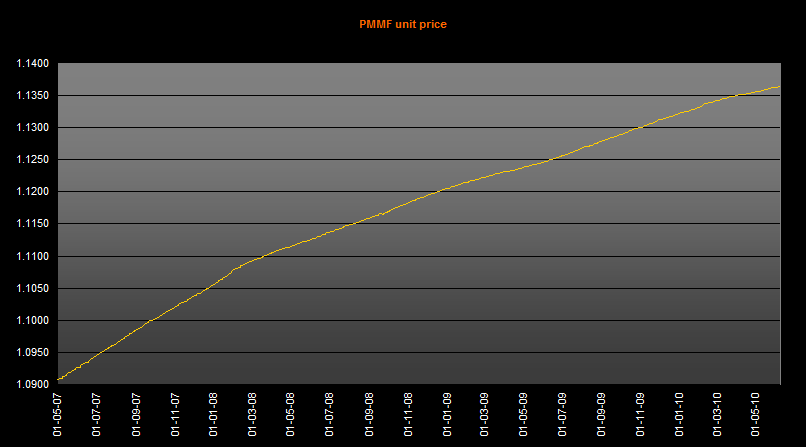

The returns per month for the following years are as follows:

2007 : 0.167% per month --> 2.01% per yr

2008 : 0.111% per month --> 1.33% per yr

2009 : 0.087% per month --> 1.04% per yr

You can see that the returns are dropping. From the fact sheet, I also saw that it is attracting more and more people into the funds, so perhaps there is so correlation. Perhaps they are finding it harder and harder to get the yields as their fund size grew bigger, or maybe it's the fact that the general low interest rate environment makes it hard for them to give us anything more competitive (they invest in low volatility assets like sgd deposits, govt bonds etc).

|

| Can you see the obvious change in gradient over time? |

Here's the figures for this yr, 2010:

Jan : 0.071% per month

Feb : 0.088% per month

Mar : 0.053% per month

Apr : 0.044% per month

May : 0.053% per month

The average monthly returns had dropped since the start of the year, giving an average of around 0.062% per month. This means that if all else remains as it is, I'll be looking at around 0.8% per year, which is under 1% per year.

Pathetic you say? Yes, it is. But I guess that's the price of 'safety'. It can't even beat inflation, which is at 3% per year. But for those who needs the liquidity (like me) and cannot safely put it into higher yield assets, I suppose this beats the even lousier interest rates for savings accounts. I think even for fixed deposits, you need a higher deposit amount and longer lock in period for this kind of returns. So, in comparison, it is still okay lah.

One thing about it is that it is not guaranteed, unlike banks. Given the low returns for the MMF, it's been a long while since I've put in any fresh funds inside. Most of my savings are put into my savings account now, because the higher returns is not worth the risk of Phillips going belly up.

6 comments :

http://info.maybank2u.com.sg/personal/deposits-banking/time-deposits/detail.asp?page=isavvy

Interest rate Among the highest time deposit interest rates in Singapore

0.25% p.a. upfront interest* one calendar day after placement

Interest-on-interest** of up to 640% when your deposit matures

That's a total of up to 1.85%ˆ p.a.

Hi bro8888,

Thanks bro, didn't know got such lobang. But the min is a bit high, so I guess it's good to put your emergency funds into it.

I'll consider it seriously, thanks :)

I agree with your statement totally, "the higher returns is not worth the risk of Phillips going belly up".

Hi Alvin,

You put your spare cash in PMMF too?

Hi,

You can consider CIMB StarSaver account. It is a current account and currently the rate is at 1% pa.

Hi anonymous,

Thanks for sharing this info :)

Post a Comment