The first post of Bullythebear is dated at 4th Dec 2006. Today is 8th Jan 2017, which means that 10 years 1 month and 4 days had passed since my very first posting here. I thought it's a good time to think and reflect about the long journey of me writing this blog and all the readers reading it.So here's the blog post that summarises my journey in Bullythebear so far.

Statistics

1. I made a total of 1,203 (excluding this) over the entire lifespan of the blog. That's about 10 post per month on average. I progressively posted less and less articles over the years. The most active years is back in 2008 with a total of 348 posts, which averaged about 30 posts per month, or 1 every day!

2. Here are the all time most viewed posts:

a. Aspial 5.25% bond - good buy or goodbye? - 19,408 pageviews

b. Hyflux 6% perpetual securities - 18,167 pageviews

c. Aspial 5.30% bond (AGAIN) - good buy or goodbye? - 14,451 pageviews

d. Perennial Real Estate 4.65% bond - good buy or goodbye? - 13,085 pageviews

e. Oxley 5% bond - good buy or goodbye? - 9,599 pageviews

It seems like my most viewed posts are all fixed income securities! I'm the James 'Bond' of the blogosphere? lol

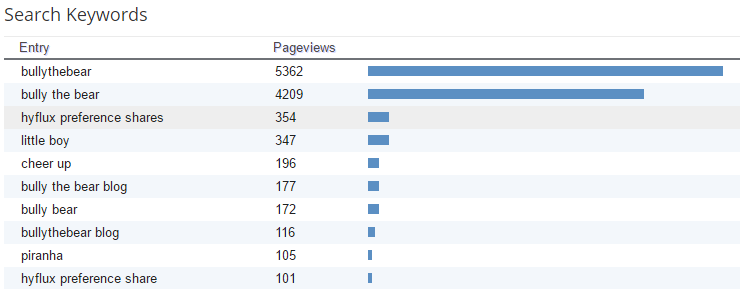

3. Most of the search keywords to get to my blog is through the following:

Bullythebear must be quite a trademark for my blog :)

Reflections

1,203 posts over 10 years involves a lot of my life energy. If each post needs 1 hr (bloggers should know it takes longer than this in general), I've spent 1,203 hours already. I think it's not weird to say that this blog is part of my growing up, maturing and evolving process. Each year is like the chapters of a book, with an appropriate title to reflect the underlying theme of that year. Let's have a look:

2006: The birth of the warrant price

This is where it all begins. Unfortunately it wasn't a good start to begin my investment journey. I started on warrant trading. "Trading" is too good a word to use here, since I don't know any technical skills by then. It's just rumor mongering, hoping and mostly just whacking. Almost all the posts here are about my warrant trading. It's not a good start, but it's still my past. I like to think that it continues to guide me in my decisions and choices now. There's a few interesting ones, like the first announcement of the Integrated resort (IR) here. Some of the younger folks had been born with the IR already built! I still remembered the intense debate over this thorny issues, and how it's going to impact the financial market, especially with regards to Genting stock price.

2007: Death of the prince heralding the dark ages

As I read more about warrants, and realized I know next to nothing, I eventually stopped doing it. Luckily it didn't wipe off my accounts (in fact, I made a small profit). On hindsight, that should be a sign that I should be stop punting, because if a newbie like me who knows no TA can make money by trading warrants, who the hell is going to buy up the market next? STI went up to 3665 as I blogged about it here, and I think after 10 years or so, STI still haven't reached that maniac level yet. I participated in my first rights issue this year (Pac Andes) and bought quite a lot of construction stocks because it's fashionable to do so. Lian Beng, Yongnam, CSC etc, I have it all. This year is also the year I cut losses on Longcheer after averaging again and again. I went into depression for a month. Work brought me out of the dark gloomy days. On hindsight again, it was one of the best periods of my life. It realigned my values and priorities so that I can have a much better attitude in life now. Everyone should have controlled depression once in their life.

2008: China milk soured, Ferrochina rusted and Hongguo hong kan-ed.

I started dabbling into value investing, at least my version of it. I spent the next few years reading intensely about accounting and all the various classics of investing. I thought I know a lot and I invested in s-shares like china milk and hongguo (I have a lot of post on the fundamentals of it, eventually it was taken private at a slight loss to me). Ferrochina killed a lot of people too but thankfully I wasn't in it. I sold a lot of my construction stocks when I realised there are cyclical in nature. I think this year and the last I trimmed a lot of nonsense in my portfolio. I was so into investing that I compared my discipline of engineering with the concept of margin of safety in this luminous post here. Looking back now, I feel like a headless chicken going everywhere the crowd is going. If investing is the right way to go, I'll go there too.

2009: Self discovery

I realised that investing is not for me. I could never have the depth of understanding with regards to accounting and investing as others, nor do I have the interest. Instead of following what others are telling me is the right thing to do, I discovered what my strengths are and what my weakness are. I started leaning less on investing and more towards technical charting again. In this post, I talked about how the pull of investing and TA made me go towards a zone where things are not so grey. More hybrid and dual class rather than single class. My philosophy towards the market gets clearer from that post onward. After a series of setbacks, I also started to rethink about the ambitious goal of setting 15% returns per year. I blogged about it here. I chuckled when I see some of the younger red-blooded bloggers wanted to reach this 15% pa goal, and I think whether they would also, in the future, change their stance. We shall see :) On a personal finance side, I think this year is the watershed year where I started on my 50k savings challenge. It started from here and I blogged about it here after I've completed it. I'm a lot more pig headed on my 50k savings challenge back then, with all the bravado "Whatever it takes, for as long as it takes". I smiled broadly when I read that post. Oh, if only the youthful me knows what I know now , haha

2010: When two becomes one

This is the year I got married. I had wanted to do something sweet for that special day and I chronicled it here. I was stressed up with the whole thing, and also had to relook at some of the values and principles that had brought me thus far. I shared this interesting post regarding the burden of supporting one's family. Kids? I also thought deeply about that issue, especially after seeing so many people having kids but not knowing why I wanted to have one. This issue is especially relevant since our new family member is coming very soon now. I blogged about my concerns here and I think I will get back to that question to answer it from another perspective. Wait for it :) There's a post that I will likely not forget too- it's so bad that my readers and close friends starting messaging me asking if I'm well. It's this post that started it all. On an interesting note, Sabana and GLP IPO this very year. After nearly 6 to 7 years, Sabana had gone down the drain and GLP huat until no horse run. As the running joke goes, when you invest, make sure you buy only companies that goes up. If only we knew in advance!

2011: The march towards financial independence

This is the year that I started reading heavily on financial independence. I guess I've sorted out the investment philosophy (blogged about it here) by trying out both investing and trading, hence it's time to move towards the bigger picture of the 'why' in investing. I saw a paper trade of Singtel here, and the price was 3.05 thereabouts. I've set a target price of 3.19, so even if I had made the trade and made the profit, it's not going to play a big part towards my financial status. They key is in the longer term, bigger percentage gains over a long period, which is what investing should be about. But even so, unless I invested a huge chunk of my networth in it, it ultimately wouldn't affect me much too. The one thing that can affect my financial status is really just plain ol' work. That is an important realisation after so many years of trying to fight with others in the market. On the global scope, this year is where there is such a major earthquake in Japan that the nuclear plant suffered meltdown. This is not the only that that melted down; Nikkei responded by melting down 10.5% as well. See it here.

2012: Deep inside the rabbit hole

This year I hit a rough patch in blogging, and throughout the year, I only managed a total of 24 post, which is about 2 a month. I blogged about how the local pool of bloggers started dropping one by one, and I wondered if this post is going to be my swan song as well. I got really sick of my 50k challenge as well, because suddenly I don't have a reason to save anymore. That was about the time I moved into my new home, had very little work and suffered some business losses. Goodness, if I can go back in time to tell the past me, I'll tell him that good times are going to come soon, just bear with it! This year is the year where I explored my existence and wondered why I am doing what I am doing.

2013: The phoenix re-born

I broke through the rough patch in year 2012. This year I started investing for my parent's retirement funds. They initially just wanted to put in a fixed deposit, but I'm sure I can give better returns than that, hence I gave them a guarantee on their capital and also guaranteed their minimum returns. This is also known as LP's bond, and I chronicled many posts in the blog, starting from this. In the process of finding out about the allocation of their portfolio, I investigated deeply into STI here and found out that among other things, the probability of losing if you invest over 14 yrs is really really low. The average return is 8.8% pa, with median of 6.6% but with a sd of 29.1%, so that result might not mean much. I blogged about death and dying here and how my wife should act if I'm gone suddenly. This happened after lunch in a subway outlet. We might be great at investing, but our spouse might not be, so it's important to make things as simple and as stress free for them as possible. I started having a reason to save up again, and had wanted to save 30k at first (I didn't hit it, I saved $25k). I shifted a new paradigm and model of work, where students come over to my home for lessons instead of me going over. I had no idea how it will be received by them. It was a year of trepidation and anxeity, but also a great sense of peace and calm over because I know had a very good idea that I really like my work. Every time I have an existential crisis, I come out stronger and surer than before. A phoenix dies and is reborn from the ashes. On a personal finance note, I started using YNAB (you need a budget) to sync my expenses tracking with mobile and desktop easily. Never looked back to my trusty spreadsheet since.

2014: The fire of the phoenix burns brighter

After 2 years of in the dump for my work, I started getting the right mix of students who are willing to come over to my place for work. Because I don't have to travel, I can squeeze in more work hours and my income and savings exploded exponentially from this year onwards. I started kungfucatsacademy (blogged about it here) and even have a service standard for my tuition lessons (here). This whole exercise of starting a website for my tuition services makes me think and clarify the kind of work that I want to do. I started having fun with blogging again, and wrote a new series called short stories, where I wrote poems, short stories and lyrics to write about my thoughts and feelings. The first of which is a short story called An Empty House. After my clarity in my investment philosophy and the new found clarity in my tuition, I began to dream again. I set up near term plans and goals here, and even up to now, I'm still working on them. This year I broke my 50k savings goal and saved 68k,while skipping to work with a playful smile.

2015: Channeling the mana

Started on spiritual journey and challenged myself to 100 days of meditation here. I began reading about all sorts of mantra and religious texts to discover the spiritual side of me, something that I've not explored till this far. It start off a series of exercises that began with meditation, eating healthily and intermittent fasting. What an amazing journey, and I must thank our founding father LKY for introducing meditation to me in his interviews. This year is also the year where many retail bonds started listing in the market, like Aspial, Oxley and fraser centrepoint ltd. Most of the post I've blogged about them ended being the most read posts in my blog, so there's immense interest in them. I must re-share this poem about realizing the value of our time here. Do you know what's the value of one year, of one month, of one hour, of one minute, of one second and one millisecond? Read it to find out.

2016: When two becomes three

I closed off the first tranche of my parents's investing, called LP bond that I started in 2013. I blogged about the returns here. I also updated my goals and streamlined the process in which my savings are chanelled to. I still haven't resolved the issue of what to do with my savings - to invest or to pay off housing debt, but at least I'm doing something that hedges both. You can read it here. I discovered Investingnote (here) and it changed how I handle my charting homework that I do almost every week. I'm still amazed at the kind of things that is shared over there and I'm glad I can learn a few tricks here and there shared by the generous bunch of folks there. For the very first time, I also shared my method of counter-trend trading here. I realised that most traders are trend followers and counter trend is about as different to trend trending as trading is to investing. This year is also the last year where me and my wife is going to spend Christmas together as a couple :)

Conclusions

I think not a lot of bloggers can boast having written a reflection post after a decade long period of blogging, haha! There is so much more that is left unsaid, and this is just a copy of a copy of a copy. While bullythebear is always here, my cbox had always been around. There are regulars in the cbox whom I've met and become friends through our various meals together at Beng Hiang, some of whom even attended my wedding. While some had come and gone, at least the memories of having fun together still stays in my mind. Thank you to all the readers, some of whom have gone on to start their own blogs, to all the cbox regulars and irregulars, even to the troll who really hate me but still loves to comment, thank you all for adding colour and texture to my life.

May there be more 10 years to come!

Trying to Make Sense of DBS’s 18% Return on Equity

12 hours ago

12 comments :

This also means that I linked up your blog for 10 years too. LOL!

Hi bro8888,

Yes! I still rmb the long Beng Hiang lunches where we queued up to give each other treats! What, 10 years already?

LP,

Wow!

Talk about the Mother of all Reflections!

LOL!

Idiot! After so long only now I know you are into counter-trend trading.

So you are the one who made the life of Trend Followers like me difficult...

Please don't block my way OK?

Hot water! Shio zhui! Shiam!

Let's see we can have another 10 years of blogging together!

Have fun!

(P.S. You poke at the 15%... Wait you don't get invited for the free dinners! Next time say 16%. LOL!)

Hey LP, congratulations on your blog's "tin anniversary". Here's to more good years ahead! Cheers!

The next 10 would be fun with your boy (and maybe a few more over the next few years) coming into your family! :D

I bought Hongguo after reading your analysis and made a significant profit when it was privatized. I felt a sense of miscarriage of justice to know that you suffer a slight loss....

Anyway, congratulations on 10th Anniversary! Keep up the good work. Really enjoy your "first principle" look at many issues.

ts

Hi SMOL,

We trading different things, don't think will meet :) Haha, let's see if we have another 10 years of blogging to look back at this post and poke fun of ourselves :)

Hi Fuzzyview,

Haha, still have 'tin' anniversary one ah? :) I think the next 10 yrs will be very very different from the last 10 yrs. As long as each year forward is as happy as the last one, it'll be great :)

And we'll see after the first boy is out :)

Hi ts,

Oh wow, i didn't know someone actually followed my post and bought haha :) In the stock market, there's no adv to being the first to move, haha! Great that you made good money, and I'll see you around my blog :)

I was looking at my posts for the past 3 years too LP!

In fact, I had wanted to blog about it, but didn't. You post views made me jealous LOL.

But surprise surprise ...

I always thought financial post will be moe popular. My top 3 posts are 2 from random thought series And 1 from 随心笔,written in Chinese.

Lol. My Chinese posts while always slow in gathering views but tend to "survive much longer"

Hi SI,

You should blog about it :) At least you have one reader from me haha

Interesting thing hor? I'm a personal finance blogger, but my post on savings and all the self employed hacks are not popular. It's funny how we see ourselves as one thing but the general perception by others can be quite off.

Your chinese posts are the tortoise kind - slow and steady :)

Hi LP,

Amazing journey in blogging. Kudos.

Congrats to the new addition. Another new phase awaits and I rejoice with you.

Read through some of your old posts, and can really see how much you progresses positively. The writing style changes and most importantly, the thinking matured, wisdom blossomed and character strengthened!

All the best in 2017.

Hi Rolf,

Thanks for your encouragement :) Haha, must learn from you since you're an experienced dad :)

I don't hope for no problems or mistakes, but I rather the courage and wisdom to overcome all these and emerge stronger!

Post a Comment