|

| Comfortdelgro weekly: bullish weekly divergence |

|

| Comfortdelgo daily: break out of down trend line and retracing back to trendline |

Can ComfortDelGro(C52) regain its customers of taxi service?

Brief Background of ComfortDelGro:

ComfortDelGro Corporation Limited is a Singapore-based investment holding and management services company. It operates in eight segments:

1) Bus & bus station

2) Rail

3) Taxi

4) car rental and leasing

5) automotive engineering services

6) inspection and testing service

7) driving centre and

8) insurance broking services and outdoor advertising.

Summary of ComfortDelGro’s recent financial performance:

The group maintains a steady growth of net profit despite a slight revenue decline caused by unfavourable currency translation this year. With the entrance and fierce competition brought by Uber and Grab, ComfortDelGro’s taxi business succeed to keep growing profitability. The five-year lowest P/E ratio indicates it is undervalued in a greater degree by the market. However, ComfortDelGro’s actions and measures towards issue of diesel tax and further competition are vital.

Recent Event: 10 Feb 2017 ComfortDelGro - Full Yearly Results of 2016

Key Financial & Operating Highlights:

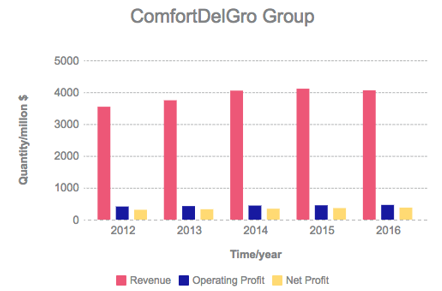

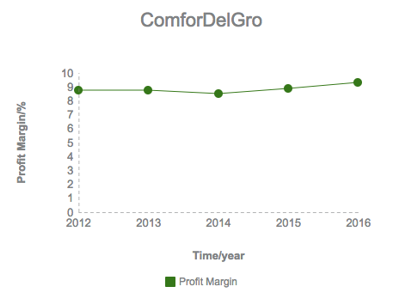

1. ComfortDelGro group had a steady growth of revenue during the period from 2012 to 2015, but experienced a light drop (1.26%) of revenue in 2016, which is mainly caused by unfavourable foreign currency translation, as the Group revenue should have been increased 1.76% by $72.4m. Stable growth of both operating and net revenue can be observed, but the growth rate has been declined after 2014. Also, the group achieved its highest profit margin in 2016.

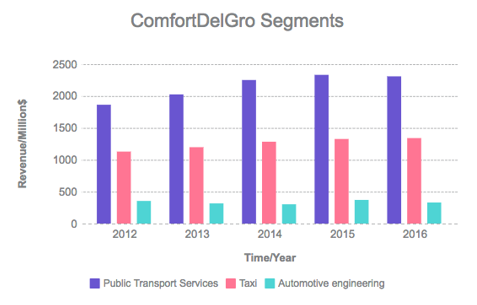

2. From the perspective of segments operation (the eight segments can be found in the previous part of Brief Background), in the financial year of 2016, more than half (57%) of the group revenue was contributed from the segment of Public Transport Services Business. One third (33%) of the group revenue was driven by the segment of Taxi business, which is also the most discussed segment in recent years because of the competition from Uber and Grab. Approximate 10% of their revenue came from the Automotive engineering services.

The chart represents revenue of the three largest segments of ComfortDelGro. According to the chart, revenue of taxi business managed to maintain slow growth under the competitive pressure of Uber and Grab, especially after the aggressive expansion of Uber in early 2015. ComfortDelGro stated in their financial report that the revenue growth in the Public Transport Services Business, Taxi business, and the Driving centre business was offset by the decrease at Automotive engineering services business, the Inspection and Testing Services Business, the Car Rental and Leasing Business and the Bus Station Business.

3. Compared to the number of 31 Dec 2015, the group burdened less secured and unsecured borrowings and less payables. Total equity had a growth of 5.96%. Net cash generated from operating activities edged up to $702.5m from $600.2m at the same period of last year. However, the amount of free cash flow has a small slide of 1%. Overall, the group maintained a stable financial and cash flow position.

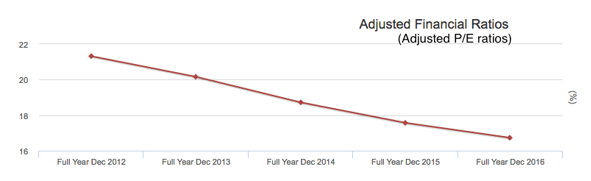

4. Now the group has a P/E ratio of 16.732, lower than that of the Transport industry (33.267), it is also the lowest number observed during the five-year period since 2012. The Earning per share (EPS) is 14.7 cents, with a dividend yield of 4.187%. (source: here)

ComfortDelGro’s Competition with Uber and Grab:

Are entrants of private-hire car threatening the profitability of taxi business?

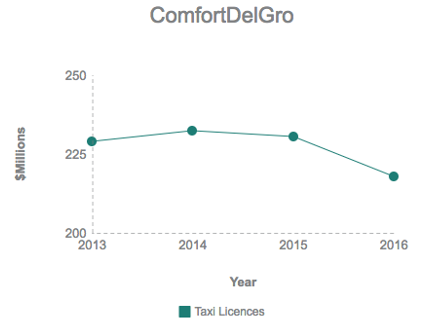

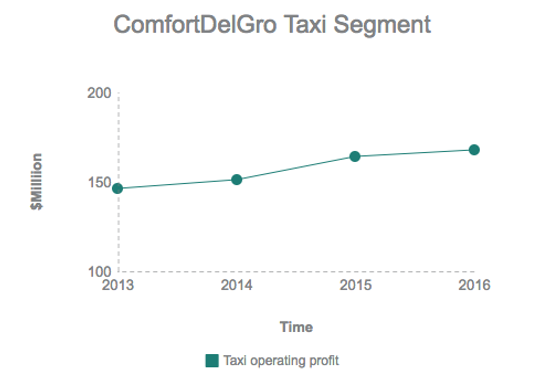

After Uber and Grab entered the market, the amount of taxi licences issued was indeed affected by the rivalry.

“There are early signs of taxi weakness”, refer to the full article here.

For ComfortDelGro, the quantity of taxi licences were prone to fall since 2014.

However, the group presented positive numbers in both revenue and operating profit of Taxi segment during the recent years.

Hence, during the competition with Uber and Grab in the taxi industry, ComfortDelGro neither suffer from decreasing profit nor from loss. The possible reason could be that certain amount of consumers choose Uber/Grab because of the attractive coupons/Promo code they can use for car services. However, under the circumstance of urgency, they still prefer taxis as they do not have the time to schedule rides in advance and do not wish to waste time waiting for the Uber drivers. ComfortDelGro has witnessed improvement in service quality since they started the competition with Uber and Grab.

Is the Business of Uber and Grab sustainable?

Uber and Grab have proved their success by conquering the Singapore market and becoming well aware by people within a short period of time, but still, they face various obstacles with their operations.

1. How long can they allure customers by using promo code?

2. Private hire cars obey the Road Traffic Act (RTA) that they cannot carry a passenger who is under 1.35m without a booster seat or a child restraint. Taxi do not required to follow this Act because they are public vehicles. Related news here.

3. Singapore's private car hire business including Uber and Gran need to be licensed according to the amendments to the Road Traffic Act (RTA) after 7 February. Related news here.

4. Private-hire scam deteriorate customer’s trust. Related news here.

New threat: increasing diesel cost and new competitor HDT singapore

The Budget 2017 of Singapore announced the levy of diesel tax of 10 cents per litre, thus increase the operating cost of taxi business. Though taxi operators adopt plans to pass on tax reduction savings to drivers by less rental fee, the actual cost will increase according to research.

“Budget 2017: SMRT, ComfortDelGro to pass on diesel tax savings to taxi drivers”, to see the full article here.

“Diesel tax will add to costs, say cabbies”, refer to the full article here.

The new competitor HDT taxi company expand their customer base quickly and adopt a fixed salaries with benefit plan. Refer to the full article here.

Trans-Cab and Premier Taxi adopt new plans to attract cabbies

The 2 taxi operators introduce surge pricing (dynamic fares) and cut their rental fee to deal with competitions from Uber/Grab. But ComfortDelGro, as well as SMRT taxi, has not disclosed any intention towards the new plan.

Related news: “2 taxi firms plan to Grab hold of more customers”, shared in the post of @FGD, refer to the news here.

“Trans-Cab cuts rental fees in bid to attract cabbies” here.

What's the discussion in our community?

“Ever-increasing challenges for Uber’s profitability”, shared by @alansmith in the post of https://www.investingnote.com/posts/47910

“Cab operators urged to offer driver more job options”, shared by @bgting in the post of :https://www.investingnote.com/posts/47721

@yjlim queried the opinion that Uber/Grab threat the business of ComfortDelGro in Taxi business, to see further discussion and share you opinion in the post :https://www.investingnote.com/posts/46795

@raynersu held the opinion that ComfortDelGro group did not make enough effort in updating their strategy for the latest market trend but rather stay out-of-fashion, while their peer Taxi operators keep improving and acquiring larger share of market gradually. Refer to more discussion in the post:

https://www.investingnote.com/posts/48547

Our Key Takeaway:

ComfortDelGro performed well under the fierce competition with private hire services and new entrants in Taxi business. Under the circumstance that Uber or Grab maintain their operating strategy, ComfortDelGro group has a great chance to gradually gain their customers in Taxi services back. However, facing with declining growth of revenue, ComfortDelGro group has to carry out appropriate measures to deal with rising diesel cost and make greater efforts on cost reduction. Additionally, ComfortDelGro’s movement towards the latest plan promoted by Trans-Cab and Premier Taxi is vital.

For ComfortDelGro, and also for the taxi industry, it is the right time to have an innovation now.

Also check out some estimations:

@Breaddbutter: https://www.investingnote.com/posts/44331

@simontan0: https://www.investingnote.com/posts/47904

@Lunner: https://www.investingnote.com/posts/47895

@hk1: https://www.investingnote.com/posts/47859

@thatsasecret: https://www.investingnote.com/posts/47204

@chinnamng: https://www.investingnote.com/posts/46630

6 comments :

Excellent analysis! I have always enjoyed your views.

Thanks for sharing your insights & useful links!

rarely take taxi (even uber / grab) but interesting to know what happening of late

may i know if investors have / should have some kind of "stop loss" like trading?

Hi Adeline,

Thanks, though the credit is not wholly mine haha :) It's a guest post, and I only contributed the 2 charts you see on the top LOL

Hi simplefolk,

Stop loss is more for traders but I think investors can have stop losses too. I know a seasoned investor who said he will not tolerate 20% downside for his position. And that's after buying at a sizable margin of safety. But the point is that there will be a end point where you say, shit, my analysis just might be wrong.

I've seen him cut loss before though, at a profit mind you, because the thesis that he based on is no longer valid. You can say that his stop loss is based on deterioration of business fundamentals, while stop loss is more on deterioration of price.

But I'm not an authority on this. Even though I'm more like a trader, I don't do stop losses too.

Hi LP

Thanks for sharing your thoughts

>> I've seen him cut loss before though, at a profit mind you

i think traders called this protective stop, not stop loss

that's probably why i'm still not comfortable with value/FA investing :(

perhaps i should do a small position on STI ETF investing as FA not my forte

Very thorough and informative article related to Automative Services! Thank you for sharing this information.

Lorry For Rent

Post a Comment