Aspial, the group that is better known for the brands under the group: Lee Hwa jewellery, Gold heart, Citigems, as well as the pawnshop that litters all over neighborhoods in Singapore like a blue plague - Maxicash. They are offering a retail bond, one of the rare ones in Singapore, at an interest rate of 5.25% per year.

The question on my mind is whether this is a good buy.

Bonds being bonds, are capital guaranteed upon maturity. But the guarantee of a bond is only as good as the solvency of the company issuing the bond. And we really just need it to last 5 yrs until the maturity of the bond in order for the bond investors to get their capital back.

I have such a hard time looking for annual reports at their main website that I have to resort to SGX's site for their financial information. There's even a missing file in their link for the annual report, tsk tsk. Usually I like to take my info first hand from annual reports, so this is quite an exception. Still, I must commend SGX's revamped site. It's quite useful to learn about a company in a very short time.

Here's the chart showing their debts and various ratios relating to debt:

Good or bad?

Their debts are just mounting year after year. But increase in debts is okay if their debts are just a small portion of their assets. Just how much of their total assets consists of debts (both long and short term)? In FY2011, it was 72%. Then progressively in FY2012, it went up to 76%, then FY2013 was 74% and finally FY2014 was 77.5%. So that's about 3/4 of their total assets. Okay, that's still alright, because perhaps that's how their business model is based on. Different industry have different debt levels to run smoothly and I'm certainly not an expert in deciding what the right level of debt is for their business to run. Debt can be a good thing in the right hands.

But can they pay their debts from the income and cashflow generated from their business?

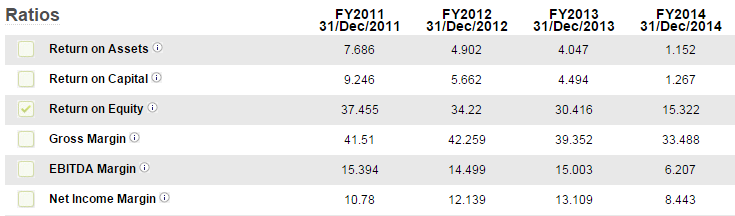

Total revenue is kind of stable, but their net income isn't coming in as well. All their earnings ratio, returns ratio are dropping, as shown below:

Okay, drop in net income is still okay as long as their cash that it brings in is enough to pay upkeep the cash burn. So, do they generate enough cash in their business?

Cash flow from operation is just negative. It seems like most of the cash flow comes from financing, and that part of the cash flow contributes enough to have the net change in cash as positive. Verdict? Debts is their way of financing their business, which isn't generating enough cash flow from their business operations and they have to progressively borrow more to upkeep their cash burn.

This is not a good company to buy, if you ask me. The bonds, however, might be a different matter altogether.

Can they survive for 5 yrs? Likely, as long as they can continue to borrow money. Or if the banks are reluctant to offer them more cashline, they can resort to another one of these retail bonds, likely at higher interest rate in the near future when their cash runs dry. They probably won't die within 5 yrs, and might even enjoy a revival of sorts in their pawnshop business if the economy downturn comes in the near future.

I wouldn't let my parents get any of these though, because there's always a risk of default in bond in this unrated debt that they are offering. It's on a whole different level from the FCL bond that is offered to retail earlier this year at 3.65 %. Since the min bid is $2k, I might get in for a small amount, maybe 2k to 3k, which is only a tiny percentage of my portfolio.

Nothing more, and definitely, no show hand in this bond. Application had started already, and will end on noon Aug 26th, with DBS as the sole bookrunner. Trading of bonds will start on 31st Aug and investors will be paid semi annually on Feb 28th and Aug 28th every year, until 2020. News just came in that Aspial had re-allocated $25 million in bonds offered to the public to its placement to institutions. So now, the public tranche is $25 million, down from $50 million.

Thursday, August 20, 2015

Subscribe to:

Post Comments

(

Atom

)

17 comments :

FCL bond has dropped back to $1. You can buy as much as you want on the open market.

Hi K,

Haha, there are better buy out there now than the bonds ;)

LP,

Thanks for the analysis. I have a more simplistic way of looking at it. It means chances are high that if Aspiral is to raise the same amount and tenor from banks, he will not get a better deal.

That itself doesn't give me confident

Hi SI,

Haha, you may be right :) Anyway, ultimately I decided not to get any. It seems like there's a lot more bargains out there than the bonds now. Shall fish for more blue cheaps instead lol

Hi LP,

Too many bluechips, which one?

Seldom hear LP blogged about which chips to buy? Is there a reason why?

:-)

Time to buy FCL now?

Hi,

I'm new to bond and stocks...

Would like to ask to if I want to get the Aspial bonds during the retail offer, do I have to have a CDP account or I can set up one after getting the bonds?

Thanks.

Rolf,

Haha, a bit late to reply..but you should have known about the big selldown recently. There's a lot of blue black cheaps that looks good to accumulate. Will do up a post soon about it - more for my own reference

K,

Nah, don't think it's time to buy any bonds now. It should be a better time to buy equities, esp those blue cheaps at reit like yields.

Hi Newwen,

You need to have an CDP account ready before you can get this. You should set it up now, though it's too late for this issue. Setting up an account might takes some weeks.

Somehow, it is a mixture of both.

gatwick airport parking deals

At some places, the ratio is going towards good buy.

luton airport parking meet and greet

Thank you for sharing your experience of staying and living in the Paris.

accountants London

Growing business is wish to everyone. Now start your business with Mobit parking Services.

Cheap Airport Parking Manchester

Ezybook's seamless Meet and Greet Heathrow service takes the stress out of travel, allowing you to focus on enjoying the BULLy the BEAR experience in the UK. Effortless parking solutions that complement your journey with convenience and ease!

Post a Comment