I think the official figures might not mean much to you, because it depends on the price of a basket of goods that may or may not be relevant to you. Hence, the concept of personal inflation rate is much more relevant and customised for individual's taste and consumption patterns. To get a good proxy of my own personal inflation rate, I thought that we can compare how my expenses rose over the years. It's not the best way to calculate it, but it's fairly good approximation.

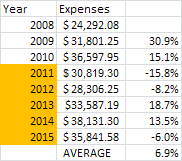

I had my first track record of my expenses back in 2008. Back then, I wanted to try tracking in detail for 1 month, or at most 2 months. But before long, 8 years had passed and I have a full record of my expenses from 2008 to 2015. Everything is included here, including parent's allowance, mortgage, daily expenses, etc. Here it is:

|

| For 2015, I annualised the expenses plus another x amt to approximate the usually more spending that occurs towards the end of the year |

I highlighted 2011 to 2015 because that's the years in which I shifted from living in my parent's house to my own home with my wife. There's a huge jump in my expenses because there are a few financial bombs that exploded over that particular period between 2008 to 2010. There's a wedding (small bomb), there's a COV and renovation of flat, plus a first down payment (big big bomb) and there's a down payment for a second hand car (small bomb). All in all, the expenses are fairly huge but unlikely to occur again.

Thus, from 2008 to 2015, my expenses increases by an average of 6.9%. To remove the one-off cost of getting a flat and renovation, I also looked at the average increase from year 2011 to 2015, and it worked out to be 0.4%. How about CAGR? From 2008 to 2015, my CAGR is 5.71% pa, and from 2011 to 2015, my CAGR is 3.85% pa.

I think for all purposes in planning, I should use an inflation rate of 4% pa until I have more stable data of my expenses. No hurry.

16 comments :

You're at a very volatile stage given all the heavy expense items involved. Wedding, housing, and perhaps kids? The numbers are probably going to be huge.

In addition, as pay increases, lifestyle inflation is going to set in. Conversely, at retirement, I wonder if lifestyle inflation will still persist or go into reversal?

Hi Lizardo,

That's a very important question. I think there's a lot of factors at work. Health is one big factor. If you're healthy, you might be able to enjoy life a little more and spend more too. If you're stuck in bed or relatively immobile, there'll be less expenses. On the other hand, there could be more spending on health related expenses as well. Really hard to know in advance.

Given my engineering training, it's better to over design a bridge than not ;)

Hi LP

Your expenses, including mortgage and car expenses, look healthy.

There are always reasons for "one-time cost". It is also a discipline to curb "one-time cost" and it is do-able.

Your income (guesstimate based on your annual saving rate) vs expenses look very healthy. Life is short, stay wild. haha.

Hi LP,

Interesting take. After recording expenses for close to two years on the blog, I am wondering if it's meaningful for me to calculate an inflation rate for my expenses.

I believe I am at a stage where things are still very dynamic and the number might not be very useful for future calibrations.

Hi fd,

Haha, thanks :) I'm definitely not looking to cutting expenses. I'm past that phase. Whatever money that I'm spending is more or less aligned with what I want, so I'm efficient in spending - no unwanted spending and no regrets also.

Don't look too much into my income. It varies widely. I've very income season these few years, which means perhaps a bad one is coming. Ah.. I'll take everything in stride.

Hi 15hww,

Probably not very useful. Still interesting to find out though haha! It'll be interesting to see the inflation rate at different stages of your life. Good for life stage planning.

Hi LP

I sense better years are coming for your career. This is just a warm up. It could be 6-digit saving rate per year soon.

At times, I asked my wife and I whether we are too frugal, but the replies I gotten from myself and my wife are usually what you have shared - we are leading our dream lifestyle and what we are spending is more or less aligned with what we want and we are efficient in our money management on expenses. Don't think there is any regrets too on my side.

Hi LP,

It seems reasonable and I am really guilty of my expenses which has been exponential over the years. Maybe because me and my wife keep adding extra mouths to the house every now and then. We have now 5 mouths to feed, car and house.

I have been trying to cut my expenses but it seems very difficult. Hence I come up with a solution!

My salary growth has been pretty stagnant over the years. So I educated my wife to work smarter and manage her boss and colleagues more efficiently. This is so that her salary can increase more p.a. to contribute more to the house.

In this way, my personal expenses can be reduce! Haha

good gauge of 4%. generally there should be an addition of a couple of % over the base inflation rate to take it as the yearly rate.

as you think about it, you will understand why.

for singles like smol and ak, perhaps they wouldn't need to or can use a lower additional percentage.

interestingly, as the interest rates have bounced off the historically low, we need to ask ourselves whether inflation will follow. Two generations have passed, not knowing the scenario of high inflation much less stagflation.

it is worrisome.

http://www.mas.gov.sg/~/media/manual%20migration/Economics%20Explorer%20Series/explorer3.pdf

Hi FD,

I think my work is kind of like feast or famine. While I'm not looking forward to having a down year, I think it'll come and I better be prepared for it. I'll spend the time doing the things that I wish to do but had little time (I actually have such a list) and will spend a good part of the time relaxing and preparing for the next upturn!

I think I hit about the max that I can save already. It's just the right balance for me right now :)

Hi Rolf,

I like your idea! It's a team work afterall and I really like the fact that you're growing the income of your team. Good for everyone! :)

Hi SMK,

I've not faced high inflation before, really. Not sure how I will handle it too...The point in me doing the personal inflation rate is so that I can monitor whether there's lifestyle inflation. I mean, there definitely is, but whether it's excessive. So far, my income growth is higher than my personal inflation rate, so I guess overall it'll work well for me.

What I'm afraid is when the income rises slower than the personal inflation rate...that'll be a red flag for me. I guess I'll know when I progressively find it harder and harder to save, lol

Thks for the link, will read it. Informative :)

My reaction to this post is the very first one.

compare parking price gatwick

Thank you for sharing such a important information with us.

luton airport valet parking

Thank you for sharing such information with us.

accounting firm in London

The point is doing the personal inflation rate , so that I can monitor whether there's lifestyle inflation.

Airport Parking Luton

Post a Comment