A few things to point out:

A few things to point out:1. I do not know the business of Kingsmen Creatives as intimately as him, as such, I'm approaching it with the curiosity of a quant. I'm just interested to see how the figures tally. Since I'm did not do a comprehensive research on Kingsmen, the figures I put into my calculation might be a case of GIGO - garbage in garbage out. DO NOT use the figures as an anchor for the intrinsic value, without doing more extensive research yourself.

2. All my calculations are based on the following assumptions:

a. I assume that the diluted EPS for FY08 is 7 cts. While 1H08 EPS is 2.85 cts, it possible to reach this full year EPS of 7 cts because Cheng mentioned that the second half is the stronger half of the financial year.

b. I assume that the EPS will grow at various rate, namely 10%, 15% and 20%. The CAGR of EPS is 45% from 2003 to 2007. The most recent EPS growth (from 2006 to 2007) is 61.3%. I do not expect Kingsmen to keep growing at the phenomenal rate of anyway near 40% or 60%, hence I’m more comfortable to use an EPS growth of at most 15%. When unsure, it’s best to not to be too optimistic.

c. My investment horizon is 10 years, hence I will discount the earnings up to 10 years. I assume that the company will fold over then, hence it will have no terminal or perpetuity value. This serves as an underestimate of the worth, as a great bulk of the intrinsic value comes from the terminal value (assuming that the company continues growing in perpetuity).

d. Interest rate is taken as 4%. I prefer using a range from 4% to 8% with the lower limit as the long term (10yrs) SGD Treasury bond rate and the 8% as the long term index market return. The figures are just ball park estimate, so any more accurate values will not add any more certainty to the inherent uncertainty of the calculation. So, why so serious?

Here's what I get:

I'm comfortable with the intrinsic value from 0.80 to 1.00. That's the target for 10 yrs. Current price is now at 0.435. Thus, the CAGR returns will be between 6.3% to 8.7%. If we take the maximum value of 1.39 (20% EPS growth rate, 4% discount rate), the CAGR returns will be 12.3%.

How about we do it the reverse way? I want to get 15% per annum over 10 years, so what price will I have to buy in now so as the get that kind of returns? Assuming an intrinsic value from 0.80 to 1.39, we'll need to buy in from 0.20 to 0.34.

PE based on FY07 earnings is now at 5.53 x. Historical lowest PE is around 4.9, so maybe we can expect to see it drop to 0.385 (representing 4.9x FY07 earnings) before it's safer?

------------------

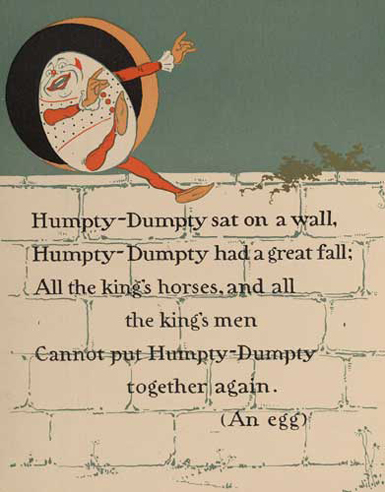

Humpty Dumpty sat on the wall

Humpty Dumpty had a great fall

All the king's horses and all the king's men

Had scrambled eggs for weeks and for weeks

0 comments :

Post a Comment