Since in the real world, there are no teachers to check for you and no answers behind the textbook to assure that you're right, we always have to try solving the problem using different methods. If all the methods arrive at the same conclusion, then chances are, you're right until someone proves you wrong.

First method:

I tried using numbers to have a feel of how it works:

Let's say I have 10 lots of ARA shares @ $1.00 average price. Since the dividend is declared at $0.025 per share, or $25 per lot, I'll have $250 dividend for my 10 shares. The closing price a day before XA was $1.15, so I can calculate what's my profits so far.

My inventory before XA: 10 lots of ARA shares bought at $1.00

Sell price : 1.15

Profit from shares : (1.15 - 1) x 10,000 = $1,500

Dividend : $250

Total profit before XA: $1,750 (1500+250)

Now, what happens after XA? The price of ARA drops because there are more shares floating around due to the 1 for 5 bonus issue. This means that for every 5 lots of ARA shares you own, you will now have 1 lot of bonus ARA shares. The price drops accordingly to reflect the fact that the market value of ARA remains the same. Do note that only the ordinary shares are entitled to dividend; Bonus shares are not entitled to this round of dividend but they are eligible for future dividends.

Let y be the price of ARA after XA.

My Inventory after XA: 10 lots of ARA bought at $1.00 PLUS 2 lots of bonus shares

Sell price : y

Dividend : $250

Profit from the original 10 lots of shares : (y - 1.00) x 10,000

Profit from the bonus share : y x 2,000

Total profit : 10,000y + 2,000y -10,000+ 250 = 12,000y - 9,750

Since y should represent the theoretical price such that my profit/loss before and after XA is to be the same, I equate the two profits,

12,000y - 9,750 = 1,750

Solving, y = 0.95833

Hence $0.958 is the price such that my profits before XA and after XA is the same.

Second calculation:

I noticed that several terms can be removed without changing the answer. First of all, dividends doesn't matter as both sides of the equation contain the $250 divy term. Next, even if I tried different no. of shares bought at different price, it doesn't change the answer. I changed all the variables to algebra, and confirmed that the calculation remains the same. Without bothering you with the details, here's the much simplified formula:

Price = 5 x (closing price before XA) / 6

Since the closing price is 1.15,

Price = 5 x 1.15/6 = $0.958

Third calculation:

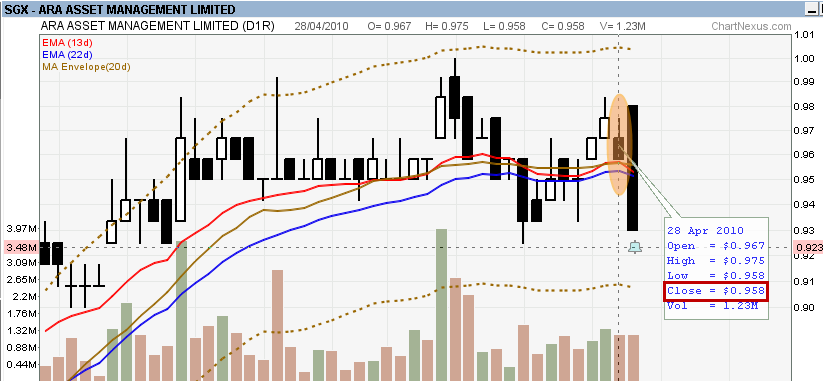

Not really a calculation. It's more like to show you that chartnexus had worked out what I had worked out in the morning. The chart clearly shows that the price before XA, on 28th Apr, had a closing of $0.958 whereas it was 1.15 just the day before the software updated the changes.

|

| The closing price a day before XA clearly shows $0.958 instead of $1.15 |

The theoretical price is definitely different from the closing price. I cannot predict how the price will close and I know that the theoretical price will only be there for a fleeting moment. So, isn't it a waste of time trying to calculate something that only exists for a moment?

Not to me. I take great pleasure in such intellectual masturbation. It's like an unreachable itch behind the back, irritating me until I can solve it :)

16 comments :

Market doesn't trade on theoretical price; otherwise nobody make money. Good mental exercise but beware of such rational reasoning slowly creeping into your market views by doing more such mental exercise. 3M of trading - Mind is one of them.

aiyoh. You said:"I take great pleasure in such intellectual masturbation."

Similarly, if one develops great pleasure in sexual masturbation, sooner or later one is going to develop problems towards natural sex when one gets married. 2M of sex - Mind and Methods.

Try to cut down on masturbation.

Hi LP,

This is why I think giving out bonus shares is really rubbish, fundamentally. I have never been impressed by bonus shares. Shareholders are just taking back their own money.

Basically, EPS, NAV/share and so on would all suffer proportionally. No nett benefit for shareholders.

By increasing the number of shares, it might encourage more trading of its shares and is almost like stock splits in that sense.

Hi bro8888,

If you don't know the theoretical price, you wouldn't know if you lose money or make money after the rights.

It's complicated enough having bought 3 batches of shares, each having dividend, then splitting them up with bonus, and finally the price of all these shares dropping upon XA. I haven't even included the commission.

I'm not doing it for the romantic reasons - it's driven by a practical need to keep records for my transactions.

Regarding masturbation, yea, it makes you blind too.

Hi AK,

Yes, you're totally right. As I worked out the calculations, I realised that it's the same as a stock split, especially since they mentioned that the dividend declared will be maintained after the bonus exercise.

The management already mentioned that the reasons is to increase the liquidity of the shares and to 'reward' shareholders.

I don't see any rewards. Instead, my profits actually dropped after XA because it's trading below the theoretical price. Bummer...

Hi LP,

Exactly. A reader asked me a question about bonus shares as well and I told him I have a very dim opinion of such exercises.

If a company wants to reward its shareholders, a plain vanilla dividend payout would do. Thank you very much. :)

Hi Ak,

Well, a bonus share is to generate hype, if you ask me. There are many who think of shares in terms of quantity - i.e. the more shares I can buy with this amt of money, the better.

To me, it's just like giving you one whole cake vs giving you 10 slices of the same cake but cut into 10 equal parts.

That said, ARA is not too bad a company.

Hi LP,

Haha... Yes, I guess the company cannot say "We are issuing bonus shares to generate hype" ;-p

Yes, ARA is ok. I prefer CMA. :)

Hi LP,

Wrong ah? haha :) I use that when I decide to buy the share after XA. Sometimes, I prefer to get them after X.

Could u help me calculate hsbc? it was 5 rights for 12 shares, @28.. what is the equivalent of hsbc price then of hkd 80 now?

My "cheapo" method is hdk 113.3-6=108

I just bought some a few weeks ago. always buy on high. :(

Cheers,

hh

Hi HH,

I'll try :)Rights is a little different from bonus shares, because you have to pay money for the rights issue.

So if say you bought 12 lots of hsbc at 100, you'll be entitled to 5 lots of rights at 28 each. Price will drop to theoretical value as calculated below:

[($100 x 12) + ($28 x 5)]/(12+5)

=78.82

Now, I'll abstract the solution by putting algebra on the amt of lots:

Let x be the no. of lots bought,

[($100*x) + ($28*(5x/12)]/{(x+(5x/12)}

Simplifying it gives me:

(12/17)*(100 + 35/3) = 78.82

I'll further abstract the solution by putting algebra on the price bought before XR (previously $100):

Let y be the price bought

The formula becomes:

(12/17)*(y + 35/3)

Since you want to know what is the equivalent of hsbc before XR when now it's 80, we just equate the formula to 80,

(12/17)*(y + 35/3)=80

Solving, y = 101.67

That means if you see a price of hsbc now at 80, it's equivalent to the price of 102 before all the rights issue comes in.

http://createwealth8888.blogspot.com/2010/02/bonus-shares-good-news.html

If you are holding this counter and are active in trading this counter, probably it is getting exciting

Hi LP,

That's right.. most rights, like hsbc were introduced to raise capital. And when the rights were mostly taken up, hsbc price went up after X. The trading price for rights were also up drastically. HSBC at $33 was around $33-$6, the average price for the rights.

Thanks for the formula :) I got the same value via trial & error. I will jot down somewhere so that I can easily compare but I suspect, I am comfy with hsbc around this price or lower. I don't know how the bank reform will affect hsbc. I'm waiting to get insurance company from China. Not ex now and not likely to fall much due to super high growth.. but we'll never know :)

Cheers!

hh

Hi LP,

I don't mind bonus issues in a up market, and when the company is a high growth, high cash company. Price trends back up and Bonus shares give me a push to take profit and create pillow stocks.

*Same as rights issues for Kepple and Capitaland. Prices are like prices in 2008 now.. but don't need to worry much as those are pillow stocks already, albeit v small pillow.

As u can see, novice play. No confidence to invest thru due too lack of conviction & confidence. As I read the new book on Yeo Hiap Seng.. I am surer I better invest in super blues or etfs.. even then need to monitor a bit.

Cheers,

hh

Dear LP

Intellectual stimulation is good to keep the brain cells firing.

I just learnt from James Handy "The Age of Unreason", learning = cycle of question, theory, test, reflection :-)

Be well and prosper.

Hi PG,

Hmm, interesting read. I saw that you had a personal growth spurt :) haha, I think I had it a while ago - been reading these kind of books since I cleared almost everything in investing in the library.

These days, I select my books more carefully - no time to read rubbish :)

Hi LP,

when will the ARA bonus shares credited? Just check my CDP account...my bonus shares not in yet.

DS

Hi anonymous,

I do not know the exact dates. They will send a letter to tell you that the shares had been credited to your CDP, if I remembered correctly.

Post a Comment