There are a few kinds of moving average, and usually I'm using exponential moving average (EMA) because they are more sensitive to the latest price movement. Moving average should be drawn in a pair, one shorter and one longer term with the longer one being twice that of the shorter one. That means if you use 10 days MA, you should include 20 days MA as the longer term line. It doesn't really matter which days you're using, it could be 50/100, or 100/200, but for the purpose of this article, I'm using my 13/26 days EMA. 13 days EMA is my short term line and 26 days EMA is my longer term line, unless otherwise stated.

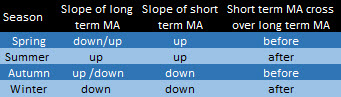

Here's the matrix:

I'll illustrate with an example: Singpost

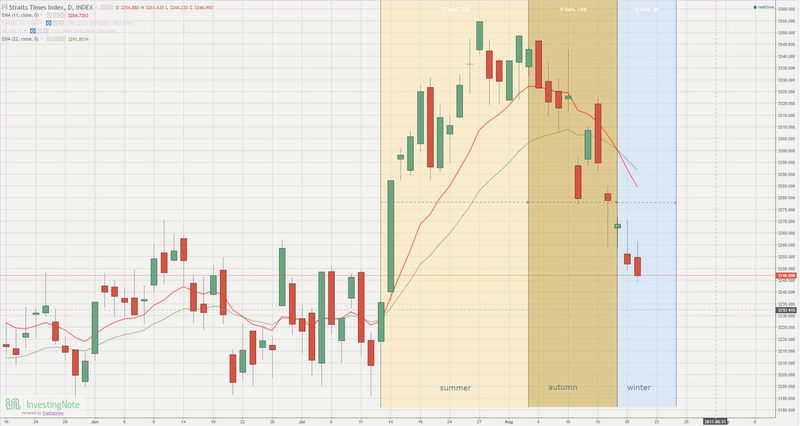

(The red line is the short term line - 11d EMA and the green line is the long term line - 22d EMA)

Let's have a look at the different index:

DJI : after a prolonged summer, it's autumn now

S&P: autumn had given way to winter. The first snow just fell a few days ago.

HSI: It's still bright and sunny, but to the observant ones, some of the leaves on the trees are turning brown and starting to fall

STI: winter is coming (or had already come).

This is neither a rally to buy or to sell, it's simply weather reporting. I'm not even forecasting. Doesn't matter whether it's summer or winter, we just make sure we fatten ourselves during summer to prepare for winter, and do the necessary prep work to plant the seeds just when the last snow falls to prepare for the bright sunlight during summer.

Hi, can you share with me where you get the DJI, S&P index, STI database and etc....?

ReplyDeletebest regards

tony

Hi tony,

ReplyDeleteI got the data from investingnote.

Hi, thank you.

ReplyDeleteTo whom it may concern,

ReplyDeleteWe Offer Personal, Commercial and business Loans with very Minimal annual Interest Rates as Low as 3% within 1 year to 50 years repayment duration period to any part of the world. We give out loans within the range of $10,000 to $100,000,000 USD. Our loans are well insured for maximum security is our priority.

Interested Persons should contact me via E-mail

Lender's Name: Justine Williams

Lender's Email: unique2aal@gmail.com

BORROWERS INFORMATION

NAME:

LOAN AMOUNT:

DURATION:

PHONE#:

COUNTRY:

Note: all emails are to be forwarded to our email at unique2aal@gmail.com for more info.

One time I bought real estate without even laying eyes on it. It was a small property. I ended up earning a decent return on my investment Suggestion via http://www.mmfsolutions.sg/

ReplyDeleteDo you need Personal Finance?

ReplyDeleteBusiness Cash Finance?

Unsecured Finance

Fast and Simple Finance?

Quick Application Process?

Finance. Services Rendered include,

*Debt Consolidation Finance

*Business Finance Services

*Personal Finance services Help

Please write back if interested with our interest rate

Contact Us housingfinance22@gmail.com

Contact us on whatspp +447513195409