On my social media feeds, I've been fed this quote a couple of times this week. The first time I read it, it seems pretty logical. In fact that's the thing I told my wife too when she goes on some bulk purchase to save a couple of dollars. The second time I've seen it, I had a nagging feeling that something isn't quite right. So I went to think and analyse deeper into this statement.

Firstly, what is savings? Savings is what's left of your income after spending. Mathematically, the formula is:

Savings = Income - Expenses

Let's just put a number to these items in order to illustrate the situation better. Let's assume the following:

A) Income = $3000

B) Expenses = $2000

C) Savings = $3000 - $2000 = $1000

The above illustrates the base situation where we did not make the purchases. In our base scenario, our savings is $1000.

Let's analyse 3 possible cases:

1) Discretionary purchases (things you can do without)

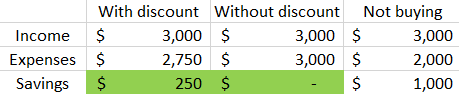

For frivolous and discretionary purchases, we usually compare against the case of not buying it vs buying it. Why? Because we can well do without it. If you spend $750, your expenses increases by $2750, so your savings becomes $3000 - $2750 = $250. Between not buying and having a savings of $1000, vs buying and having a savings of $250, you save lesser by $750.

2) Non-discretionary purchases (things you can't do without)

For non discretionary purchases, we usually compare against the case of buying the item at non-discounted price vs buying at discounted price. If u buy at a non-discounted price of $1000, your expenses increases to $3000. Hence your savings becomes $3000 - $3000 = 0. If you buy at a discounted price of $750, your savings becomes $250. Since it's an item that you have to buy anyway, you save $250 if you buy at this discounted price. Notice that we do not compare against the case of not buying it and having a savings of $1000, because it is a purchase that we must make.

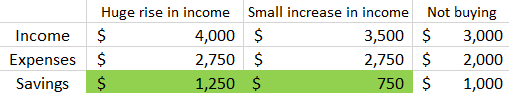

3) Investments (things you buy that increases your income)

For purchases that increases your income, the spending of $750 may result in a rise in future income. If your future income increases by more than the amount spent, you save more even after the purchase. If future income increases less than the amount spent, then net net there will be less savings. So, it depends on the investment returns to see if we save more or we save less or we don't save at all.

It's not so simple now, isn't it? As with all aphorism, the simple statement works as a good soundbite - catchy, memorable and impressive. But it simplifies the truth of the matter too much. There's a lot of details that need to be mentioned.

We can put this analysis to the test by analysing the purchase of a car. If a car is a discretionary purchase, the fall in COE has nothing to do with you. Having the cost of the car dropping from 100k to 80k still means that you have to spend 80k. However, if a car is a decision you are going to make anyway, a drop in the cost of the car is great for you. Now you can make the car purchase at a cheaper price, resulting in a net savings of 20k. Finally, if your car can make you earn more income because it extends your range and reach and allows you to save time and energy, it doesn't mean you should commit to the purchase immediately. The next step is to see if the potential increase in income is worth more than the purchase. Frankly, it need not even be just the increase in income, because we could be looking at other intangible stuff that we cannot put a money value to it. If after weighing all the good against the total cost of the car, and you think it's worth it, then we can go on and make the purchase.

Next time when someone says buying something is not a good purchase, you'll have to ask yourself first : out of the 3 scenarios, which one fits your situation the best?

1 comments :

Hello Everybody,

My name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

Post a Comment