Today we see a splendid rebound. At first in the morning, it was lackluster everwhere, with HSI and STI trending up and down. Basically there is a lack of direction because dow close -15 last night. It didn't rally, yet it didn't crash.

Around afternoon, nikkei starts to cheong. I do not know the reason why it suddenly shot up +325 points. With that, HSI start to rally up too, finally closing at +256. STI also went up to close at +63.

This isn't something to be happy about. Why do I say that? There is volume divergence. In bullish market, when stock market rallys, it will be accompanied by rising volume and lower volume when it corrects. When this fails to happen, volume divergence is said to have occurred. Since volume is independent of price action, it is not easily manipulated and is thus seen to be quite a good forward indicator of things to come.

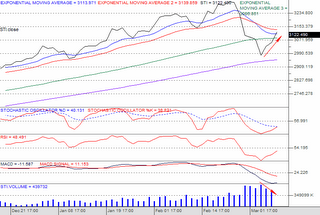

Look at STI. Rising index but downtrending volume. Volume divergence happened.

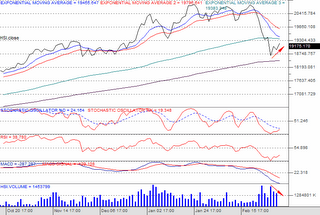

Look at HSI. Before the recovery, falling index is accompanied by falling volume. These few days during the recovery, it is accompanied by decreasing volume. Volume divergence too.

Due to this, I still have a rather bearish sentiment towards both HSI and STI. I was introduced to a put warrant issued by SG for STI, strike price at 3000, expiring at end of april. That might be a good warrant to play with for the immediate and next week.

HSI is coming closer to my target of 19400. Haha, if that happens, I'll whack puts for HSI.

A song by Avril Lavigne. Described what is happening to the stock market now, haha :)

---------------------------------------

Everybody nursing wounds ah? How come so quiet? haha :)

0 comments :

Post a Comment