Despite being in the market for like 4-5 years, I've never played any IPO before. I used the word 'play' because since all IPOs are described in the prospectus as the best company ever listed, and there are no history of any price to do any TA, the only way to make a buck is to punt and to speculate. I applied for the Global Logistic Prop Limited (known as GLP) and got myself 1 lot. Actually it's half a lot because I shared with my father, who don't have any account with CDP, hence he can't apply it.

The IPO price was top of the range at $1.96 per share, but there's a pedigree name behind it - GIC. Since Ah gong is giving us money in the market, I say we take it. I believe many others are thinking along the same line too, so just whack and see how many lots we'll get. At least for GLP, the retail tranche is much bigger than MIT, so for those who applied, most will get at least 1 lot. Nothing much but better than nothing. On the other hand, I've not heard of anyone who got MIT. I applied for around 30 lots but got back nothing.

I eventually sold it at 2.17 very early in the morning, about a few minutes after 9am. I had studied the past IPO performance and decided before debut trading that this is unlike the pennies IPO (around 20cts to 40 cts range). Those have around 20-30% gains on the first day before sliding down. GLP should be around the performance level of Tiger airways (IPO price 1.50, highest of the debut trading is 1.60), which is around 6-7%. Taking 7% of the IPO price of GLP, I get around 2.10, so that's my target price.

I woke up early in the morning at 830am to prepare myself to sell it off and was surprised to see that there are many married deals (marked with x next to the transactions) even before market opens. The married deals are around the range of 2.10 to 2.15 so I knew it must be a hot IPO. Since the opening price is already above my target price, I just queued at the next bid at 2.17. Within seconds, I got my order filled and I'm out of the game.

All in all, it was quite an interesting experience since I've never had an IPO before. I got 9.19% after all commission charges and application fee and taken into account, which is not a bad deal even though I got only $90 out of it (half of which is shared by my father). The price can continue to go up, but it doesn't affect me because I'm happy to exit at a price higher than my target price. This kind of punting game wouldn't make me richer nor poorer, so it's best not to think too much about it.

I think I've enough of IPO for now, since I didn't get any MIT. There are a few more IPOs coming up, and no doubt they will be hot. But I don't think I'll subscribe to them. Let others take the thrill. Interesting, there's no seller's remorse nor buyer's 'high' after this IPO. It's just slightly irritating because I've to wake up earlier than normal to watch prices tick on the market so that I can sell. I think I've changed a lot since I started this stock market thingy.

The IPO price was top of the range at $1.96 per share, but there's a pedigree name behind it - GIC. Since Ah gong is giving us money in the market, I say we take it. I believe many others are thinking along the same line too, so just whack and see how many lots we'll get. At least for GLP, the retail tranche is much bigger than MIT, so for those who applied, most will get at least 1 lot. Nothing much but better than nothing. On the other hand, I've not heard of anyone who got MIT. I applied for around 30 lots but got back nothing.

I eventually sold it at 2.17 very early in the morning, about a few minutes after 9am. I had studied the past IPO performance and decided before debut trading that this is unlike the pennies IPO (around 20cts to 40 cts range). Those have around 20-30% gains on the first day before sliding down. GLP should be around the performance level of Tiger airways (IPO price 1.50, highest of the debut trading is 1.60), which is around 6-7%. Taking 7% of the IPO price of GLP, I get around 2.10, so that's my target price.

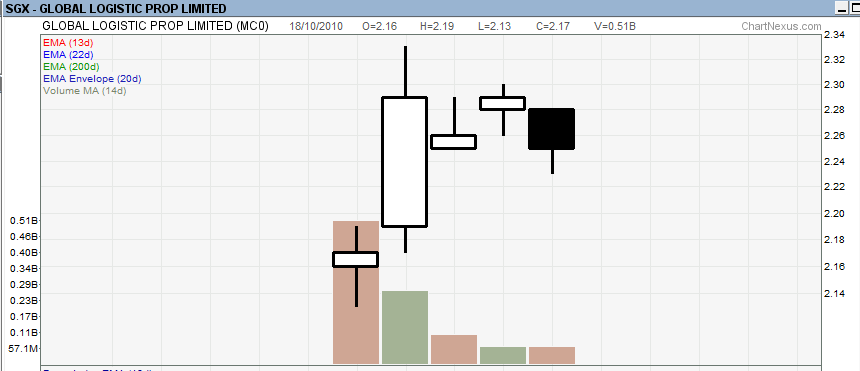

|

| Price of GLP for the last 5 days |

I woke up early in the morning at 830am to prepare myself to sell it off and was surprised to see that there are many married deals (marked with x next to the transactions) even before market opens. The married deals are around the range of 2.10 to 2.15 so I knew it must be a hot IPO. Since the opening price is already above my target price, I just queued at the next bid at 2.17. Within seconds, I got my order filled and I'm out of the game.

All in all, it was quite an interesting experience since I've never had an IPO before. I got 9.19% after all commission charges and application fee and taken into account, which is not a bad deal even though I got only $90 out of it (half of which is shared by my father). The price can continue to go up, but it doesn't affect me because I'm happy to exit at a price higher than my target price. This kind of punting game wouldn't make me richer nor poorer, so it's best not to think too much about it.

I think I've enough of IPO for now, since I didn't get any MIT. There are a few more IPOs coming up, and no doubt they will be hot. But I don't think I'll subscribe to them. Let others take the thrill. Interesting, there's no seller's remorse nor buyer's 'high' after this IPO. It's just slightly irritating because I've to wake up earlier than normal to watch prices tick on the market so that I can sell. I think I've changed a lot since I started this stock market thingy.