borrowed from the discipline of economics but in this case, it's applied to the field of personal finance. Basically, it's just an equation that is somewhat similar to the the mathematical form of efficiency. No wonder the concept feels similar to productivity.

| |

| This is extracted from the book Killing Sacred Cows by Garrett Gunderson |

Basically, the concept is talking about how to keep input at a minimum while increasing as much output as possible. The point here is how to continually extract more output and yet at the same time reduce your input. One example of this is to use the savings you had to buy into financial instruments that gives you a passive income. Then you use the passive income to buy more such instruments that will generate even more passive income. While the input remains the same (which is the initial amount of savings that you put into the instrument in the first place), the output keeps getting higher and higher. This is because the principal and the interest both earns you an interest, thus creating a self feeding loop - exactly how compounding works.

Another example will be a business like ebay. When it started, there are not too many buyer and sellers. An effort is spent to set up all the necessary infrastructure for the ebay business to begin. Once time progress, more sellers come into ebay to hawk their wares, which in turn attract more buyers. Seeing more buyers attract even more sellers and so on, creating a self feeding loop. The input is minimized but the output is exponentially increased.

I guess it works for the tuition business as well. As I begin the career, I have to read up on a lot of stuff to have the knowledge. All these are just one time effort. Once I get some students, a proportion of them will turn out to have excellent grades, which in turn will attract more students to come in based on recommendations and so on and so forth. These kind of network effect is not proportional to the initial effort that is put in, hence it's very powerful.

The book mentioned that net worth is like stored potential, while cash flow is like a tap with running water. Having a high net worth does not mean that the person will have high cash flow, but the potential is there. It's like you have a lot of cash sitting in the bank, with little debts (high networth). Cash has low velocity because the output (the interest earned) is very little. If one just utilizes the cash to do create value (here, value is defined loosely as something that is in line with your Soul purpose), then it'll have a higher velocity of money.

|

| Again, liberally taken from the same book |

Now, seriously, I think that is a refreshing concept. As of all good speakers and good books, it's not that you do not know the concept that is at work here. It's the flair and the way the concepts are illustrated that makes it refreshing. As of above, so shall below. While the velocity of money is essentially a concept used in the financial field, I guess one can equally apply it to life in generally. I think the concept of the velocity of money forces one to think critically on out to increase the output value of every dollar that is utilized, so as to increase productivity.

Food for thought... would you rather have a high net worth or a high cash flow?

23 comments :

Hi LP,

I want both. ;)

Definitely high cash flow!

Imagine an endless flow of cash, everyday have headache what to spend the money on or else tomorrow come some more cannot handle.

Velocity of Returns = The most dollars in the least time.

I like.

Hi LP,

me and my gf has thought of this concept before, even though we have not read the book.

Basically, for us, it's an alternate viewpoint of the power of compounding. Let me raise an example

You build the business, be it ebay or tuition. Customers come in. You spend effort to generate more customers, while your current customers generate more customers for you as well. As time goes on, your customers will increase at an exponential rate until you put a stop to it.

Compounding does not work in terms of $$ investing only; it works too for other aspects like what I mentioned above. In fact, it can even work for property investments. An example would be to buy a property, pay down the loan asap, while renting it out. Then you move on to a 2nd property, and pay it down with the new rental, the old rental, and your own input. Repeat the process again and again, and soon, your properties will be numerous.

Cash flow is to me important as well, which is why I buy a lot of dividend stocks

http://wealthbuch.blogspot.com/2009/04/importance-of-cash-flow.html

In engineering, we call this a positive feedback loop, which is a loop that goes on forever and ever and the amplitude just gets larger and larger :)

What happened to you if your very first property got burnt, you got to work for a long time for free to pay your banker.

Highly leveraged is a double-edged sword, it can kill you too.

Hi Cw8888,

there are ways to play properties safely. I have my plans, but I guess I could only start if I get my HDB BTO plus 5 years after the MOP.

We should play it in such a way that highly leverage would apply only if we consider the price of the property and the debt for it alone.

One would not be highly leveraged if we take into account the whole portfolio of assets and properties.

Hi LP,

Ever thot of the "compounding effects" of transformed lives?

"Jehoram was thirty-two years old when he became king, and he reigned in Jerusalem eight years. He passed away, to no one's regret,.."

Hopefully the resources we "invest"/spend each day has a lasting effect & when we do leave this place, its not to on one regret. :)

Cheers!

hh

Dear JW

I second Createwealth8888's comment. Borrowing to invest is a risky game. There are many variables that can stop the game: loss of job, illness, interest rate increases, lack of tenants, rental income not covering even interest on mortgage etc.

One of the reasons the financial world got into a crisis was due to over-leveraging from sub-prime and now even the problems with sovereign debt.

Using Rich Dad Poor Dad's approach to using leverage to generate cash flows only works if asset prices go up in the long term. But we can see from global financial crisis that corrections and even systemic failures in debt markets can occur.

If that happens, the strategy of using leverage to invest can lead to busts.

Be well and prosper.

Hi LP

I think both is good but being in a positive net worth position is much better because you have the potential energy stored up to be unleashed in the direction you want.

In life, be careful of the suckers' choice that it is about one or the other. We need a bit of both to succeed in personal finance, i.e. build up our net worth using velocity i.e. earn more than you spend and save to build up net worth. At the same time, make use of net worth into relatively safe investments that build income streams.

The challenge I find is how to find safe investments to build up income streams without risking the entire capital.

Be well and prosper.

Indebtedness itself will never kill

http://createwealth8888.blogspot.com/2010/06/indebtedness-itself-will-never-kill.html

Hi AK and Lau,

Hmm, I've the same answer as AK. I want both actually. I think with high net worth, you can have the potential to earn a high cash flow. But with high cash flow, you'll also have the potential to have a high net worth.

Works both ways :)

Hi bro8888 and JW,

Same concept, different applications :)

I think we all have seen this concept in different applications before, or thought of it ourselves. It's interesting to see how it all converges to the same principle.

Interesting examples you gave, momo, thanks for sharing :) I might do it if I'm sure of what I'm doing :)

Hi HH,

Another application? Haha, indeed...not to regret upon leaving.

Hi PG,

Haha, indeed it's a sucker's choice. I think both choices compliment each other. However, if I have to choose just one, I'll take the high cash flow. Reason? With high cash flow, I can sit and wait for my net worth to increase, whereas for high net worth, I still have to think how to change the potential into something concrete :)

Lazy man eh?

Hi LP,

No la...its "to no one regret" :)how many ppl be sorrowful/regretful/remorseful when we leave.

"No one would remember the Good Samaritan if he'd only had good intentions - he had money, too."

Margaret Thatcher

Sorry I digress.

For Net worth; u may have property, currencies, business, stocks, bonds,commodities, clubs etc? Actually most of these generate tve cash flows (yield?) maybe Arts and antique, gold more for appreciation, so cash flow zero maybe negative coz of holding cost.

I see networth diagram as one with many taps, some fast, some slow, some back flow.

Cheers,

hh

Hi HH,

I agree with you. Seldom do high cash flow go in different direction from high net worth. A good yield instrument would itself constitute to the asset already.

Backflow tap, interesting concept :)

Hey guys, am quite a newbie in value investing but anyway, came across this book on

http://on-aroll.blogspot.com

Anyone know if its any good?

Thanks! :)

Hi ttbvi,

I've browsed through this book before. I don't find it particularly useful though. It could be that I've read other books so upon reading this particular one, I already have some literal baggage I'm carrying, hence it doesn't impress me much.

If this is your first book, I suppose you should learn quite a lot of things. We all have to start someone, aint it? :)

If you are trying to be a value investor, I suggest you read buffettology and the five rules of successful stock investing. I think you'll find them very useful. Check out my post on "the forgotten habits of reading".

Good luck!

Hi LP,

I knew a high income earner with unique "taps". Beside expenditure for his simple life style, (bought his coat from thrift shop etc). He channel his money in buying arts, antiques, collectibles. He engineered the building of a concert hall, last year. And now, he is donating all his collections for the new museum.

His "returns" is humongous, as generations would benefit from his "taps" of museum and music hall.

Chew Hua Seng, Ceo of Raffles Edu gave a talk in our church a few weeks back sharing how he donated 100 million to charity. No doubt he stays in big bangalow and has lots of money but I think it requires a big heart to give away 100 million.

I hope I also could have taps to outflow continuously for higher, longer compouding effect.

I was just thinking about it and you put up your post. :)

hh

Hi HH,

Hmm, interesting thoughts...I wonder will I be able to give up my wealth when I attained it.

I'm not certain at this moment in time :)

Hi LP,

Yes you can! when u have a change of heart and mind, one day.

Cheers!

hh

I came across this link on saving investment plan, hope can provide more insights.

saving investment plan

Thank you for sharing such great information.

It has help me in finding out more detail about <a

href="https://www.prudential.com.sg/products/medical/prushield>medical insurance coverage</a>

Post a Comment