Not too long ago, I received a letter from IRAS that I have to pay for my mandatory contribution to my medisave account as a self employed. It comes up to be $6393. I was mulling through the options that I have, so I might as well share it here since I know there is a dearth of write up just for self employed by self employed.

My situation:

1) I've done voluntary contribution to my CPF for ages, and the reason is to reduce my income tax and also to build a buffer in my OA so that if I have a bad year of income, I can rely on my OA to make payments to my mortgage, which is my biggest expense. And since I've switched to a loan with a floating interest rate, there will be a time when I need to prepay the loan when the interest rate shoots up sky high.

So far, I've saved up about 14 months of full mortgage payment in my OA account. Usually the mortgage payment is split 50-50 with my wife, so this 14 months is full payment for both of us. This means that if both of us are in a tough situation where we don't have income, I can use my OA to pay for the entire mortgage for another 14 months. I'm using a floating interest rate now, and I'm using the figures for the monthly mortgage payment with the assumption that the interest rate increases by another 40%. Should be safe enough but I can do more. Maybe 24 months?

2) Based on my age band, every dollar contributed to CPF will contribute to the accounts in the following ratio:

OA : SA : MA

0.5677 : 0.1891 : 0.2432

Since I need to do mandatory contribution of $6393, if I were to do voluntary contribution to 3 accounts, I will need to contribute $26,287 (6393/0.2432). That is way way too much for me. I don't want to put in so much into the CPF, tax relief or no.

Of course there is another way out for me. I can also do a voluntary contribution direct to MA alone. So since I need to do mandatory contribution of $6393 to MA, I just need to pay $6393 to MA.

In summary, it's a contribution of $6393 direct to MA or a contribution of $26,287 to the 3 CPF accounts. Both have tax relief, if you satisfy certain conditions.

3) It's a bit more complicated than that, because of the conditions for tax relief. I wrote about the conditions and the various types of contribution here.

I didn't do any voluntary contribution direct to MA in tax year 2017. According to the rules, if I didn't do VC to MA alone in last year, and I want to do VC to MA alone for this year, I won't be eligible for tax relief for this particular contribution. I've checked and confirmed with an officer from IRAS and got affirmation that my thinking is correct.

I did, however, done voluntary contribution to the 3 accounts in tax year 2017, hence if I do the same thing in tax year 2018 (that is, this year), I will be eligible for tax relief.

This means that in tax year 2018, I won't get tax relief for doing VC to MA. There will still be tax relief for VC to all 3 accounts.

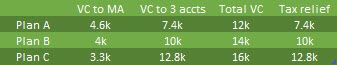

3) Hence I came up with 3 plans. Basically it's a combination of both VC to MA direct (without tax relief) and VC to 3 accounts (with tax relief).

Plan A:

Contribute a total of 12k, of which 4.6k is directly into MA, and 7.4k into the 3 accounts.

Based on 7.4k contribution to the 3 accounts, I'll have 1.8k in my MA (7.4/0.2432). Add this 1.8k to the 4.6k contribution direct to MA, I'll have a total of 6.4k into the MA, which satisfies the mandatory requirement for me.

Plan B:

Contribute a total of 14k, of which 4k is directly into MA, and 10k into the 3 accounts.

Based on 10k contribution to the 3 accounts, I'll have 2.4k in my MA (10/0.2432). Add this 2.4k to the 4k contribution direct to MA, I'll have a total of 6.4k into the MA, which satisfies the mandatory requirement for me.

Plan C:

Contribute a total of 16k, of which 3.3k is directly into MA, and 12.8k into the 3 accounts.

Based on 12.8k contribution to the 3 accounts, I'll have 3.1k in my MA (12.8/0.2432). Add this 3.1k to the 3.3k contribution direct to MA, I'll have a total of 6.4k into the MA, which satisfies the mandatory requirement for me.

It's all summarised in this table below. The tax relief is only for the VC to 3 accounts because I didn't do any VC to MA in tax year 2017 (stupid me).

4) This morning I saw the post by Kyith about 2018 July's Singapore savings bond here. The 9 yr rate already exceeds OA's interest rate of 2.5%. 10 yr rate average interest is at 2.63%...wow. This instrument beats OA's interest rate, yet allows you to withdraw relatively short term (1 month max) compared to the CPF. What more do you want?

So, instead of having the CPF contribution, maybe we can do a plan D:

Contribute a total of 6.4k directly into MA. Then put in whatever amount (likely in the range of 8 to 10k) in the Singapore savings bond to get a return similar, if not better, than the CPF-OA account. There is no tax relief for this plan, but I can treat that as a 'cost' for more flexibility in the usage of my funds without the hard lock in under CPF.

I still have half a year to decide and think through the options, and I bet I'll be coming back to this post around Dec to decide by then.

Saturday, June 02, 2018

Subscribe to:

Post Comments

(

Atom

)

0 comments :

Post a Comment